Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) [1] for the week ending October 21, 2021, shows that the 30-year fixed-rate mortgage (FRM) averaged 3.09% with an average 0.7 point, up from last week when it averaged 3.05%. A year ago at this time, the 30-year FRM averaged 2.80%.

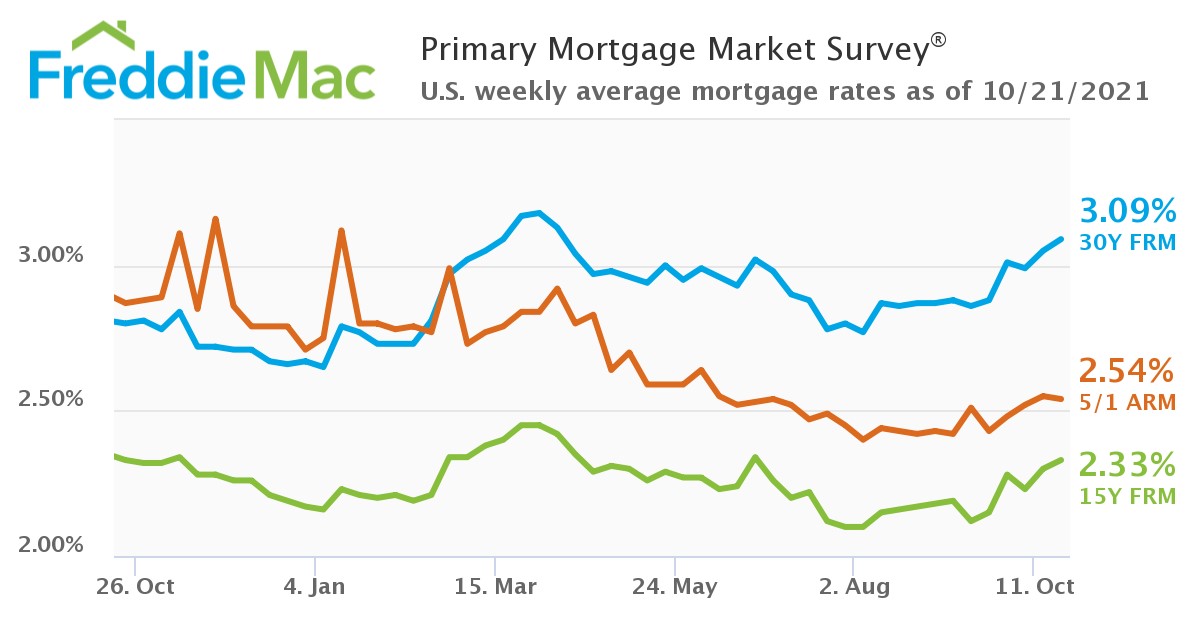

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) [1] for the week ending October 21, 2021, shows that the 30-year fixed-rate mortgage (FRM) averaged 3.09% with an average 0.7 point, up from last week when it averaged 3.05%. A year ago at this time, the 30-year FRM averaged 2.80%.

“Mortgage rates continued to rise this week due to the trajectory of both the economy and the pandemic,” said Sam Khater [2], Freddie Mac’s Chief Economist. “Even as the availability of existing homes is improving, prices remain high due to homebuyer demand and limitations on housing starts and permits resulting from the ongoing labor and material shortages. Despite these countervailing forces, we expect the housing market to remain strong as we head into the end of the year.”

The 15-year fixed-rate mortgage (FRM) averaged 2.33% with an average 0.7 point, up from last week when it averaged 2.30%. A year ago at this time, the 15-year FRM averaged 2.33%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.54% with an average 0.3 point, down slightly from last week when it averaged 2.55%. A year ago at this time, the five-year ARM averaged 2.87%.

The Mortgage Bankers Association (MBA) reported [3] mortgage applications decreased 6.3% from one week earlier. The Market Composite Index, a measure of mortgage loan application volume, decreased 6.3% on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 6% compared with the previous week.

Redfin has found that median home sale prices rose 14% year-over-year [4] to $376,800 in September 2021, the lowest growth rate since December 2020. The month of September marked the 14th consecutive month of double-digit price gains. Closed home sales and new listings of homes for sale both fell from a year earlier, by 5% and 9%, respectively.

"The severe lack of inventory is restricting home sales," said Redfin Chief Economist Daryl Fairweather [4]. "Even though plenty of people bought homes last year, many homebuyers waited while the pandemic went from bad to worse and remote-work policies were finalized. The homebuyers who are just beginning their search are finding that the well has run dry. But I am hopeful that as it becomes easier to get building materials, we will finally have a strong year for new construction in 2022. That's what the market needs more than anything."

Supply chain issues continue to plague homebuilders as materials remain an issue and have contributed to the nation’s lack of housing inventory.

Testifying Wednesday before the House Small Business Subcommittee on Oversight, Investigations, and Regulations, National Association of Home Builders (NAHB) Chairman Chuck Fowke explained [5] to lawmakers that disruptions in the building materials supply chain that have been exacerbated by the pandemic are having a disproportionate impact on smaller home building firms.

“Without large economies of scale, small businesses generally cannot negotiate bulk discounts on lumber and other key building materials,” said Fowke. “The effects of this uncertainty trickle all the way to the buyer, many of whom have balked at projects at the last minute due to unexpected price increases.”

And while lumber prices to decline in May 2021, it took months for a meaningful portion of those reductions to reach home builders and their customers. In September, lumber prices began rising again and have increased more than 40% over the past six weeks.

Bright spots can be found in the latest report from the U.S. Department of Labor [6], as for the week ending October 16, the advance figure for seasonally adjusted initial unemployment claims was 290,000, a decrease of 6,000 from the previous week's revised level, the lowest level for initial claims since March 14, 2020 when it was 256,000.