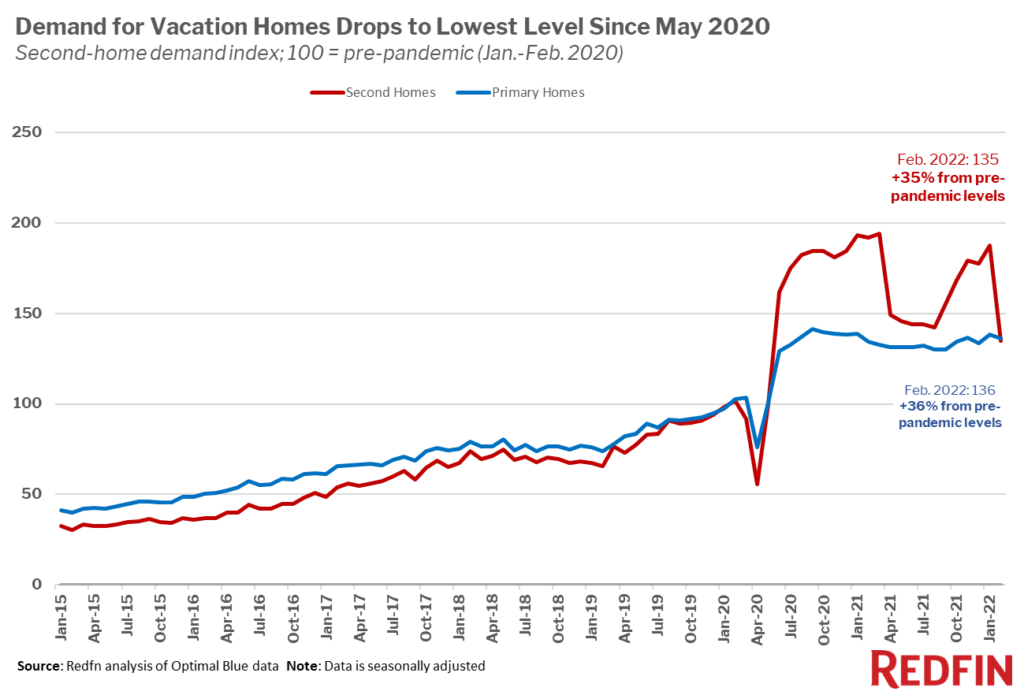

According to a new report from Redfin [1], demand for vacation homes fell drastically in February, with mortgage-rate locks for second homes reaching their lowest level since May 2020. Demand was still up 35% from pre-pandemic levels, but significantly lower than the 87% increase in January.

February also marked the first month since the start of the pandemic, with growth in demand for primary residences slightly outpacing vacation homes, as mortgage-rate locks for primary homes are up 36% from pre-pandemic levels. Demand for second homes soared in mid-2020 as the pandemic overwhelmed the nation, reaching a peak in March 2021, with demand up 95% from pre-pandemic levels. The combination of remote work, record-low mortgage rates, and the desire to steer clear from crowds encouraged many affluent Americans to buy vacation homes.

“Rising mortgage rates, combined with rising home prices, are hitting the second-home market much harder than the primary-home market,” said Redfin Chief Economist Daryl Fairweather. “That’s largely because vacation homes are optional. People don’t need a second home, but they do need a place to live. Still, people are buying up vacation homes more than they were before the pandemic, as work remains more flexible than it used to be.”

The average 30-year mortgage rate reached a peak of 3.92% in mid-February, substantially higher than the 2.65% low reached in the beginning of 2021. As a result of that increase, the typical monthly mortgage payment is up hundreds of dollars from 2021.

Demand for second homes may continue to decline in the coming months as loan fees for second homes begin to rise. The Federal Housing Finance Agency announced fees for second-home loans will increase by about 1% to 4% starting in April. The change will add an estimated $13,500 to the cost of purchasing a $400,000 home for the typical second-home buyer, which can be paid upfront or rolled into a mortgage.

Although mortgage-rate locks for second homes were down in February, prices continued to grow in seasonal towns, where vacation homes are frequently located. Home prices in seasonal towns rose 20% year-over-year in February to a median of $513,000, as February marks more than a year and a half of 10%-plus year-over-year growth for home prices in seasonal towns.

This number is due partly to a severe shortage of inventory, with the number of homes for sale in seasonal towns down a record 29% year-over-year in February. The fact that home prices are up and inventory is down, despite second-home demand declining, suggests that some workers with permanently remote jobs may be relocating to vacation destinations rather than purchasing second homes. Home prices in non-seasonal towns were up 13% to $414,000, and supply was down 17%.

To view the full report, including methodology, click here [2].