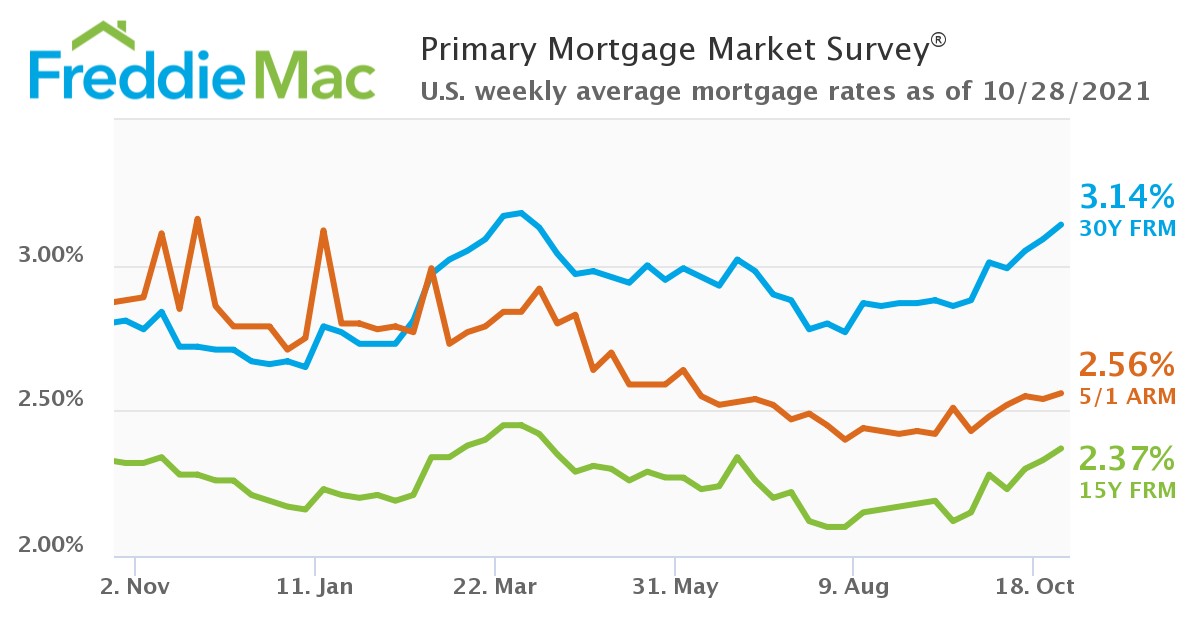

Freddie Mac has announced the results of its latest Primary Mortgage Market Survey (PMMS), showing that the 30-year fixed-rate mortgage (FRM) averaged 3.14% for the week ending October 28, up from last week when it averaged 3.09%, and up from a year ago at this time when it averaged 2.81%.

Freddie Mac has announced the results of its latest Primary Mortgage Market Survey (PMMS), showing that the 30-year fixed-rate mortgage (FRM) averaged 3.14% for the week ending October 28, up from last week when it averaged 3.09%, and up from a year ago at this time when it averaged 2.81%.

“The yield on the 10-year Treasury note has been trending up due to the decline in new COVID cases, increasing consumer optimism, as well as broadening inflation and persistent shortages,” said Sam Khater, Freddie Mac’s Chief Economist. “Mortgage rates are also rising, but purchase demand remains firm, showing that latent purchase demand exists among consumers.”

The Federal Reserve's Federal Open Market Committee (FOMC) meeting next week, November 2-3, will decide on the next monetary steps the nation will take as we enter Q4. Experts say the Fed is expected to announce a tapering of its asset purchases in light of stronger employment and higher inflation, with expectations of mortgage rates to continue to rise.

"Real estate markets are showing signs of a new equilibrium, marked by a steady pace of transactions, and more moderate price growth. As more homeowners list their houses for sale, these homes are spending more time on the market," said Realtor.com Manager of Economic Research George Ratiu. "A good number of cities that were fraught with bidding wars earlier this year are finding a calmer housing landscape, where price reductions are bringing sky-high asking prices back down to earth. While the market remains brisk, there are fewer competing offers, and contingencies have returned, both clear signs of a healthier housing market. For buyers, approachable mortgage rates and less competition mean good opportunities to find the right home. Even so, at today’s rate, buyers of a median-priced home will pay an extra $142 toward their mortgage payment compared with a year ago.”

As rates rise, mortgage refi activity has begun to tail off, as the latest Weekly Mortgage Applications Survey from the Mortgage Bankers Association (MBA) found the refinance share of mortgage activity decreased to 62.2% of total applications from 63.3% the previous week.

"The increase in rates triggered the fifth straight decrease in refinance activity to the slowest weekly pace since January 2020. Higher rates continue to reduce borrowers' incentive to refinance," said Joel Kan, MBA's Associate VP of Economic and Industry Forecasting. "Purchase applications picked up slightly, and the average loan size rose to its highest level in three weeks, as growth in the higher price segments continues to dominate purchase activity. Both new and existing-home sales last month were at their strongest sales pace since early 2021, but first-time homebuyers are accounting for a declining share of activity. Home prices are still growing at a rapid clip, even if monthly growth rates are showing signs of moderation, and this is constraining sales in many markets, and particularly for first-timers."

And while the slight uptick in rates is a result of an improving economy, the U.S. Department of Labor reported today that unemployment claims dipped slightly, as for the week ending October 23, the advance figure for seasonally adjusted initial unemployment claims was 281,000, a decrease of 10,000 from the previous week's revised level, marking the lowest level for initial claims since March 14, 2020 when it was 256,000.

Freddie Mac’s PMMS also found that the 15-year FRM averaged 2.37% with an average 0.7 point, up from last week when it averaged 2.33%. A year ago at this time, the 15-year FRM averaged 2.32%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.56% with an average 0.3 point, up from last week when it averaged 2.54%. A year ago at this time, the five-year ARM averaged 2.88%.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news