Lending standards overall loosened during October, the Mortgage Credit Availability Index [1] (MCAI) from Mortgage Bankers Association [2] (MBA) and Ellie Mae indicates.

Lending standards overall loosened during October, the Mortgage Credit Availability Index [1] (MCAI) from Mortgage Bankers Association [2] (MBA) and Ellie Mae indicates.

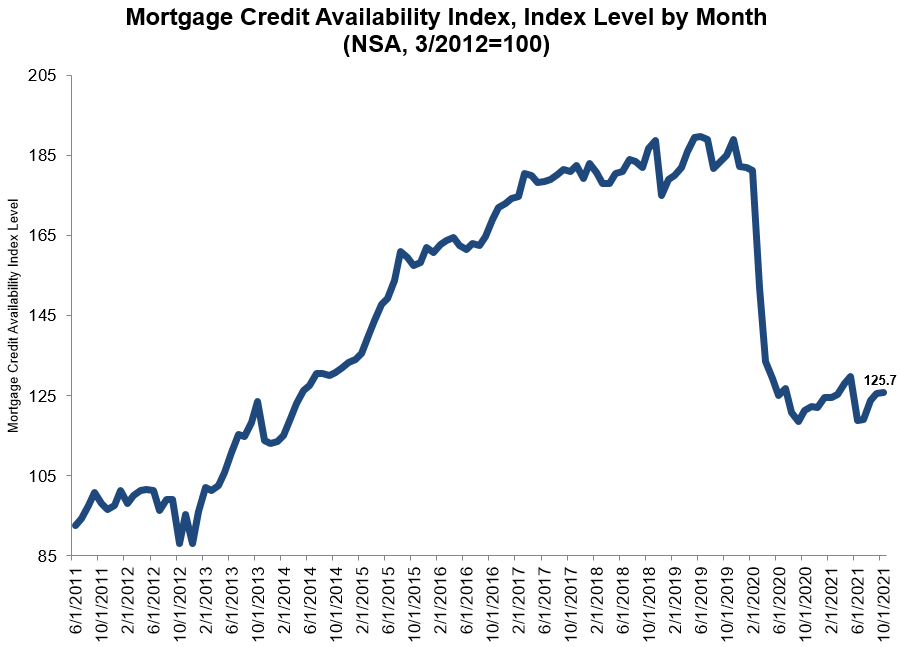

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etcetera). The latest MCAI rose 0.1 percent to 125.7 in October.

The index benchmark was set to 100.0 in March of 2012.

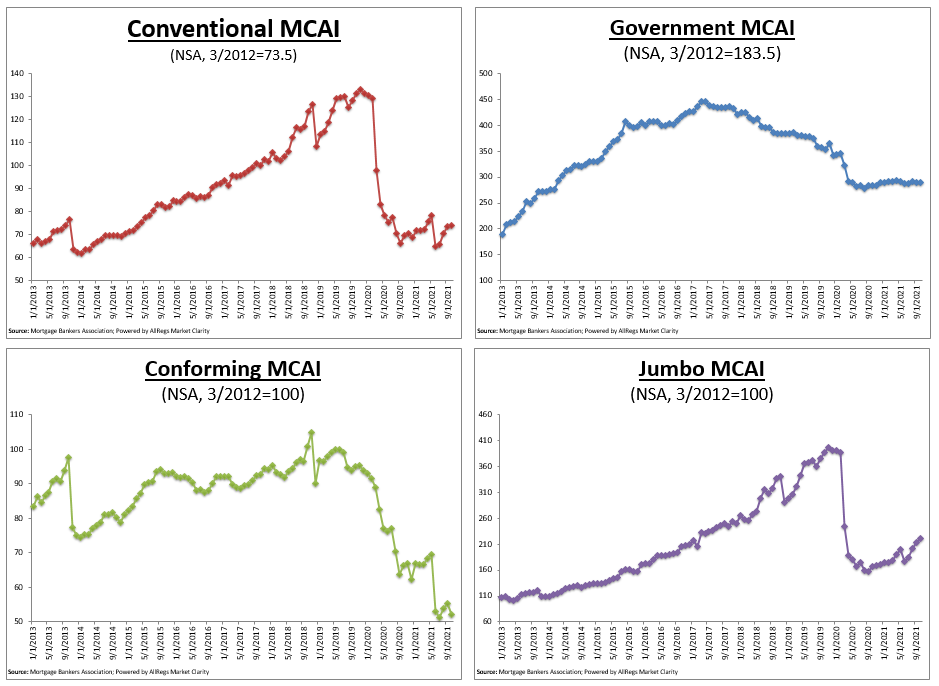

The Conventional MCAI increased 0.1 percent, while the Government MCAI remained essentially unchanged. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 4.1 percent, and the Conforming MCAI fell by 6.0 percent.

"Credit availability inched forward in October, but the overall index was 30 percent lower than February 2020 and close to the lowest supply of mortgage credit since 2014," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "Within the subindexes, a 4 percent increase in the jumbo index was essentially offset by a 6 percent drop in the conforming index. There was an increase in the supply of jumbo ARM and non-QM products, which drove most of the increase in the jumbo index. On the conforming side, there was a pullback in ARMs, higher LTV loans, and lower credit score products. While there is tightening in ARM credit availability both for jumbo and conforming loans, ARM loans have accounted for a small share of loan applications, ranging from 2.5 percent to 5 percent of applications to date in 2021."

"Tight credit availability, combined with ongoing supply and affordability challenges, are significant obstacles for some prospective first-time buyers,” Kan added.

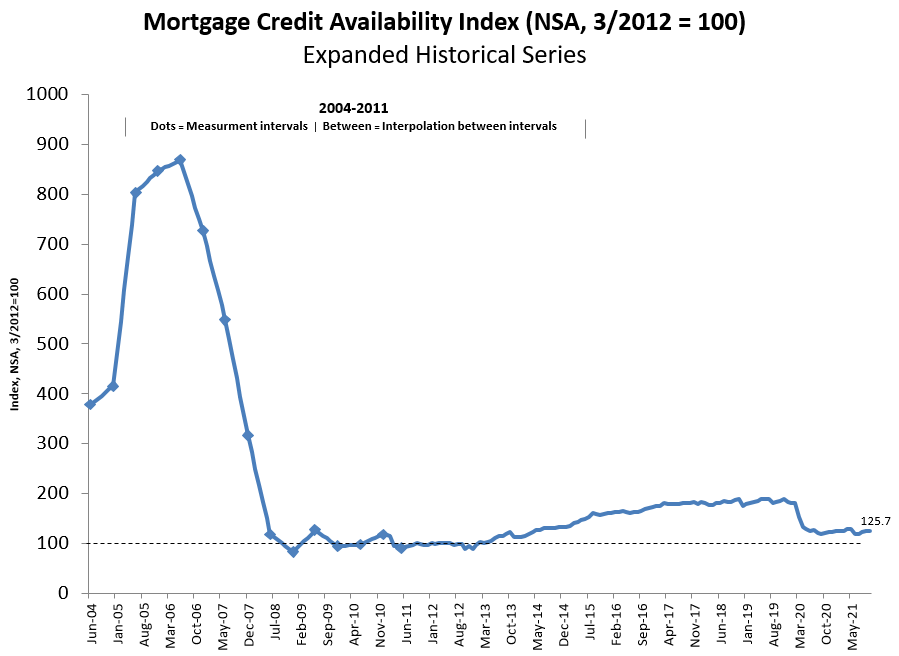

Note: Data before 2011 was generated using less frequent and less complete data measured at six-month intervals interpolated in the months between for charting purposes, according to the MBA.

The Total MCAI has an expanded historical series that gives perspective on credit availability from the last 10 years. It was created to provide historical context to the current series by showing how credit availability has changed, including during the housing crisis and ensuing recession.

Learn more about the MCAI at mba.org [2].