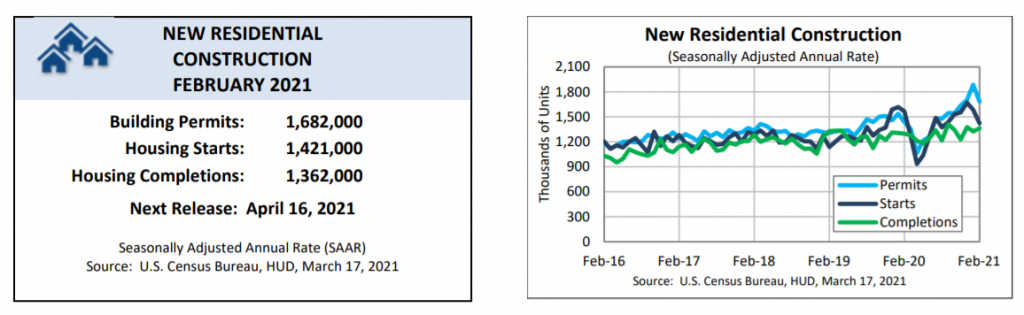

Severe winter weather that gripped Texas and parts of the Northeast slowed residential construction in February, as privately-owned housing starts in February were at a seasonally-adjusted annual rate of 1,421,000, 10.3% below the revised January 2021 estimate of 1,584,000, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development (HUD). Although down month-over-month in February, housing starts were 9.3% below February 2020’s pre-pandemic rate of 1,567,000.

Severe winter weather that gripped Texas and parts of the Northeast slowed residential construction in February, as privately-owned housing starts in February were at a seasonally-adjusted annual rate of 1,421,000, 10.3% below the revised January 2021 estimate of 1,584,000, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development (HUD). Although down month-over-month in February, housing starts were 9.3% below February 2020’s pre-pandemic rate of 1,567,000.

Single-family housing starts in February 2021 stood at 1,040,000, a decline of 8.5% below January’s figure of 1,136,000. The February rate for units in buildings with five units or more was 372,000.

“Today’s new residential construction report from the Census Bureau showed an expected fall in the pace of housing starts for the month of February, likely in part due to extreme weather,” said Doug Duncan, Chief Economist at Fannie Mae. “Total starts fell 10.3% over the month, following January’s decline of 5.1%. Starts were at the slowest pace since last August. Single-family starts fell 8.5% in February, the second monthly consecutive decline, and multifamily starts pulled back 15%, following a 28.7% surge a month earlier. Despite the month’s weakness, at an annualized pace of 1.42 million, total starts remained considerably above the pre-COVID 2019 average of 1.30 million.

Privately-owned housing completions in February were at a seasonally-adjusted rate of 1,362,000, 2.9% above the revised January estimate of 1,324,000 and 5% above February 2020’s rate of 1,297,000. Single-family housing completions in February stood at 1,042,000, 2.8% above the revised January rate of 1,014,000. The February rate for units in buildings with five units or more was 314,000.

Regionally, single-family starts in the Midwest and South, areas that experienced the brunt of the extreme cold, fell 19% combined; while in the West, they rose 22.9%;and in the Northeast, single-family starts were roughly flat.

“The regional data tends to be especially noisy, but it is consistent with the recent pattern of state-level mortgage applications and home listings data, which show an abnormal concurrent slowdown in the South and Midwest regions,” said Duncan. “This, combined with the rate of permits significantly outpacing the level of starts the past two months, leads us to expect a near-term bounce-back in single-family starts over the upcoming months.”

With the winter chill fading and the spring homebuying season beginning, cautious optimism is on the horizon.

“Robust construction activity is likely this year due to extremely tight inventories of existing homes for sale; however, homebuilders continue to face supply constraints, most notably labor, lumber, and other materials,” said Duncan. “Additionally, the recent increase in interest rates and the waning effect of the COVID-19 disruption to homebuyers’ purchasing timelines is, in our view, likely to modestly cool demand for new homes following a near-term rebound.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news