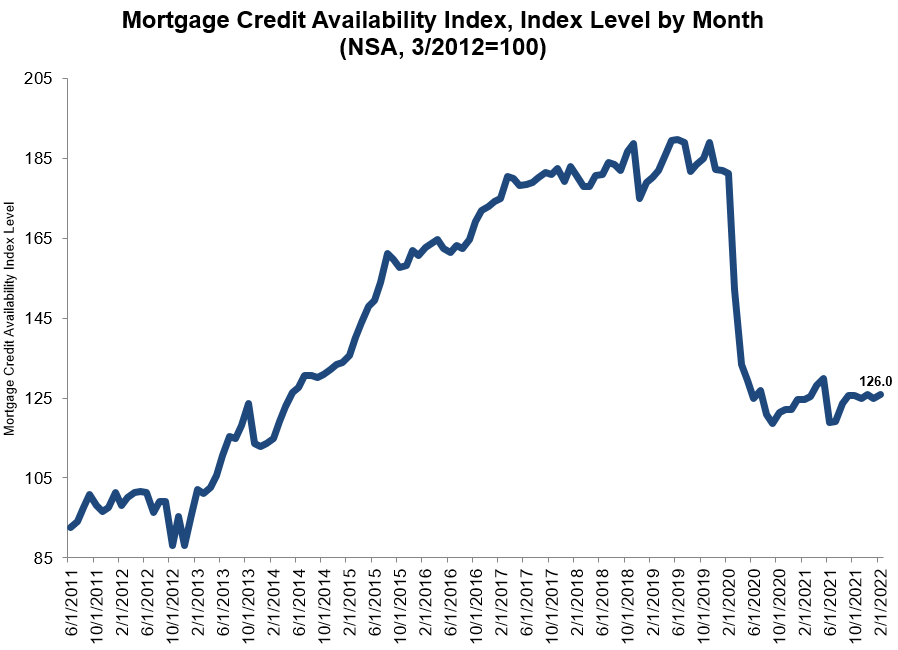

Mortgage credit availability increased in February, according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA).

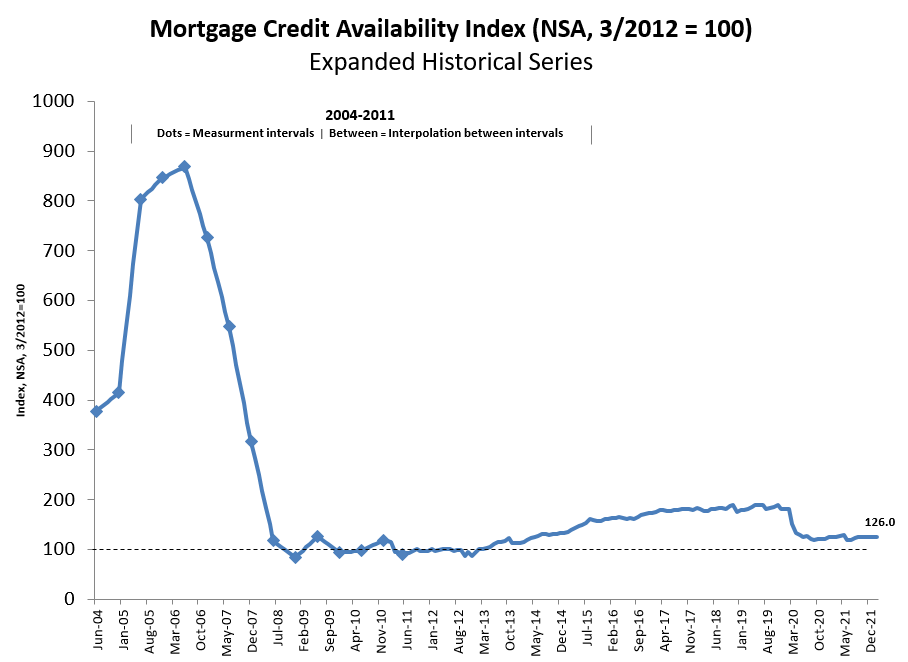

The MCAI rose by 1.0% to 126.0 in February. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI increased 3.2%, while the Government MCAI decreased by 0.9%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 3.9%, and the Conforming MCAI rose by 2.2%.

"Credit availability increased to its highest level since May 2021, driven by growth in jumbo loan programs, as well as those that include allowances for ARMs and expanded credit score and LTV requirements," said Joel Kan, MBA's Associate VP of Economic and Industry Forecasting. "In a period of rising mortgage rates, affordability challenges, and declining volume, lenders have made efforts to slightly broaden their product offerings."

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs.

The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

To read the full report, including all charts and methodology, click here [1],