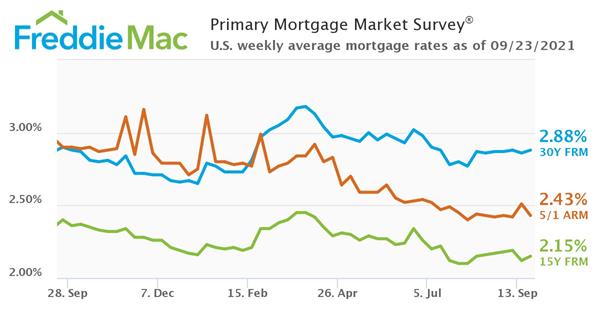

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) [1] has found that the 30-year fixed-rate mortgage (FRM) averaged 2.88%, with an average 0.7 point for the week ending September 23, 2021, up slightly from last week, when it averaged 2.86% [2]. A year ago, at this time, the 30-year FRM averaged 2.90 percent.

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) [1] has found that the 30-year fixed-rate mortgage (FRM) averaged 2.88%, with an average 0.7 point for the week ending September 23, 2021, up slightly from last week, when it averaged 2.86% [2]. A year ago, at this time, the 30-year FRM averaged 2.90 percent.

“The slowdown in economic growth around the world has caused a flight to the quality of the U.S. financial markets,” said Sam Khater [3], Freddie Mac’s Chief Economist. “This has led to a rise in foreign investor purchases of U.S. Treasuries, causing mortgage rates to remain in place, despite the increasing dispersion of inflation across different consumer goods and services."

Earlier today, the U.S. Department of Labor reported [4] that for the week ending September 18, the advance figure for seasonally-adjusted initial unemployment claims was 351,000, an increase of 16,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 332,000 to 335,000.

“On the housing front, homebuyers continue to snap up available inventory, which has improved modestly, and home price growth is moderating,” said Khater. “However, the next few months will be choppy, as several home builders are signaling that they are going to deliver less supply amid labor and materials shortages.”

Earlier this week, the National Association of Home Builders (NAHB), in its NAHB/Wells Fargo Housing Market Index (HMI) [5], found that builder confidence inched up in September on lower lumber prices and strong housing demand, even as the housing sector continues to grapple with building material supply chain issues and labor challenges. Ending a three-month slide, builder sentiment in the market for newly built single-family homes edged up one point to 76 in September, according to the HMI.

“Builder sentiment has been gradually cooling since the HMI hit an all-time high reading of 90 last November,” said NAHB Chairman Chuck Fowke [6]. “The September data show stability as some building material cost challenges ease, particularly for softwood lumber. However, delivery times remain extended, and the chronic construction labor shortage is expected to persist as the overall labor market recovers.”

And for the second consecutive month, economists at Fannie Mae revised expectations for near-term real GDP growth downward—and outward—due to persistent supply chain disruptions and labor market tightness, according to its September 2021 commentary [7] from the Economic and Strategic Research (ESR) Group. Those factors, they say, will affect the housing market as the economy at large.

"Economic growth continues to be held back by supply chain and labor market constraints, both of which we expect to continue well into 2022," said Doug Duncan [8], Fannie Mae SVP and Chief Economist. "We also expect inflation to remain elevated through much of next year, even if the crest of the recent surge is behind us. Given the strength of recent house price appreciation and rent growth, we continue to believe that the contribution from housing to underlying inflation has yet to be fully realized within the official measures of inflation. Further, affordability remains a challenge, even with mortgage rates near historic lows; if the pace of income growth doesn't keep up with inflation and interest rates rise more than expected, we'd expect housing activity to slow from our current projections."

Also, this week, Freddie Mac’s PMMS found the 15-year FRM averaging 2.15%, with an average 0.6 point, up from last week when it averaged 2.12%. A year ago, at this time, the 15-year FRM averaged 2.40%. Meanwhile, the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.43%, with an average 0.3 point, down from last week when it averaged 2.51%. A year ago, at this time, the five-year ARM averaged 2.90%.

"For real estate markets, 2021 has been a year of record-high prices fueled in part by record-low mortgage rates," said Realtor.com Manager of Economic Research George Ratiu [9]. "Moving into the last quarter of the year, the Fed’s stated intent to cut back on asset purchases is likely to begin nudging rates higher. The move will likely be gradual, giving buyers time to take advantage of still-favorable rates amid a growing number of homes for sale. New listings on Realtor.com have been rising in 21 of the last 26 weeks compared with the same period in 2020. However, price growth continues on an upward trend, albeit at a slower pace. Affordability challenges may play a bigger role as mortgage rates rise in the months ahead. At today’s rate, the monthly mortgage payment on a median-priced home is $97 higher than it was a year ago.”