Private mortgage insurance (PMI) has overtaken the Federal Housing Administration (FHA) for largest share in the U.S. mortgage insurance market. But this is unlikely to prompt the FHA to drop its prices anytime soon to avoid overexposure to higher risk borrowers, given the high quality of mortgages originated post-crisis, according to the Urban Institute.

Private mortgage insurance (PMI) has overtaken the Federal Housing Administration (FHA) for largest share in the U.S. mortgage insurance market. But this is unlikely to prompt the FHA to drop its prices anytime soon to avoid overexposure to higher risk borrowers, given the high quality of mortgages originated post-crisis, according to the Urban Institute.

In April 2016, the PMI industry lowered premiums for borrowers with credit scores above 700, considered lower-risk borrowers, and raised them for higher-risk borrowers, or those with credit scores below 700; the higher (or lower) the credit score, the greater the decrease (or increase) in the borrower’s mortgage insurance premium.

“The price reduction motivated many high-creditworthy borrowers to choose mortgages with PMI backed by the government-sponsored enterprises (GSEs) over FHA mortgages, as we anticipated in May,” said Karan Kaul of the Urban Institute. “The timing of the bump in PMI share strongly suggests that the price cut is a key driver.”

In early 2015, the GSEs introduced their low down payment programs, some as low as 3 percent with reduced mortgage insurance. Due to the advantage of FHA pricing, volumes on the GSEs’ low down payment mortgages—until the PMI lowered its premiums for higher credit score borrowers. This change “(gave) lenders, especially those already wary of the FHA’s heavy enforcement, a reason to turn to the GSEs’ low–down payment programs,” Kaul said.

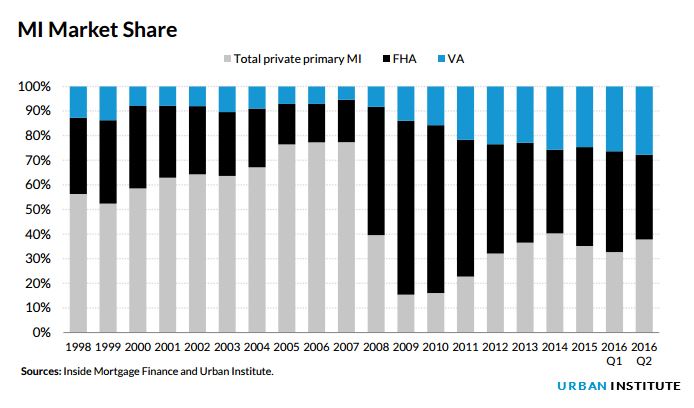

In 2014, PMI held a higher market share than the FHA (40 percent compared to 34 percent). The FHA lowered its up-front mortgage insurance premiums by 50 basis points in January 2015 in an effort to reach first-time buyers; as a result of this action, the FHA’s market share rose from 34 percent to 40 percent from 2014 to 2015 while PMI’s share did the reverse, falling from 40 percent to 35 percent. It will be interesting to see what action FHA will take now that PMI has regained the larger market share, Kaul said.

In 2014, PMI held a higher market share than the FHA (40 percent compared to 34 percent). The FHA lowered its up-front mortgage insurance premiums by 50 basis points in January 2015 in an effort to reach first-time buyers; as a result of this action, the FHA’s market share rose from 34 percent to 40 percent from 2014 to 2015 while PMI’s share did the reverse, falling from 40 percent to 35 percent. It will be interesting to see what action FHA will take now that PMI has regained the larger market share, Kaul said.

“If PMI pricing continues to appeal more to borrowers with higher credit scores, over time, this will pull the best-performing borrowers out of the government program and into conventional mortgages, leaving the FHA with a riskier mix of borrowers,” Kaul said. “And if the mix becomes too risky, the FHA might consider its own premium cut to take back some of these more creditworthy borrowers.”

The high quality of mortgages originated in the last few years, which has resulted in a much lower delinquency rate, gives the FHA time to make a decision, according to Kaul.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news