The doozy of a year that the real estate market experienced in 2021 did not just include homeowners, but renters as well with Redfin finding that the average rent kept up rising real estate prices and increased 21% nationally last year. But due to the COVID-19 pandemic’s remote work phenomenon, rent prices in smaller, outdoorsy metropolitan areas surged even higher.

The doozy of a year that the real estate market experienced in 2021 did not just include homeowners, but renters as well with Redfin finding that the average rent kept up rising real estate prices and increased 21% nationally last year. But due to the COVID-19 pandemic’s remote work phenomenon, rent prices in smaller, outdoorsy metropolitan areas surged even higher.

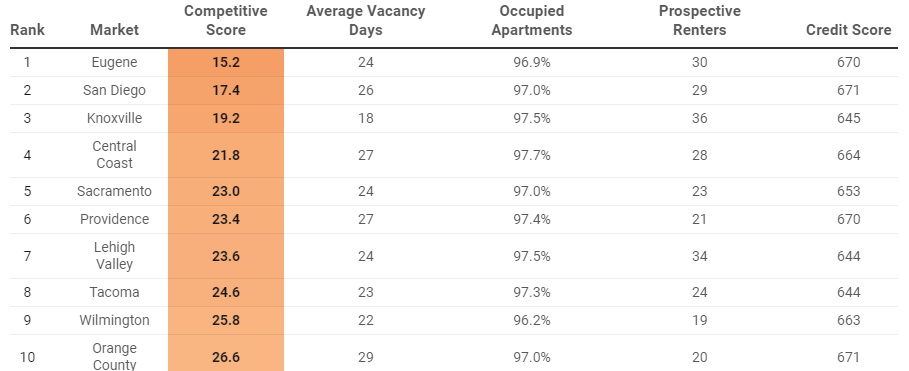

According to a new study by RentCafe, small metro areas—such as Eugene, Oregon, and Knoxville, Tennessee—were magnets for new residents (even out-of-state newcomers) relocating from very densely populated metros. And, the common thread among these areas was a combination of affordable lifestyle, more elbow room and proximity to the great outdoors.

In order to rank these markets, RentCafe scored the 105 largest metros in the metrics of: the number of days rentals were vacant, the percentage of apartments that were occupied, the number of renters competing for vacant apartments, and rental applicants’ average credit scores.

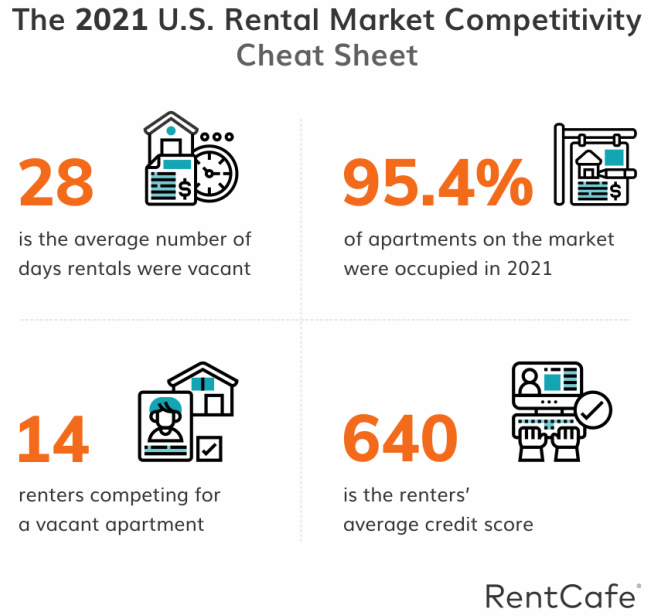

Nationally, a vacant apartment typically sat empty for 28 days before finding a new tenant last year. This resulted in an occupancy rate of 95.4%.

In addition, the average apartment had 14 applicants, signaling a tough market to break into. These applicants were also found to have an average credit score of 640, up two points from 638 seen in 2020.

On a national level, apartments that became vacant were filled within 28 days on average this rental season. During the same time period, 95.4% of total rentals were occupied, with an average of 14 prospective renters competing for a vacant apartment.

“In fact, more than 30% of renters in the nation’s top 50 hottest rental markets in our ranking had average credit scores significantly higher than the national average—which is indicative of renters’ financial strength this year,” the report said. “In other words, more renters with better credit scores were competing for apartments in 2021. And, by and large, the most in-demand U.S. rental markets appealed primarily to Millennials, as Gen Zers are still in the process of building credit history.”

The hottest rental market RentCafe found was Eugene, Oregon, which personifies the beauty of the Pacific Northwest. The metropolitan area attracted new residents at a breathtaking pace due to the relaxed atmosphere, temperate climate, and nearby access to natural attractions.

Eugene is also quickly becoming a tech center as more companies and their employees move to the area—so much so that it is being called the “Silicon Shire” to reflect its rapidly growing tech scene.

According to the data, the total number of apartments in Eugene has increased by a miniscule 5% (2,380 units) over the last two years. When the low number of new and available units are combined with the influx of people that want to move to the area, at least 30 people are applying for every vacant unit when they come up resulting in a turnover time of 24 days from tenant-to-tenant.

Additionally, people who applied for apartments in Eugene had an average credit score of 670, 30 points above the national average.

“It's worth noting that nine of the nation’s top 50 most competitive metros were in the Northeast—a sign that the pandemic has put a premium on spaces in this part of the country, as well, the report said. “As a matter of fact, demand here was so high that, in some cases, prospects were willing to offer months of advance payments to secure an apartment. What's more, most Northeastern metros in our top 50 list had occupancy rates above the national average of 95.4%, including Providence, Rhode Island (97.4%); Long Island, New York (96.7%); and Central New Jersey (96.5%).”

The information for this report was gathered by RentCafe’s sister company Yardi Matrix, a business development and asset management tool for brokers, sponsors, banks and equity sources underwriting investments in the multifamily, office, industrial and self-storage sectors. Application information was derived from RentGrow, Inc

To view the data from the report, including a breakdown for the top-50 metro areas, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news