The Consumer Financial Protection Bureau (CFPB) released its report [1] on the financial well-being in America, showing most Americans are generally satisfied with their household situation.

The Consumer Financial Protection Bureau (CFPB) released its report [1] on the financial well-being in America, showing most Americans are generally satisfied with their household situation.

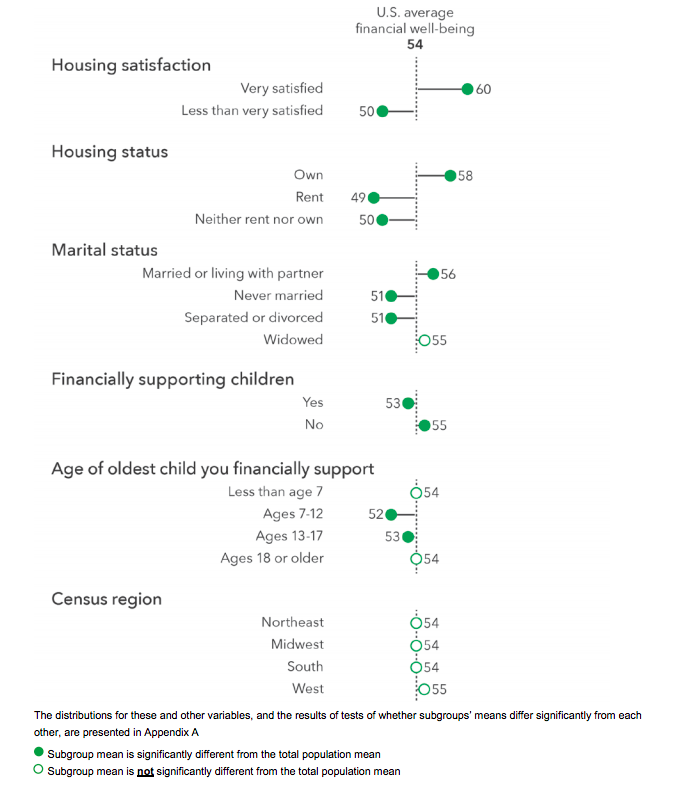

According to the report, average adults who answered to be “very satisfied” in the place they live have a higher level of financial stability (10 points by the metrics of the data, at 60,) than those that report being “less than very satisfied,” which stood at 50 points.

The report, notes, however, that this could be a chicken or an egg situation, “It is possible that being satisfied with one’s residence influences financial well-being, but it is also possible that individuals with greater financial resources and higher financial well-being have greater flexibility to select housing that meets their needs.”

However, the report makes clear that homeowners feel they have a higher financial well-being than those that rent, or those that identify with neither group, although the report remains hesitant to attribute cause and effect: “Again, this finding does not necessarily mean that homeownership causes higher levels of financial well-being. While it is possible that owning a home enhances financial well-being, it is also possible that those who are able to purchase a home are in a stronger financial position (i.e., have higher levels of income and savings) than those who are not and that those factors are associated with higher levels of financial well-being”

You can find the table included in the report below, and the full CFPB report here [1].