Low supply levels and increasing demand in the housing market are fueling home prices, in turn, placing all of the cards into sellers' hands.

Low supply levels and increasing demand in the housing market are fueling home prices, in turn, placing all of the cards into sellers' hands.

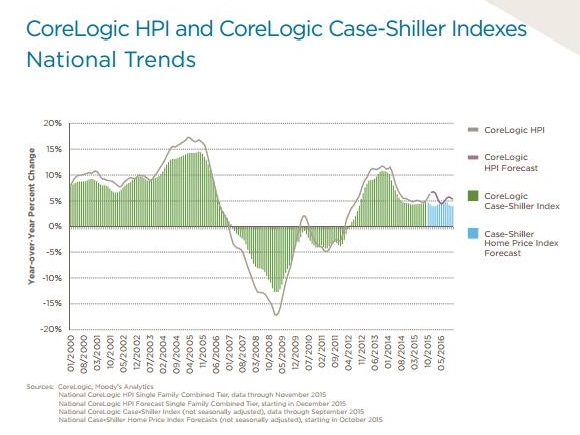

Home prices, including distressed sales, rose by 6.3 percent in November 2015 compared to the same month last year, according to CoreLogic's November 2015 Home Price Index (HPI) report released Tuesday.

“Many factors, including strong demand and tight supply in many markets, are contributing to the long-sustained boom in prices and home equity which is a very good thing for those owning homes,” said Anand Nallathambi, President and CEO of CoreLogic. “On the flip side, prices have outstripped incomes for several years in a number of regions so, as we enter 2016, affordability is becoming more of a constraint on sales in some markets.”

Corelogic reported that the U.S. has experienced 45 consecutive months of year-over-year increases in home prices, but these increases are no longer hitting double-digits.

On the down side, national single-family home prices, including distressed sales, are still 7.3 percent below the peak set in April 2006.

Home prices in the national single-family combined tier, including distressed sales, are up 0.5 percent month-over-month in November 2015, the data shows.

CoreLogic's HPI Forecast predicts that home prices will rise by 5.4 percent year-over-year from November 2015 to November 2016. Meanwhile, home prices are projected to remain flat month-over-month from November 2015 to December 2015.

Single-family home prices, including distressed sales, are expected to reach a new peak by May 2017, the report found.

"House price growth is accelerating as a rise in demand has combined with low inventory levels to boost sellers’ bargaining power. Increases in interest rates will act to cool the market to some extent, but prices are still set for a steady rise this year," said Matthew Pointon, Property Economist at Capital Economics.

He continued, "Even with the Fed increasing rates for the first time in nine years in December, mortgage affordability is historically very favorable. Falling unemployment and early signs that earnings are finally starting to grow has also given more households the confidence to buy a home. And lenders have responded to that gradual rise in demand by loosening credit conditions."

A total of eight states reached new highs in November 2015 including Colorado (10.4 percent), Hawaii (6.3 percent), Montana (4.4 percent), Nebraska (4.9 percent), New York (6.3 percent), Tennessee (5.7 percent), Texas (7.0 percent), and Wyoming (3.4 percent).

On the other hand, three states endured negative home prices appreciation including Mississippi (-3.0 percent), Louisiana (-1.6 percent), and New Mexico (-0.7 percent).

“Heading into 2016, home price growth remains in its sweet spot as prices have increased between 5 and 6 percent on a year-over-year basis for 16 consecutive months,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Regionally we are beginning to see fissures, with slowdowns in some Texas and California markets, but the northwest and southeast remain on solid footing.”

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news