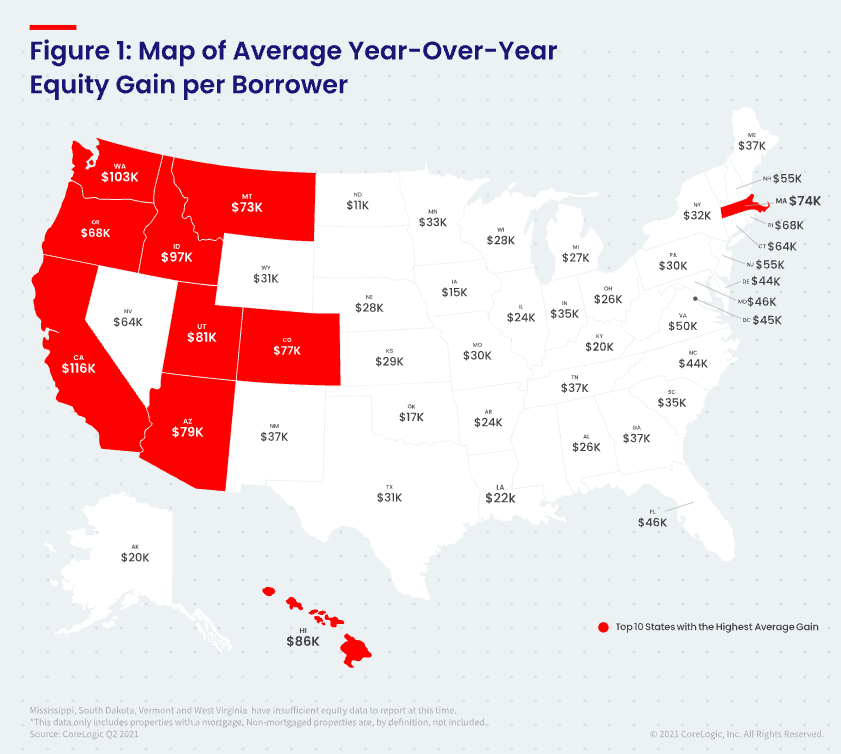

CoreLogic’s Homeowner Equity Report for the second quarter of 2021 has found that U.S. homeowners with mortgages (which account for roughly 63% of all properties) have seen their equity increase by 29.3% year-over-year, a collective equity gain of more than $2.9 trillion, and an average gain of $51,500 per borrower, since Q2 of 2020.

CoreLogic’s Homeowner Equity Report for the second quarter of 2021 has found that U.S. homeowners with mortgages (which account for roughly 63% of all properties) have seen their equity increase by 29.3% year-over-year, a collective equity gain of more than $2.9 trillion, and an average gain of $51,500 per borrower, since Q2 of 2020.

By June 2021, consumer confidence had risen to its highest level since the onset of the pandemic. This positive sentiment was echoed by current mortgage holders in a recent CoreLogic consumer survey, which found that 59% of respondents feel extremely confident in their ability to keep current on their mortgage payments in the coming year.

Most borrowers have been able to remain current on their mortgage payments, thanks to ongoing government provisions, increased vaccine availability, and record homeowner equity gains. CoreLogic found that the majority of borrowers that fell behind on payments have a large home equity cushion that will help them avoid foreclosure.

“The growth in homeowner equity provides a strong financial cushion for tens of millions of Americans. For those most impacted by the pandemic, equity gains will help play a critical role in staving off foreclosure,” said Frank Martell, President and CEO of CoreLogic. “Based on projected increases in economic activity and home values over the next year, we expect to see further gains in equity, and a corresponding drop in negative equity, forbearance rates and foreclosure.”

Negative equity, underwater mortgages, or upside down mortgages in Q2 of 2021, were as follows:

- Quarterly change: From Q1 of 2021 to Q2 of 2021, the total number of mortgaged homes in negative equity decreased by 12% to 1.2 million homes, or 2.3% of all mortgaged properties.

- Annual change: In Q2 of 2020, 1.8 million homes, or 3.3% of all mortgaged properties, were in negative equity. This number decreased by 30%, or 520,000 properties, in Q2 of 2021.

- National aggregate value: The national aggregate value of negative equity was approximately $268 billion at the end of Q2 of 2021. This is down quarter-over-quarter by approximately $5.2 billion, or 1.9%, from $273.2 billion in Q1 of 2021, and down year over year by approximately $18.9 billion, or 6.6%, from $286.8 billion in Q2 of 2020.

“Home equity wealth is at a record level and will bolster economic activity in the coming year,” said Dr. Frank Nothaft, Chief Economist for CoreLogic. “Higher wealth spurs additional consumer expenditures and also supports room additions and other investments in homes, adding to overall economic activity.”

Because home equity is impacted by home price changes, borrowers with equity positions near (+/- 5%) the negative equity cutoff are most likely to move out of or into negative equity as prices change, respectively. Looking at Q2 of 2021 book of mortgages, if home prices increase by 5%, 160,000 homes would regain equity; if home prices decline by 5%, 211,000 would fall underwater.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news