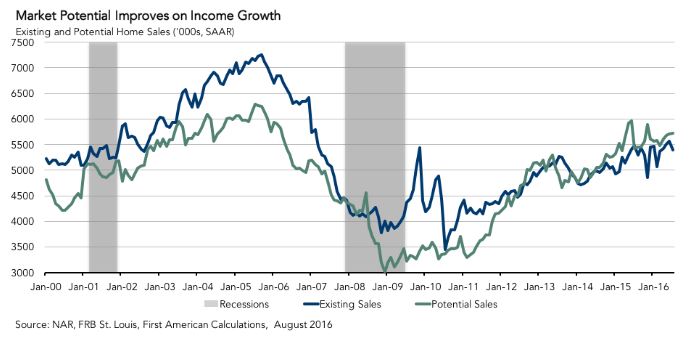

The market for existing-home sales is underperforming its potential by an estimated 5.6 percent (323,000 annual sales) but did grow by 1.08 percent from July to August (62,000 annual sales) and nearly 6 percent over-the-year, according to First American Financial Corporation’s Potential Home Sales model.

The market for existing-home sales is underperforming its potential by an estimated 5.6 percent (323,000 annual sales) but did grow by 1.08 percent from July to August (62,000 annual sales) and nearly 6 percent over-the-year, according to First American Financial Corporation’s Potential Home Sales model.

Potential existing-home sales have improved by nearly 92 percent since the market hit its low point in December 2008 at the depth of the crisis. Despite nearly doubling, however, existing-home sales are still down by 6.4 percent from their pre-recession peak of market potential from July 2005, according to First American.

The National Association of Realtors reported that existing-home sales nationwide dropped off from an annual rate of 5.57 million in June to 5.39 million in July, with the West being the only region out of the four to post an increase (2.5 percent). Low inventories continue to put upward pressure on home prices, according to First American Chief Economist Mark Fleming.

“Despite tight inventories and rising prices, consumers continue to be optimistic about the housing market. Nowhere is this more evident than in new-home sales volume, which according to the U.S. Census Bureau, grew by 12.4 percent between June and July and 31.3 percent from the year prior,” Fleming said. “Furthermore, the share of new home sales under $300,000 grew to 52 percent in July up from 48 percent in June, indicating that not only are homebuilders adding much needed supply to the market, but they are doing so at the lower end of the price distribution with an eye on entry-level buyers.”

Fleming pointed out that near historic low mortgage rates have been extremely influential in boosting the housing market, as it has softened the impact of home price appreciation. Recent improvements in the labor market, namely the areas of employment data and income gains, are providing a firm foundation for homebuying demand and playing a larger role in influencing homebuying power, according to Fleming. He cited the BLS employment situation for August 2016; though 151,000 jobs added for the month fell slightly below expectations, the unemployment rate held at 4.9 percent and average hourly earnings moved up by 2.4 percent over-the-year up to $25.73. Also, the Census Bureau reported that real median household incomes rose by 5.2 percent from 2014 to 2015, the first annual increase in household incomes measured since 2007—with the greatest increases happening for lower- and middle-income households.

“These recent gains in consumer financial health not only impact housing demand, but also play a role in the Federal Open Market Committee’s (FOMC) rate policy. With the September meeting just around the corner, some are now questioning if these positive economic indicators are enough for the Fed to raise rates,” Fleming said, noting that “Rising rates will have a modest impact on housing demand, but they also signal a strengthening labor market and increased inflation pressure due to rising incomes—both unequivocally good for housing market health.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news