When the pandemic hit, rent prices in large cities took a hit as people fled heavily populated areas and moved to the less crowded, and cheaper, suburbs. But as vaccines rolled out, people came back and rent began to rebound.

When the pandemic hit, rent prices in large cities took a hit as people fled heavily populated areas and moved to the less crowded, and cheaper, suburbs. But as vaccines rolled out, people came back and rent began to rebound.

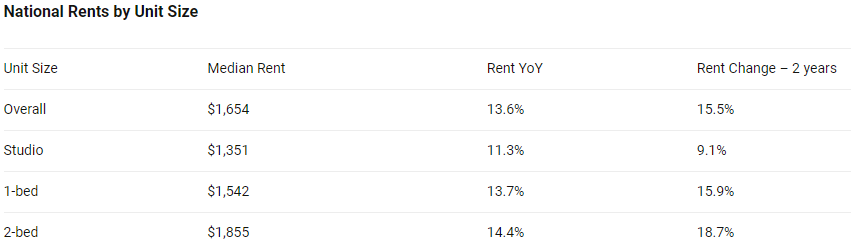

According to a new report by Realtor.com, rent prices over the last month have not just recovered but are making up for lost time—in the 50 largest metros, the median rent was $1,654, up 13.6% year-over-year. This translates to an additional $198 per month for renters. Compared to September 2019, the median rent has increased by $222 (15.5%).

Rents across the country first grew by double-digit percentage in August (11.5%) and continued that trend into September, but rent is some areas increased much more than the national average.

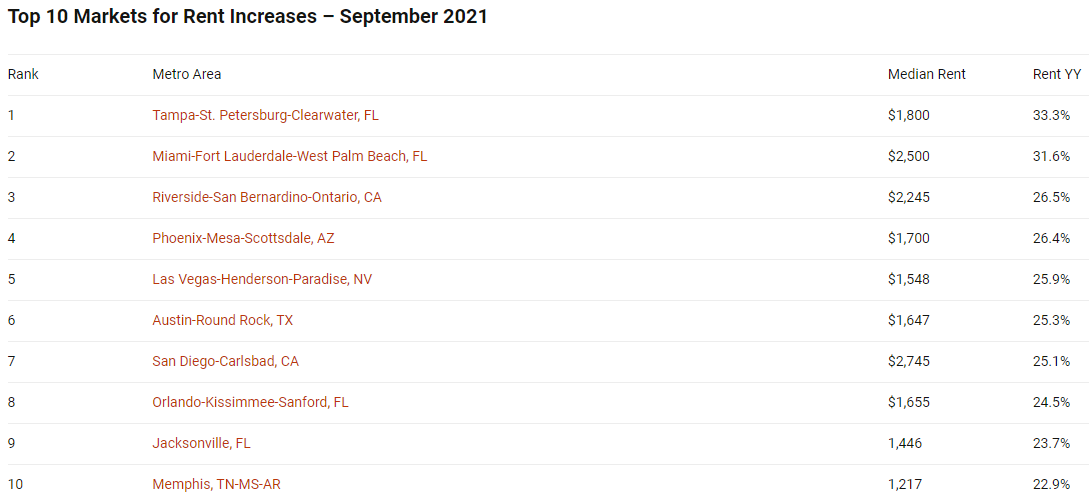

According to Realtor.com rent increased the most in Tampa-St. Petersburg-Clearwater, Florida, areas where prices increased 33.3% to an average $1,800 a month. Also in Florida, the Miami-Fort Lauderdale-West Palm Beach areas saw a 31.6% increase to $2,500.

"With rents continuing to surge to new highs nationwide, including in big tech hubs, September data confirms the U.S. rental market has moved past the recovery phase and is fully back in business. Rental demand remains unseasonably high, driven by still-limited housing supply, rising mortgage rates pushing buyers towards renting, and more people returning to big cities," said George Ratiu, Manager of Economic Research for Realtor.com. "At the same time, it's important to put recent rental activity in the context of housing trends throughout the pandemic. Rents didn't rebound from COVID declines as quickly as for-sale home prices, but rental activity has now reached a level not unlike the homebuying frenzy seen earlier this year, before fall seasonality kicked in. The good news is that if rents continue to parallel home listing prices, rental price growth could potentially begin cooling this winter."

"The days of rental deals in metros like San Francisco and Manhattan may be over, but there is a silver lining for renters with more flexible timelines. Big city rental competition and high prices is a sign of normalcy, which could precede more seasonal norms like winter cooling in rent growth in parts of the U.S.," Raitu added. "For renters on tighter schedules, compromises will be key to staying on budget and not getting swept up in bidding wars. If location and size are your must-haves, consider deprioritizing extra amenities or upgrades. You can use tools like the Realtor.com® Rentals app to set up searches and alerts for rentals that match your top criteria."

Data for the report was gleaned from Realtor.com and included apartment communities, private homes (condos, townhomes, single-family homes). All units were studio, 1-bedroom, or 2-bedroom units.

Click here to view a complete copy of the report, including a breakdown of rent in the top-50 metro areas.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news