Millennials have been cited by many analysts as the key to increasing the homeownership rate. Now a new study has found that they will likely be the key driver and the target market for sustained loan growth at credit unions—and a main driver of that growth has been mortgages.

Millennials have been cited by many analysts as the key to increasing the homeownership rate. Now a new study has found that they will likely be the key driver and the target market for sustained loan growth at credit unions—and a main driver of that growth has been mortgages.

Research from TransUnion released on Tuesday indicated that credit union membership grew at more than three times the rate of credit activity of consumers at other types of lenders in the first quarter of 2016 (6.35 percent growth rate for credit unions compared to 1.86 percent for industry credit active consumers).

The share of credit union members who are millennials has risen from 20 percent to 25 percent in the last three years, which is indicative of a recent strategic focus on millennial growth on the part of credit unions. Non-credit unions experienced a slower pace of millennial growth during that same three-year period (23 percent in Q1 2013 to 25 percent in Q1 2016).

“Millennials are an important set of borrowers for credit union growth,” said Nidhi Verma, senior director of research and consulting in TransUnion’s financial services business unit. “Credit unions are actively building their millennial membership, and in fact have experienced growth in this segment every quarter since 2010. Millennials are likely candidates for new mortgages and other credit products as they age, offering credit unions a way to further their market share.”

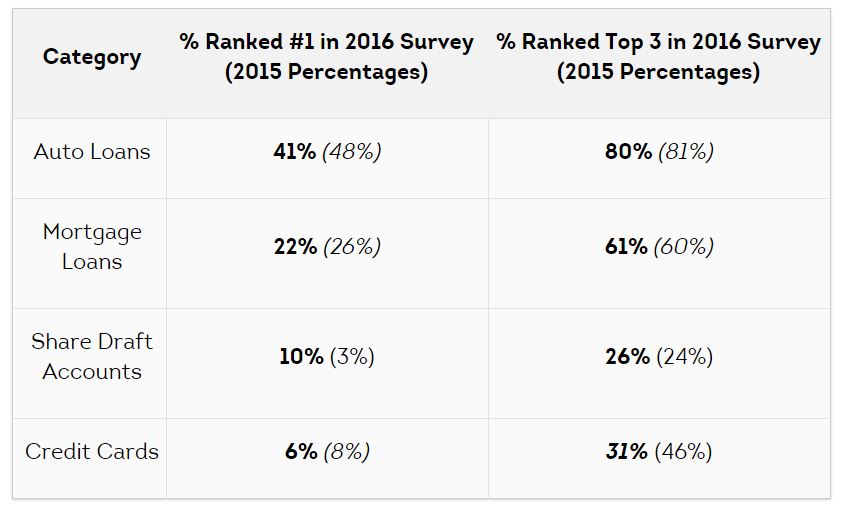

TransUnion’s research was coupled with a survey of 96 credit union executives, gathering insights on key industry issues. According to the survey, 42 percent of those executives reported a growth rate over-the-year of higher than 5 percent—and one of the major drivers of the growth has been credit union membership via mortgage origination. The number of credit union members grew from 3.67 million members in Q1 2015 up to 3.8 million members in Q1 2016 (a 4 percent increase). Credit union mortgage memberships have increased by 13 percent since Q1 2011, when they totaled 3.29 million.

TransUnion’s research was coupled with a survey of 96 credit union executives, gathering insights on key industry issues. According to the survey, 42 percent of those executives reported a growth rate over-the-year of higher than 5 percent—and one of the major drivers of the growth has been credit union membership via mortgage origination. The number of credit union members grew from 3.67 million members in Q1 2015 up to 3.8 million members in Q1 2016 (a 4 percent increase). Credit union mortgage memberships have increased by 13 percent since Q1 2011, when they totaled 3.29 million.

“The data show that credit union membership rates are growing much faster than the overall credit-active population,” said Verma. “Credit union executives are strategically focused on gaining membership growth through mortgage originations, as well as offering products such as credit cards to their existing member base.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news