As the housing market rebalances, homes on the market that sell are doing so relatively quickly — slower than at the height of last year's frenzy, but more quickly than pre-pandemic norms — according to a new market latest analysis from Zillow. Data also found that other homes are lingering on the market much longer, motivating sellers to build an attractive and competitively priced listing to attract a buyer in today's market.

Differences in days to pending — the median number of days homes that sell have been listed before an offer is accepted— and the age of inventory — the median number of days homes currently listed for sale have been on the market — can reveal valuable information for home sellers, especially during a time of transition.

Highlights:

- Gaps between the median age of inventory and typical time on the market for homes that sell can reveal markets in which certain home types, neighborhoods or price points are in demand, while others linger on the market.

- While buyers have won back some negotiating power, sellers with an attractive listing can still expect a fairly quick sale.

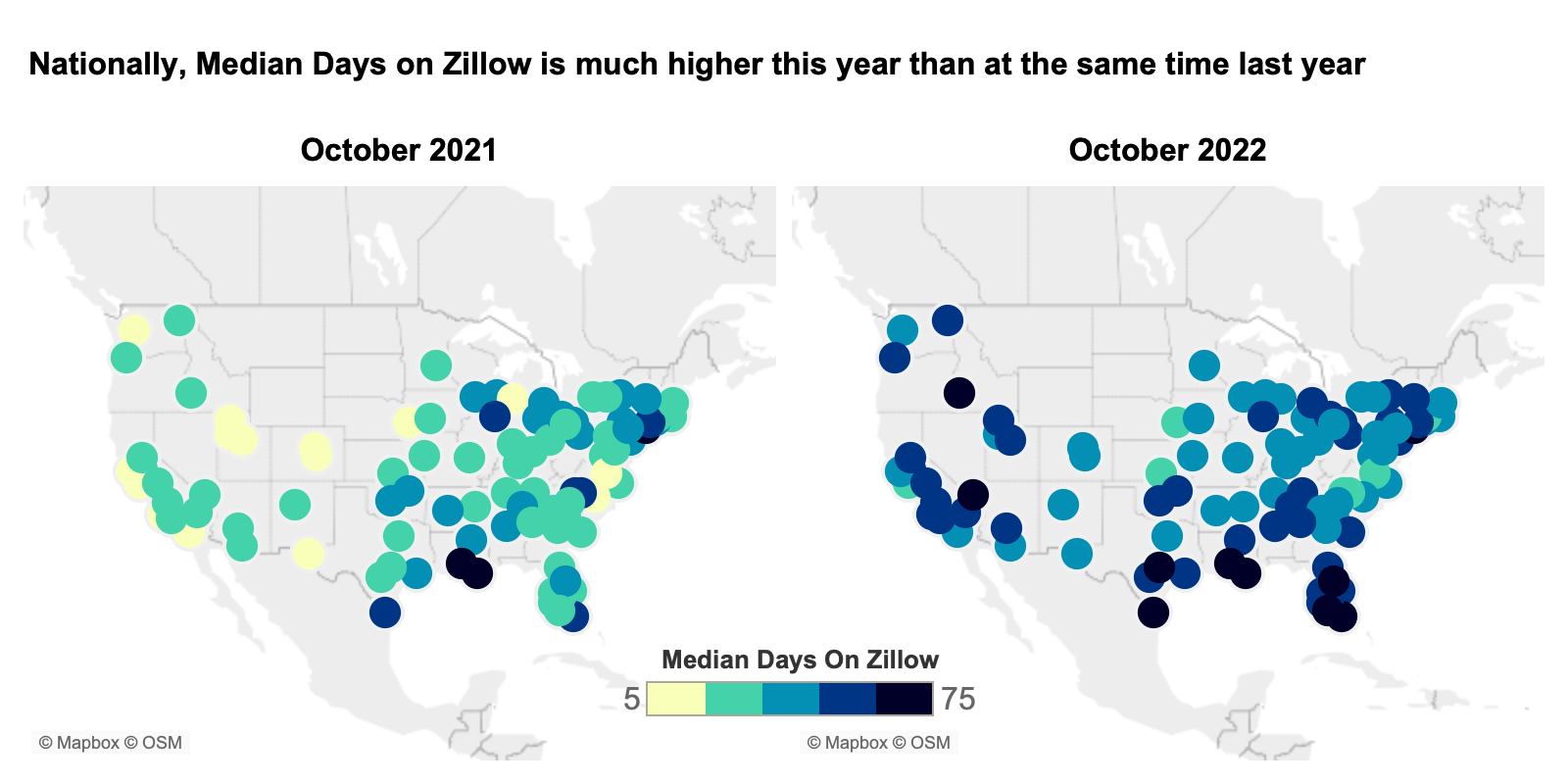

- The median number of days a for-sale home has been on the market is up 45% from last year nationally, and is up in 48 of the 50 largest markets

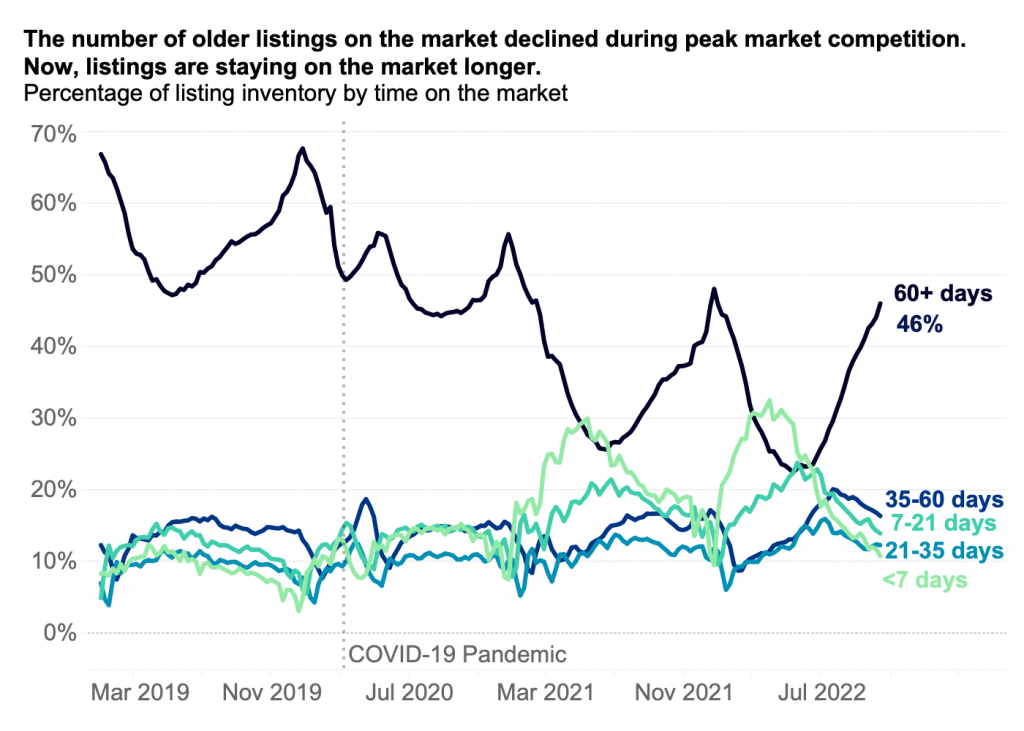

- Some 46% of listings have been on the market for more than 60 days, up 10 percentage points from last year.

- In some markets, homes that sell continue to go quickly even as the typical amount of time a for-sale home has been on the market has increased substantially. This widening gap may indicate that the market for homes with certain characteristics remains competitive even in the current high-interest-rate environment.

Homes that were pending in September typically did so after 19 days; a far cry from the record lows seen during much of the pandemic when homes went pending after a week on the market, but 10 days faster than in September 2019. However, that only takes into account homes that find a buyer. Looking at the full stock of for-sale listings, homes have been on the market a median of 54 days as of mid-October, a 45% increase from a year earlier.

"Last year, sellers could seemingly list their home at any price and see multiple offers roll in above list price within days," said Zillow senior economist Nicole Bachaud. "Now, buyers have some negotiating power, and sellers are under pressure. Buyers are still out there and willing to buy when they find the right home at the right price, which will provide a floor for the price declines we are currently seeing. But sellers need to do things right to attract the attention of these buyers — pricing their home competitively and making their listing attractive to online home shoppers. Especially in a market that's quickly changing like today's, working with an experienced agent who knows the local market is valuable."

Since an all-time low of 19 days in early April, the median age of inventory on Zillow has grown at the fastest rate since at least 2018, when this analysis began. While demand has certainly cooled — Zillow estimates there are 32% fewer active buyers than there were a year ago, though still more than there were in September 2019 — the rapid growth in the median age of inventory may say more about how intensely competitive last year was than about what is happening today. In 2021, the flow of new listings was on par with prior years, but there were so many buyers flooding the market that listings were gone in the blink of an eye.

Even now, the median age of inventory is 30% below pre-pandemic norms. If age of inventory continues to grow at this rapid pace — not a bad bet given we are nearing what is usually the slowest time of year for the housing market — inventory is estimated to be on the market a median of 68 days by the end of this year. That would be more than a month shorter than before the pandemic. For-sale homes had typically been on the market for 100 days at the end of both 2018 and 2019.

The rapid increase in the age of inventory is primarily because the dip in buyer demand has been deeper than the drop in new listings. Buyers are pulling back primarily due to affordability hurdles, as mortgage rates have risen, and the pace of sales has slowed. Homeowners are reluctant to sell and give up what is likely a mortgage rate of around 3% in order to buy a new home at today's interest rates. The lack of new inventory hitting the market means the share of inventory taken up by listings a week old or less is down 42% from a year ago.

Some markets have seen days to pending stay fairly low, while the median age of inventory has risen much more. This indicates that a subset of homes continue to see strong competition as buyers snatch them off the market quickly, while others linger. One example is St. Louis, where typical days to pending has remained about a week, while the median age of inventory has jumped to 40 days from a low of nine days this spring.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news