The STRATMOR Group [1], in its September 2021 Insights Report, points to data that suggest that this year will be one of the biggest years for industry mergers and acquisitions (M&A) activity. In “Mortgage Industry Consolidation: Fact, Fiction or Frenzy? [2]” David Hrobon [3], STRATMOR Group Principal and former Chairman and CEO of Wintrust Mortgage, digs deeper to find a connection between profitability and M&A activity.

The STRATMOR Group [1], in its September 2021 Insights Report, points to data that suggest that this year will be one of the biggest years for industry mergers and acquisitions (M&A) activity. In “Mortgage Industry Consolidation: Fact, Fiction or Frenzy? [2]” David Hrobon [3], STRATMOR Group Principal and former Chairman and CEO of Wintrust Mortgage, digs deeper to find a connection between profitability and M&A activity.

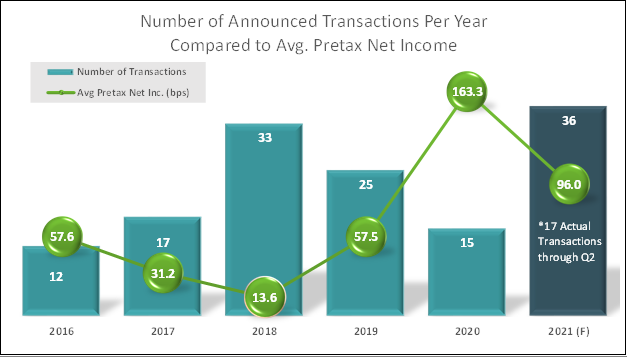

“The historical relationship is clear,” Hrobon said in the report [2]. “When profitability increases, owners hold onto their companies. When it falls, more look to sell. The biggest year in recent history for M&A was 2018 with 33 deals, when the industry only made 13 basis points of net income. By the end of the second quarter of this year, 17 deals had already closed. We expect to see a total of at least 36 deals close by the end of the year.”

Hrobon says that this is happening because, while profitability is still high from a historical perspective, it is already far below what lenders earned last year.

“Where are we in 2021? So far, as we work through the third quarter, profitability is still high, although dropping from the highs of 2020,” said Hrobon. “We expect lender income this year to average about 90-100 basis points by year’s end. But this is far below what lenders earned last year, and when profitability falls, we see owners start to consider selling. And, we’re seeing buyers with war chests earned when profits were high looking to leverage their earnings and tech investments. It can be a win for both.”

STRATMOR says that net income is only one of the factors that is driving increased M&A activity. The other factors include the aging of industry leadership and their desire to retire, the excess capital that buyers have on hand, the shifting business mix to the more-expensive-to-originate purchase money lending, and the potential for adverse tax consequences if sellers wait.

“Given a couple of years, good execution, skilled management and a little good luck and timing, a company could achieve its production growth goal,” Hrobon said. “Alternatively, management can go to market, find a well-suited acquisition target and buy the company. Our analysis indicates that after all expenses are tabulated, companies that achieve growth organically via recruiting will pay nearly 1.5 times more for that volume as those that buy it through acquisition.”

Source: Mortgage Bankers Association Quarterly Performance Report, STRATMOR

Before jumping into specific M&A deals, STRATMOR advises on a very specific, five-step process that companies should follow as they navigate their journey.

- Data matters: Experienced buyers understand this fact. However, the most successful mortgage company buyers also understand that you can’t evaluate and execute a transaction based on financials alone.

- Culture: Never underestimate the importance of cultural alignment. No one wants to sell their company and put the business in the hands of someone that may potentially erode the franchise they built. Candid, up-front, and skillful evaluation of compatibility, both in terms of business model and culture, are critical.

- Ask the important questions: Asking every question as if it is important will ensure that the important ones get answered.

- Don’t assume the deal is just formulaic: Every transaction is different and brings with it its own opportunities and risks. Ultimately, the value of the company is in the eye of the beholder.

- Don’t proceed if models aren’t reasonably aligned: Post-deal performance will depend upon the combined company operating effectively after the teams are merged. If the models aren’t aligned, this is not reasonable, and everyone will lose.

“Be wary of the fiction out there that there are no premiums being paid for mortgage companies,” said Hrobon. “Don’t think that it doesn’t matter when you sell or that it is remotely possible to grow into a down market with no risk. Our experience and data confirm these are all fiction, particularly in this environment.”

Click here [2] to read more from STRATMOR’s September Insights Report.