Mortgage credit availability decreased in January according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology.

Mortgage credit availability decreased in January according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology.

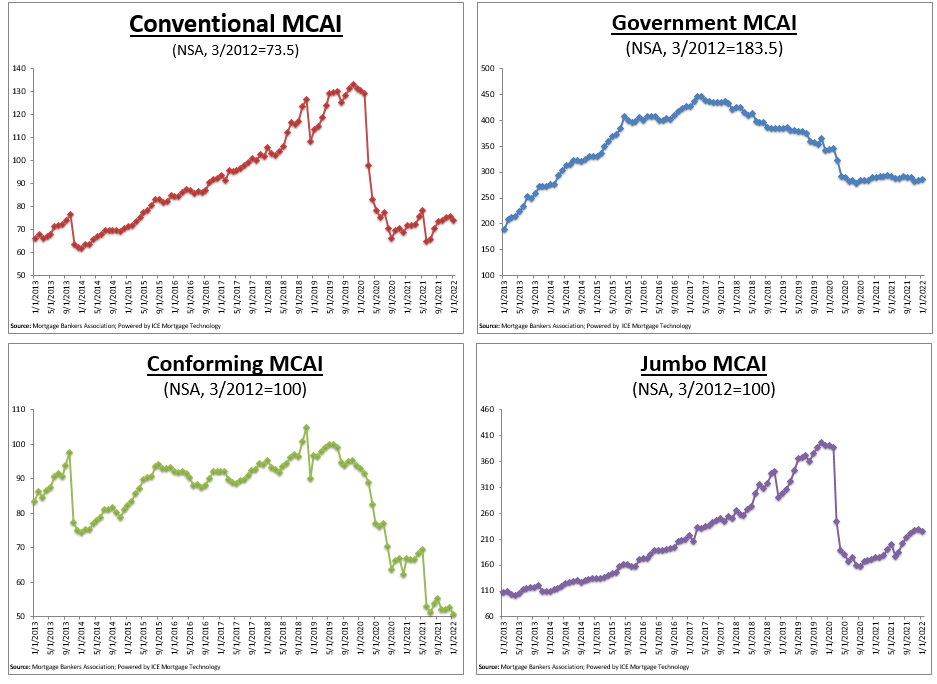

The MCAI fell by 0.9% to 124.8 in January. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI decreased 2.5%, while the Government MCAI increased by 0.7%. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 1.6%, and the Conforming MCAI fell by 4.2%.

"Credit availability declined to its lowest level since August 2021, even as the economy and job market continued to improve," said Joel Kan, MBA's Associate VP of Economic and Industry Forecasting. "The decline in credit supply came at a time of rising mortgage rates and limited inventory, which add to the challenges that some prospective buyers are facing. The supply of conforming mortgage credit dropped to its lowest level dating back to 2013, driven by a decrease in investor demand for loan programs catering to borrowers with higher LTVs and lower credit score profiles."

"Prior to last month, there were six months of increasing jumbo credit supply, driven by strong demand, rapid home-price appreciation, and the overall strength in the economy." said Kan. "That growth streak ended last month, as investors reduced their willingness to purchase jumbo loans and also raised credit requirements."

The MCAI fell by 0.9% to 124.8 in January. The Conventional MCAI decreased 2.5%, while the Government MCAI increased by 0.7%. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 1.6%, and the Conforming MCAI fell by 4.2 percent.

To see the full report, including charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news