A trend of strong growth in single-family rental prices was show in the Sun Belt states during the second quarter of 2016, according to data released by RentRange on Monday.

A trend of strong growth in single-family rental prices was show in the Sun Belt states during the second quarter of 2016, according to data released by RentRange on Monday.

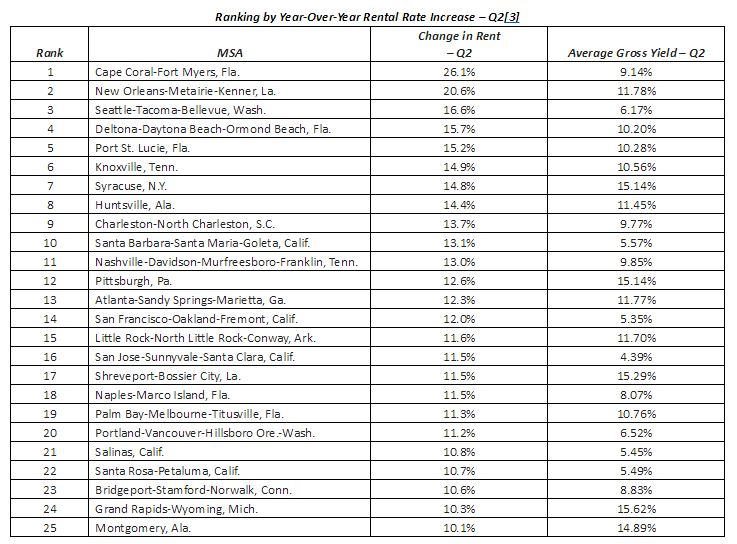

Florida and California turned in the most markets on the list of top 25 markets for highest year-over-year single-family rent increases in the second quarter, as ranked by RentRange. Rapid home price appreciation in those states is problematic for potential buyers, which is contributing to rising demand and low vacancy rates in those areas—thus driving up the price of single-family rents.

In fact, Florida had three markets in the top five for highest year-over-year rent increases, with Cape Coral-Fort Myers leading the way at 26.1 percent. The only other market with more than a 20 percent over-the-year rent increase was second-place New Orleans with 20.6 percent.

“An increasingly competitive home buying market bodes well for the single-family rental market relative to both demand and rental rate increases,” said Wally Charnoff, Chief Executive Officer, RentRange Data Services. “As home prices appreciate across the U.S., detailed market intelligence is essential to making well-informed and thoughtful investment decisions for single-family rental properties.”

The RentRange data showed that out of the top 25 markets in Q2, the top three highest performing markets by average gross yield (income return from an investment prior to operating costs) were new to the ranking compared with Q1. All three, interestingly enough, are also located outside the SunBelt. The metro of Grand Rapids-Wyoming, Michigan, ranked first on the list with an average gross yield of 15.62 percent; Shreveport-Bossier City, Louisiana ranked second at 15.29 percent, and Pittsburgh ranked third with a 15.14 percent average gross yield.

The highest-ranked markets for gross yield all experienced a high income generation to home value ratio, according to RentRange.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news