Since hitting a post-crisis peak annual pace of 5.79 million in June 2016, existing-home sales have not fared so well.

Since hitting a post-crisis peak annual pace of 5.79 million in June 2016, existing-home sales have not fared so well.

Existing-home sales cooled off in August, dropping by nearly a full percentage point down to an annual rate of 5.33 million amid rising prices and declining inventory. And if forecasts turn out to be accurate, things might not get better for existing-home sales in the near term.

The latest Nowcast from Ten-X suggests that existing-home sales will take another step backward, predicting they will fall in the 5.1 million to 5.44 million range with a target rate of 5.27 million. If this forecast comes true, this would be a 1.2 percent decline from the National Association of Realtors’ August figures and a 4.5 percent decline from Ten-X’s Nowcast from a year ago.

Demand for residential homes has remained strong even though there has not been much to choose from. NAR reported that total housing inventory in August was 10 percent lower than the same time last year, with approximately 2.04 million units for sale.

“The ongoing inventory shortage is putting a strain on sales growth, particularly as the resulting price gains erode affordability, but demand for housing remains elevated nonetheless,” Ten-X stated. “The labor market is adding jobs at a solid clip, unemployment is hovering at a low level, wage growth persists, and historically low mortgage rates are enticing homebuyers; all conditions that remain supportive of the housing market. Though foreign buying activity has cooled following economic uncertainty abroad, increased regulation, and contention with the strong dollar, US home sales have held at a high level to date.”

“The ongoing inventory shortage is putting a strain on sales growth, particularly as the resulting price gains erode affordability, but demand for housing remains elevated nonetheless,” Ten-X stated. “The labor market is adding jobs at a solid clip, unemployment is hovering at a low level, wage growth persists, and historically low mortgage rates are enticing homebuyers; all conditions that remain supportive of the housing market. Though foreign buying activity has cooled following economic uncertainty abroad, increased regulation, and contention with the strong dollar, US home sales have held at a high level to date.”

While job growth has been solid throughout most of the year, it has not translated to greater home sales as of yet, according to NAR.

“Healthy labor markets in most the country should be creating a sustained demand for home purchases,” NAR Chief Economist Lawrence Yun said. “However, there's no question that after peaking in June, sales in a majority of the country have inched backwards because inventory isn't picking up to tame price growth and replace what's being quickly sold.”

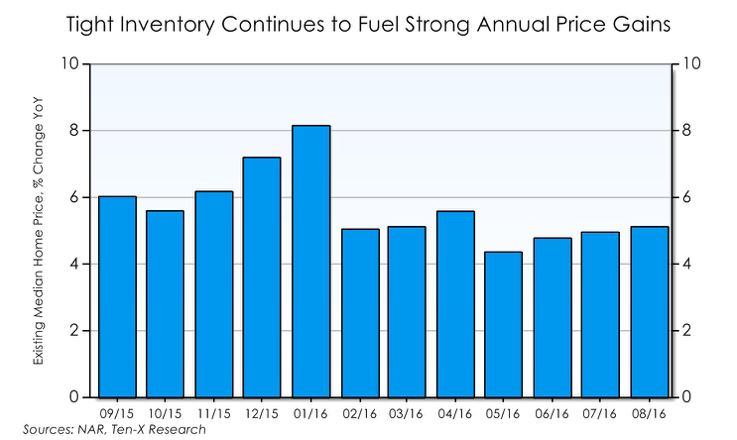

The low inventory may hold back home sales for the near term, but Ten-X believes that price appreciation will result in homeowners wanting to sell, which will create an uptick in inventory. Ten-X is forecasting a range of $227,300 to $251,200 for September’s median existing-home price, with a target of $239,268. This would be a year-over-year increase of nearly 8 percent from NAR’s figure and 5.1 percent from last year’s Nowcast. The August 2016 median existing-home sales price was $240,200, marking the 54th consecutive month of year-over-year home price appreciation.

The decline of existing-home sales “could stimulate new home sales a bit, since one of the primary reasons for the dip in existing home sales appears to be the severe lack of inventory,” Ten-X Chief Marketing Office Rick Sharga said. “People who might normally have purchased an existing home may simply decide to look for a new home instead. Of course, new home inventory is still lower than average as well, but is at least trending in the right direction. Similarly, assuming that we see increased levels of household formation, we're likely to see a corresponding increase in the number of renters—in both apartments and single family homes. If existing home sales continue to decline, mortgage originators will certainly suffer, as will the professional service providers who are typically involved in some aspect of the transaction—appraisers, realtors, inspectors, etc. A continuing decline in existing home sales could have an impact on the overall economy. The housing market's gradual return to health has definitely been one of the bright spots in what has been an otherwise tepid economic recovery. If housing takes a turn for the worse, it may become a drag on economic growth.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news