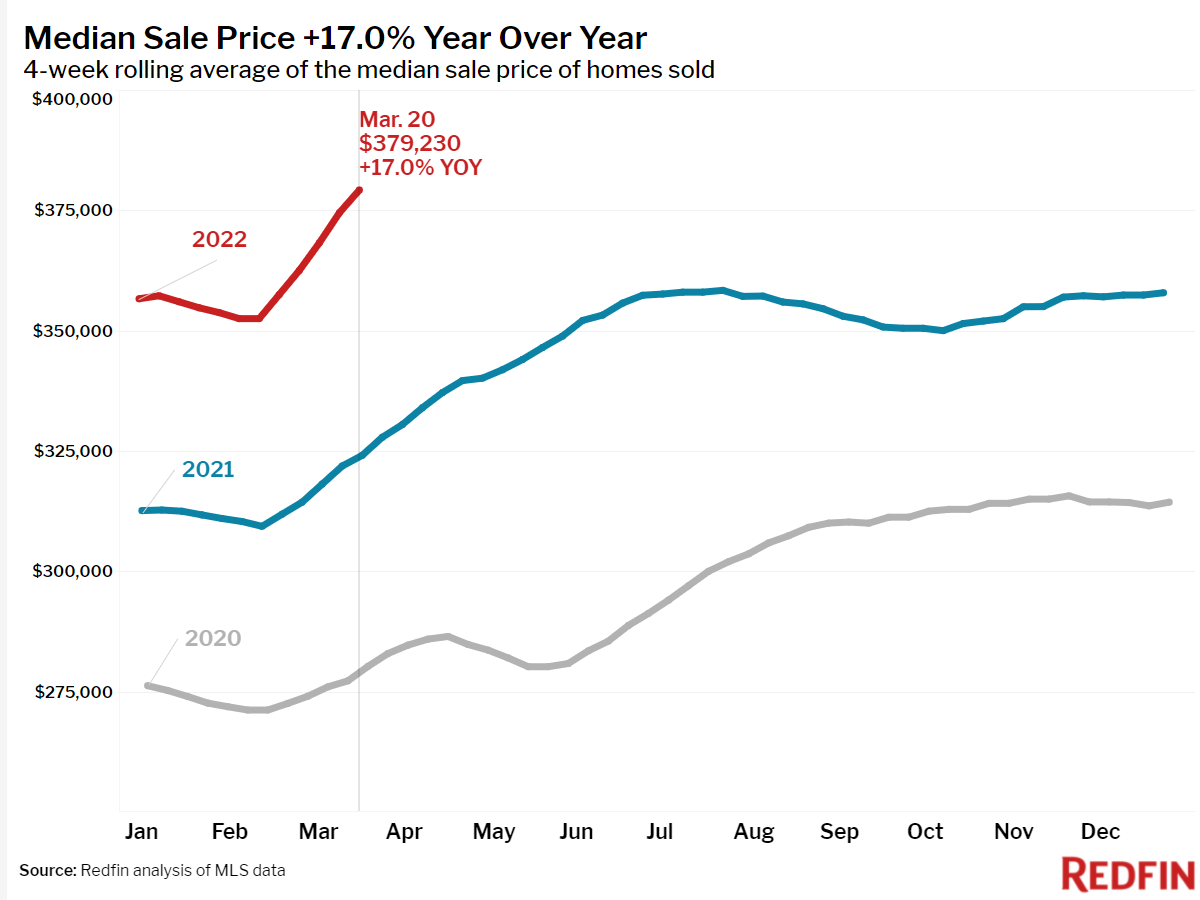

Housing prices jumped the most since summer 2021—up 17% year-over-year to a new high, according to a new report from Redfin. At the same time, a 7% drop in new listings kept homebuyer competition elevated amid rapidly rising mortgage rates.

“With so much uncertainty in the world and economy, it makes sense that homeowners are staying put,” said Redfin Chief Economist Daryl Fairweather. “High prices and rising mortgage rates are a strong impediment even for homeowners who would ideally like to move to a better home. First-time homebuyers, on the other hand, are still seeking the security of homeownership despite the chaos of this market.”

Key housing market takeaways for 400+ U.S. metro areas:

Unless otherwise noted, this data covers the four-week period ending March 20. Redfin’s housing market data goes back through 2012.

- The median home sale price was up 17% year-over-year to a record high of $379,230, the biggest increase since the four weeks ending Aug. 1, 2021. Prices were up 6% from 4 weeks prior.

- The median asking price of newly listed homes increased 15% year over year to $398,850.

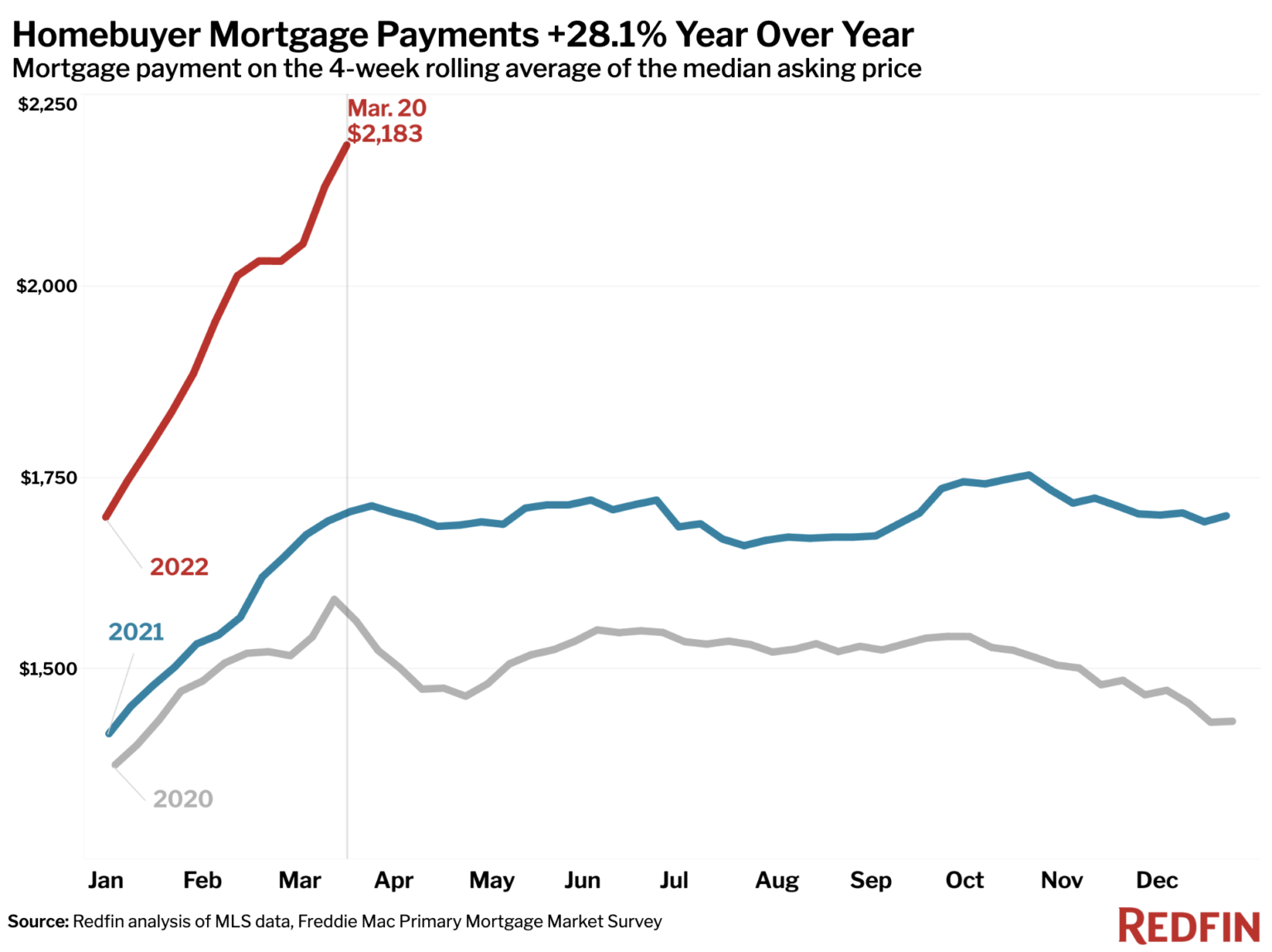

- The monthly mortgage payment on the median asking price home rose to a record high of $2,183 at the current 4.42% mortgage rate. This was up 28% from a year earlier, when mortgage rates were 3.17%.

- Pending home sales were up 1% year over year.

- New listings of homes for sale were down 7% from a year earlier.

- Active listings (the number of homes listed for sale at any point during the period) fell 23% year over year to an all-time low of 469,000.

- 59% of homes that went under contract had an accepted offer within the first two weeks on the market, an all-time high. This was up from the 53% rate of a year earlier.

- 45% of homes that went under contract had an accepted offer within one week of hitting the market, an all-time high. This was up from 41% during the same period a year earlier.

- Homes that sold were on the market for a median of 21 days, down from 31 days a year earlier.

- 50% of homes sold above list price, up from 39% a year earlier.

- On average, 2.8% of homes for sale each week had a price drop, up from 2.3% at the same time in 2021.

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, rose to 101.7%. In other words, the average home sold for 1.7% above its asking price. This was up from 100.0% in 2021.

Other leading indicators of homebuying activity:

- Mortgage purchase applications decreased 8% week over week (seasonally adjusted) during the week ending March 18.

- For the week ending March 24, 30-year mortgage rates rose to 4.42%—the highest level since January 2019. This was up from 4.16% the prior week.

- Touring activity from the first week of January through March 20 was 16 percentage points behind the same period in 2021, according to home tour technology company ShowingTime.

- The Redfin Homebuyer Demand Index fell less than 1% from the previous week during the seven-day period ending March 20 and was up 6% from a year earlier.

- Nearly 3 in 5 homes were snagged up within two weeks, an all-time high, and half sold for over the asking price.

To view the full report, including charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news