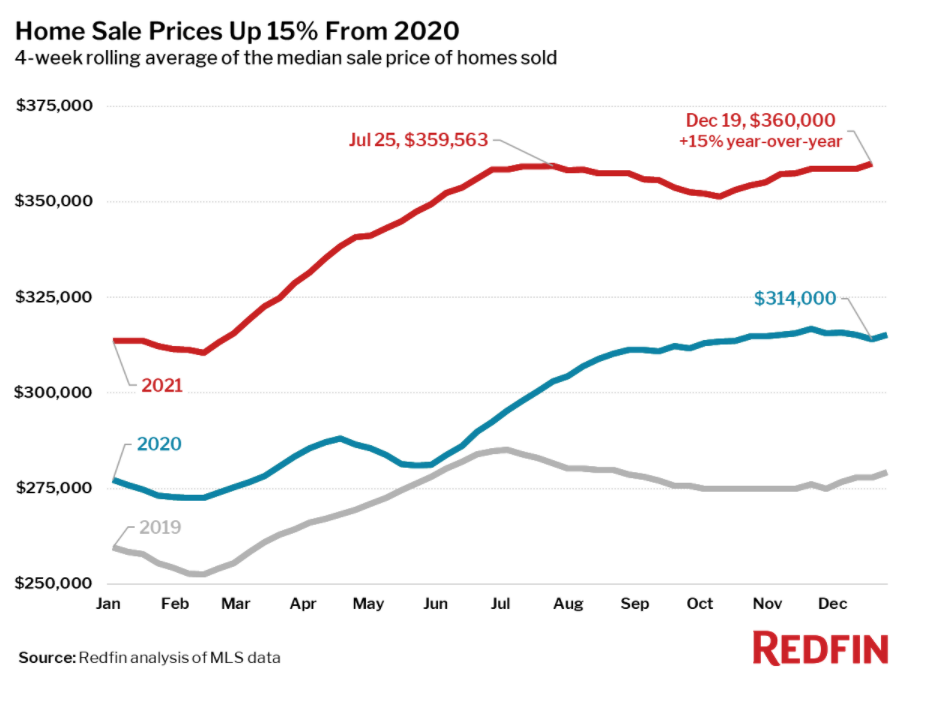

Redfin has reported that during the four-week period ending December 19, the median home sale price in the U.S. rose 15% year-over-year to an all-time high of $360,500. The median asking price of newly listed homes increased 14% year-over-year to $347,475, up 29% from 2019.

Redfin has reported that during the four-week period ending December 19, the median home sale price in the U.S. rose 15% year-over-year to an all-time high of $360,500. The median asking price of newly listed homes increased 14% year-over-year to $347,475, up 29% from 2019.

Meanwhile, pending home sales were up just 0.1% year-over-year, and up 46% compared to the same period in 2019. New listings of homes for sale were down 9% from a year earlier, but up 11% from 2019, marking the largest two-year increase since September.

And in a sign that inventory remains an issue for the market, active listings (the number of homes listed for sale at any point during the period) fell 26% year-over-year to an all-time low, down 45% from 2019.

"As the number of homes for sale drops to a new all-time low every week, homebuyers have a sense that the well is running dry," said Redfin Chief Economist Daryl Fairweather. "Fewer homes are selling because of a lack of supply, while demand remains strong. That's why home prices continue to climb higher and higher. But once mortgage rates increase in 2022, I expect the rate of price growth to slow down significantly."

Additional takeaways by Redfin for 400+ U.S. metro areas:

- The share of homes that went under contract that had an accepted offer within the first two weeks on the market was 42%, above the 36% rate of a year earlier and the 25% rate in 2019.

- Thirty-one percent of homes that went under contract had an accepted offer within one week of hitting the market, up from 26% during the same period a year earlier, and 16% in 2019.

- Homes that sold were on the market for an average of just 26 days, down from 32 days a year earlier and 48 days in 2019.

- Forty-three percent of homes sold above list price, up from 34% a year earlier, and 20% in 2019.

- On average, 3% of homes for sale each week had a price drop, up 0.5 percentage points from the same time in 2020, and up 0.3 points from this time in 2019.

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, was 100.4%, meaning the average home sold for 0.4% above its asking price.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news