The number of residential mortgage loans refinanced through the FHFA’s Home Affordable Refinance Program (HARP) has been steadily declining for the last four years, according to the FHFA’s Refinance Report for October 2016 [1].

The number of residential mortgage loans refinanced through the FHFA’s Home Affordable Refinance Program (HARP) has been steadily declining for the last four years, according to the FHFA’s Refinance Report for October 2016 [1].

Since HARP was launched in April 2009 as a way to help underwater borrowers lower their monthly mortgage payments, more than 3.4 million borrowers with GSE-backed loans have refinanced through HARP. Now, with the program scheduled to expire on September 30, 2017 [2], there are still thousands of borrowers eligible for the program, according to the Urban Institute’s December 2016 Chartbook [3].

To be eligible for HARP, borrowers must have a loan owned or guaranteed by Fannie Mae or Freddie Mac, have a loan originated on or before May 31, 2009, have a current LTV of greater than 80 percent, and be current on mortgage payments at the time of the refinance. Borrowers are allowed one late payment in the 12 months prior to the refinance as long as it did not occur in during the six-months period before the refinance. FHFA estimates these borrowers save an average of approximately $2,400 per year on mortgage payments.

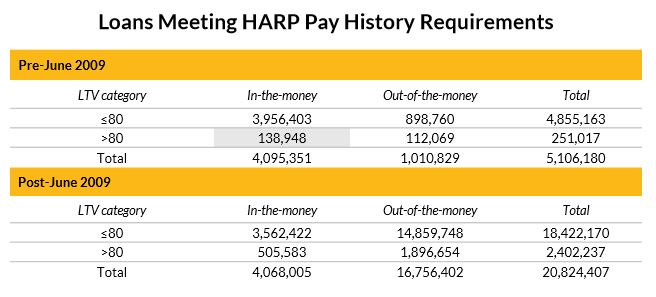

According to Urban Institute, as of the end of September 2016, there were slightly more than a quarter of a million (251,017) mortgage loans nationwide that met these criteria. However, “45 percent are out-of-the-money because the closing cost would exceed the long-term savings, leaving 138,948 loans where a HARP refinance is both permissible and economically advantageous for the borrower,” Urban Institute reported.

More than 80 percent of the loans in the GSE book of business that meet the HARP pay requirement were originated after the HARP cutoff date of May 31, 2009. There are approximately 4.85 million GSE-backed loans that are below the LTV minimum required to refinance through HARP, but meet the other HARP requirements, and are therefore eligible for GSE streamlined refinancing, according to Urban Institute. Out of those, approximately 3.96 million are in the money.

FHFA plans to launch a high LTV refi option toward the end of 2017 to replace HARP, according to the Agency.

Click here [3] to view the entire Urban Institute Chartbook for December 2016.