A substantial spike in mortgage revenue helped to create a profitable third quarter for U.S. Bancorp, according to the bank’s Q3 earnings report [1] released Wednesday.

A substantial spike in mortgage revenue helped to create a profitable third quarter for U.S. Bancorp, according to the bank’s Q3 earnings report [1] released Wednesday.

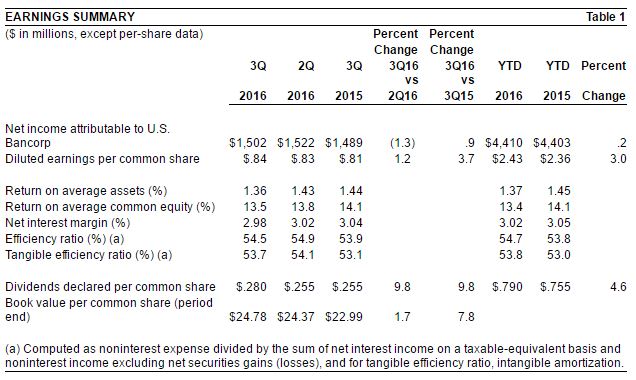

U.S. Bancorp reported a net income of $1.502 billion for Q3, or $0.84 per common share, an increase of approximately 1 percent from the bank’s Q3 2015 totals of $1.489 billion and $0.81 per common share.

The bank’s Q3 total of mortgage revenue was $314 million, which was an increase of 32 percent from Q2’s total of $238 million and an increase of 40 percent from Q3 2015 ($224 million). The increases were driven by strong refinancing activities due to lower longer-term interest rates during Q3, according to the bank. Year-to-date through the first three quarters, U.S. Bancorp’s mortgage revenue is $739 million, which is 6.3 percent higher than the first three quarters of 2015 ($695 million).

The spike in mortgage banking revenue drove U.S. Bancorp’s noninterest income for Q3 up to $2.445 billion, from $2.326 billion in the same quarter a year ago.

“U.S. Bancorp reported solid, industry-leading financial results in the third quarter,” U.S. Bancorp Chairman and CEO Richard K. Davis said. “The banking industry continues to face steady headwinds, including persistently low interest rates, a flat yield curve, and a slow economic recovery that caused some commercial customers to pause investments in their businesses during the quarter. Despite the operating environment, we announced record earnings per share and solid revenue growth, particularly within our fee-based businesses. Fee-based revenues grew year over year across most categories including payments, mortgage banking and wealth management while capital markets continued to have solid performance in the third quarter. We remain confident in our ability to generate consistent, predictable and repeatable industry-leading financial results because of our diversified business model and the execution of our strategy.”

U.S. Bancorp’s average total loans increased by 8.6 percent over-the-year up to $19.1 billion in Q3, driven by an increase in residential mortgage loans (from $51.8 million up to $56.3 million).

Click here [1] to view U.S. Bancorp’s entire Q3 earnings report.