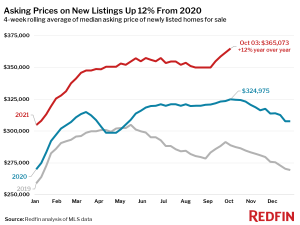

Amid rising home prices, the average mortgage payment has increased by $50 over the last six weeks as sellers’ median asking price increased 12% year over year to a new record high according to a new report from Redfin.

Amid rising home prices, the average mortgage payment has increased by $50 over the last six weeks as sellers’ median asking price increased 12% year over year to a new record high according to a new report from Redfin.

Even though median asking prices are at record-highs, houses are still being purchased at a blistering pace—46% of homes that went under contract had an accepted offer within the first two weeks on the market, above the 42% rate of a year earlier. 33% had accepted an offer within the first week of hitting the market.

“Mortgage rates and asking prices are both on the rise, which translates to higher housing costs,” said Redfin Chief Economist Daryl Fairweather. “For now, mortgage rates are still hovering near 3% and demand remains strong. However, we are likely to see rates tick up into the winter months, and that could slow demand just like it did in late 2018. As that happens, sellers will have a harder time getting buyers to bite on their sky-high asking prices.”

The report, authored by Redfin Analyst Tim Ellis, also found:

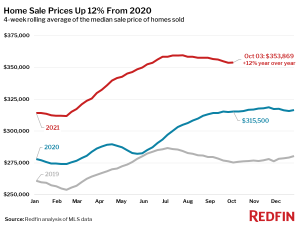

- The median home-sale price increased 12% year-over-year to $353,869.

- Asking prices of newly listed homes were up 12% from the same time a year ago to a median of $365,073, an all-time high.

- Pending home sales were up 3% year-over-year, the smallest increase since June of 2020.

- New listings of homes for sale were down 8% from a year earlier.

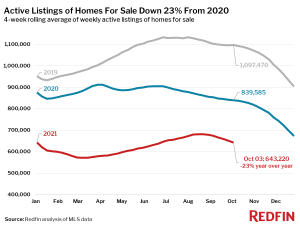

- Active listings (the number of homes listed for sale at any point during the period) fell 23% from 2020.

- Homes that sold were on the market for a median of 21 days, nearly a week longer than the all-time low of 15 days seen in late June and July, and down from 31 days a year earlier.

- 47% of homes sold above list price, up from 34% a year earlier, but the smallest share since April.

- On average, 5% of homes for sale each week had a price drop, up 1.4 percentage points from the same time in 2020, and the highest level since the four-week period ending October 13, 2019.

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, decreased to 100.9%, the first time it has been below 101% since April. In other words, the average home sold for 0.9% above its asking price.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news