The low mortgage rate environment has created an incentive for homeowners to refinance. But fewer and fewer of them are doing it through the government’s Home Affordable Refinance Program (HARP).

The low mortgage rate environment has created an incentive for homeowners to refinance. But fewer and fewer of them are doing it through the government’s Home Affordable Refinance Program (HARP).

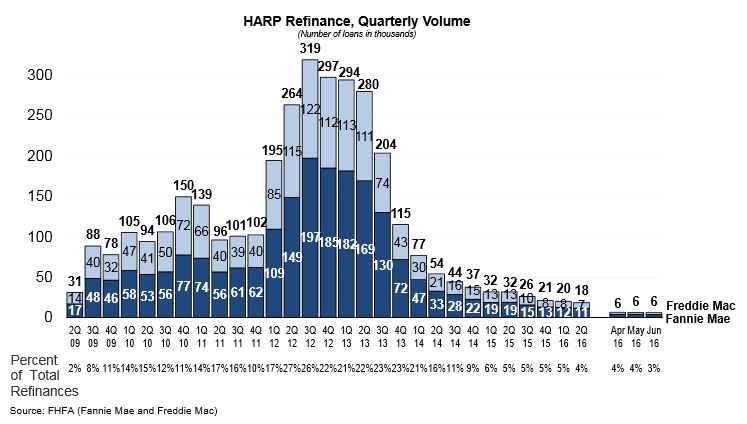

The total number of refinances completed through HARP now stands at approximately 3.42 million as of the end of June 2016, according to FHFA’s Q2 Refinance Report released Thursday. Though the number of total HARP refinances topped more than 3.4 million and the total refinance volume increased in June, the 18,310 borrowers who refinanced through HARP in the second quarter represented only 4 percent of total refinances—the lowest share for HARP since Q2 2009, when the program was launched.

HARP, which was launched in early 2009 to help borrowers who are current on their mortgage payments, but have little or no equity in their home, to take advantage of low interest rates and other refinancing benefits, is scheduled to expire at the end of this year. With time winding down for HARP, FHFA estimates there are still a few hundred thousand borrowers nationwide who are eligible to refinance through the program.

“There are still more than 323,000 U.S. borrowers eligible for the program who have a financial incentive to refinance, as of the first quarter of 2016,” FHFA stated in its report. “These so called ‘in-the-money’ borrowers meet the basic HARP eligibility requirements, have a remaining balance of $50,000 or more on their mortgage, have a remaining term on their loan of greater than 10 years, and their mortgage interest rate is at least 1.5 percent higher than current market rates.”

FHFA estimates that eligible borrowers who refinance through HARP can save approximately $2,400 per year on mortgage payments. The Agency has made attempts to reach borrowers eligible for HARP through a series of outreach events in cities with the most eligible borrowers (Chicago, Atlanta, Detroit, Miami, Newark, and Phoenix), webinars, websites, and social media campaigns.

Slightly more than one-quarter (26 percent) of HARP refinances as of the end of Q2 were for 15- or 20-year mortgages, which typically build equity faster than 30-year mortgages. FHFA also reported that 10 states accounted for more than 60 percent of remaining HARP-eligible borrowers who have an incentive to refinance: Florida, Illinois, Ohio, Michigan, Georgia, Pennsylvania, New Jersey, California, New York and Maryland.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news