Mortgage originations are expected to surge in the third quarter as Freddie Mac’s forecast for the best year in home sales in a decade looks more and more on target, according to Freddie Mac’s September 2016 Monthly Outlook.

Mortgage originations are expected to surge in the third quarter as Freddie Mac’s forecast for the best year in home sales in a decade looks more and more on target, according to Freddie Mac’s September 2016 Monthly Outlook.

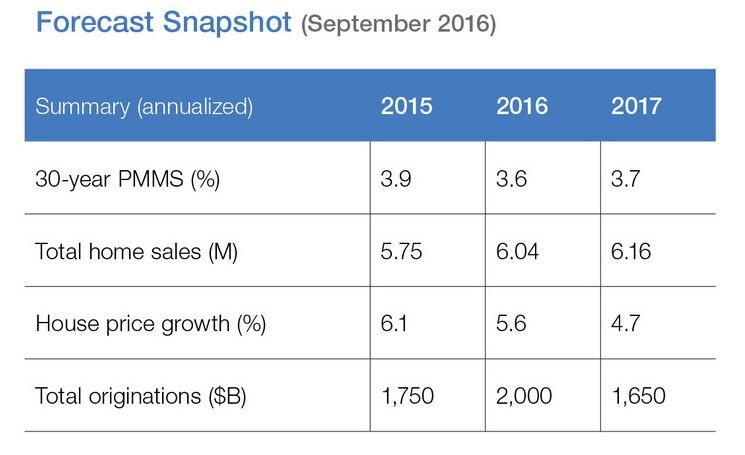

The average 30-year fixed rate mortgage (FRM) is expected to come in at 3.6 percent for the whole year of 2016, according to Freddie Mac’s forecast. A 3.6 percent average would be the lowest annual average for 30-year FRMs in more than 40 years (the current record low is 3.66, set in 2012). The 30-year FRM has fallen from around 4 percent at the end of 2015 down to around 3.5 percent as of mid-September, according to Freddie Mac’s latest Primary Mortgage Market Survey.

Homeowners converted a total of $13.3 billion worth of home equity to cash during refinancing in the second quarter, in increase from $11.4 billion in the first quarter. Q2’s total was still substantially lower than the peak cash-out refi volume of $84 billion, which occurred during Q2 2006.

“The housing market remains a bright spot for the U.S. economy, with solid job gains and low mortgage interest rates sustaining the economy's momentum in September,” Freddie Mac chief economist Sean Becketti said. “In most markets, low mortgage rates have more than offset the rise in house prices, preserving homebuyer affordability for the typical household. Homeowners are also taking advantage of low rates and house price appreciation that is increasing their home equity. The share of cash-out refinances grew to 41 percent in the second quarter of 2016, compared to 38 percent in the first quarter and 15 to 20 percent during the housing crisis.”

Freddie Mac’s home price appreciation forecast rose in September up to 5.6 percent for 2016 and 4.7 percent for 2017—up from August’s forecast of 5.3 percent and 4.0 percent, respectively.

The higher price appreciation forecast will not prevent a spike in refinances during Q3, according to Freddie Mac.

“Mortgage originations are expected to surge in the third quarter, reflecting the impact of Brexit in recent mortgage activity,” Becketti said. “We continue to believe that originations will reach $2 trillion this year, the highest since 2012.”

Click here to view the complete monthly outlook for September.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news