Home prices in many once-affordable metros have surged and priced out many would-be buyers —a dynamic that’s being exacerbated by rising mortgage rates— but a handful of popular migration destinations. Found mainly in the South, some hotspots are still relatively affordable, according to a new report from Redfin.

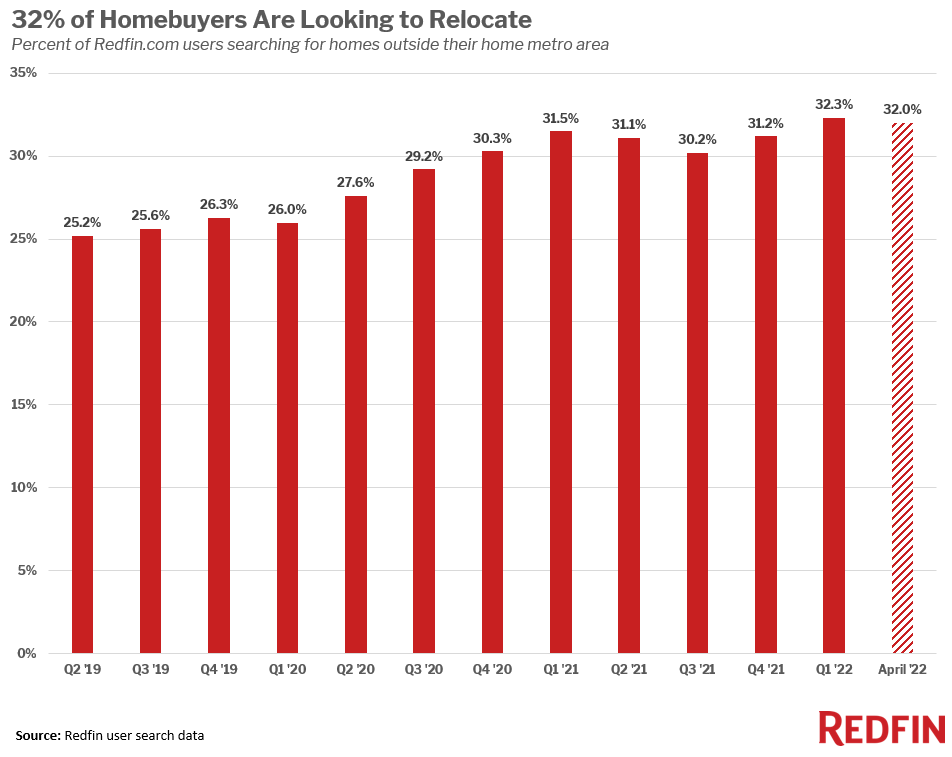

Some 32% of homebuyers nationwide looked to move to a different metro area in April, close to the all-time high of 32.3% set in Q1.

The typical home in Virginia Beach, —the 15th-most popular destination for buyers moving to a different metro— sold for $315,0000 in April. That’s well below the national median of $424,400 and the lowest median sale price of the top 20 migration destinations in the U.S.

The typical home in Virginia Beach, —the 15th-most popular destination for buyers moving to a different metro— sold for $315,0000 in April. That’s well below the national median of $424,400 and the lowest median sale price of the top 20 migration destinations in the U.S.

Next, a pair of Texas metros were ranked 9th and 10th on the list of most popular destinations: San Antonio, where the typical home sells for $330,000 —and Houston, with a median sale price of $340,000.

Jacksonville, Florida was ranked 13th where the typical home sold for $357,000, and Bakersfield, California —ranked 20th most popular destination— with a median sale price of $365,000 round out the top five.

Followed by:

- Tampa, Florida (ranked 3rd, $370,000)

- Atlanta, Georgia (ranked 12th, $383,000)

- Cape Coral, Florida (ranked 6th, $419,000)

While the destinations listed above may be affordable for people moving in from expensive areas like New York, San Francisco and Seattle, many locals have been priced out. Homebuyers in Tampa, for example, need to earn 47.8% more than they did a year ago to afford the median-priced home, and buyers in Atlanta need to earn 40.6% more.

“A lot of people are moving to Florida for the price point, beaches and quality of life, especially since the pandemic started,” said Eric Auciello, a Redfin Team Manager in Tampa. “For a buyer who sold their home in a place like New York for a million dollars, Tampa is affordable. They can get a nice home in a desirable neighborhood for around $550,000. But for locals looking in the $300,000 to $400,000 price point, there’s next to nothing for sale. Locals are turning to condos or moving to more affordable rural areas.”

In four of the top five migration hotspots, home prices are above the national average. In Miami —the number-one migration destination— the typical home sold for $475,000 in April, up from $330,000 in April 2020 at the onset of the pandemic.

In number-two ranked Phoenix, the typical home sold for $480,000, up from $305,000 in April 2020. In number-four ranked Sacramento, prices went from $430,000 to $605,000; and in number-five ranked Las Vegas, they went from $294,000 to $445,000. Tampa, ranked three, was the only metro in the top five with a median sale price below the national level.

Sun Belt migration hotspots are also home to some of the highest inflation rates in the U.S., meaning costs of other goods and services are also soaring. While they’re still some of the hottest destinations in the country, the flow of buyers into Phoenix and Las Vegas is slower than it was a year ago.

“Places like Phoenix and Sacramento are still relatively affordable compared to San Francisco or Los Angeles–but they’re not nearly as much of a bargain as they were before the pandemic,” said Redfin Deputy Chief Economist Taylor Marr. “Now that homes everywhere have become more expensive, buyers searching for deals should expand their horizons. The good news is that even with surging prices and mortgage rates, there are plenty of relatively affordable options: Buyers from expensive areas looking for more housing options can consider parts of the country that are still relatively affordable, like San Antonio or parts of Florida.”

San Francisco saw more homebuyers looking to leave than any other metro in April. Followed Los Angeles, New York, Washington, D.C. and Seattle —some of the largest job centers in the U.S.

Expensive coastal job centers typically top the list of metros homebuyers are leaving, a trend that has strengthened during the pandemic as remote work has made moving to relatively affordable locations more feasible.

To view the full report, including charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news