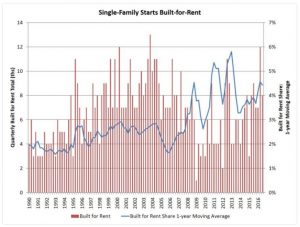

The market share of single-family homes built for rent is currently below its peak but is higher than its historical average and has been gaining over the past year, according to the Census Bureau’s Quarterly Starts and Completions by Purpose and Design [1].

The market share of single-family homes built for rent is currently below its peak but is higher than its historical average and has been gaining over the past year, according to the Census Bureau’s Quarterly Starts and Completions by Purpose and Design [1].

Measured on a one-year moving average, the market share for single-family homes for rent as of the end of Q3 2016 was 4.4 percent—higher than the 2.8 percent historical average market share but still below its 5.8 percent peak reached in 2013.

“With the onset of the Great Recession and the ongoing declines in the homeownership rate [2], the share of built-for-rent homes rose,” NAHB Chief Economist Robert Dietz said [3]. “Despite the current elevated market concentration, the total number of single-family starts built-for-rent remains low in terms of the total building market. However, after falling during 2013, the market share has grown over the past year.”

For the 12-month period ending with Q3, 34,000 homes were built for the purpose of hold and rent—an increase of 28,000 for the four quarters prior, according to the Census Bureau.

While the Census Bureau’s data includes just homes that are built and held for rent, there are also opportunities for third-party investors who are looking to get into the space. George Huang, founder and managing partner of Bridge Tower Group [4], said his company owns about 600 homes in the Dallas area and is looking to expand to about 1,000 homes—primarily through acquiring built-for-rent starter homes.

While the Census Bureau’s data includes just homes that are built and held for rent, there are also opportunities for third-party investors who are looking to get into the space. George Huang, founder and managing partner of Bridge Tower Group [4], said his company owns about 600 homes in the Dallas area and is looking to expand to about 1,000 homes—primarily through acquiring built-for-rent starter homes.

Huang started the company in 2013 about a year after the Dallas market bottomed out and began buying foreclosure inventory. But with the normalization of the market over the past three years and the decline in foreclosure volume, he, like many investors, have turned elsewhere for opportunities.

“It turns out on the subdivision level—50, 100, or 200 homes, and 200 is our largest subdivision that we're building—you can get decent cost efficiencies and the return is quite comparable to the foreclosure inventory that we were picking up in 2013,” Huang said. “With REOs, the neighborhoods are typically older and a typically little bit closer to the city, so you can subtract about 5 or 10 minutes from the commute. You'll have a lower cost at first, but overall, higher renovation costs and over time, higher maintenance costs to those homes.”

Huang said he gets about an 8 percent net return on foreclosed properties, and with new starter homes, about an 11 percent net return in the beginning—possibly more after the subdivision is fully rented out.

“The returns, ultimately, on the new homes, are pretty similar,” Huang said. “You also get some cost efficiencies on the back end in terms of management. If you want to rent out three homes simultaneously because there is some degree of vacancy or turnover, that can be done much more efficiently. The cost is way lower when you have multiple homes in a subdivision that you have to deal with as opposed to just one, and you have to drive another 10 minutes to the next subdivision to deal with the next house. We found that the returns, pretty much, from our last couple of years of experience, is pretty similar even though new homes are a little pricier.”