While inflation remains a financial hurdle for many, a new study showed credit scores are improving nationwide. A team of QuoteWizard analysts found that between 2020 and 2021, the average American credit score increased by half a percent, going from 712 to 716.

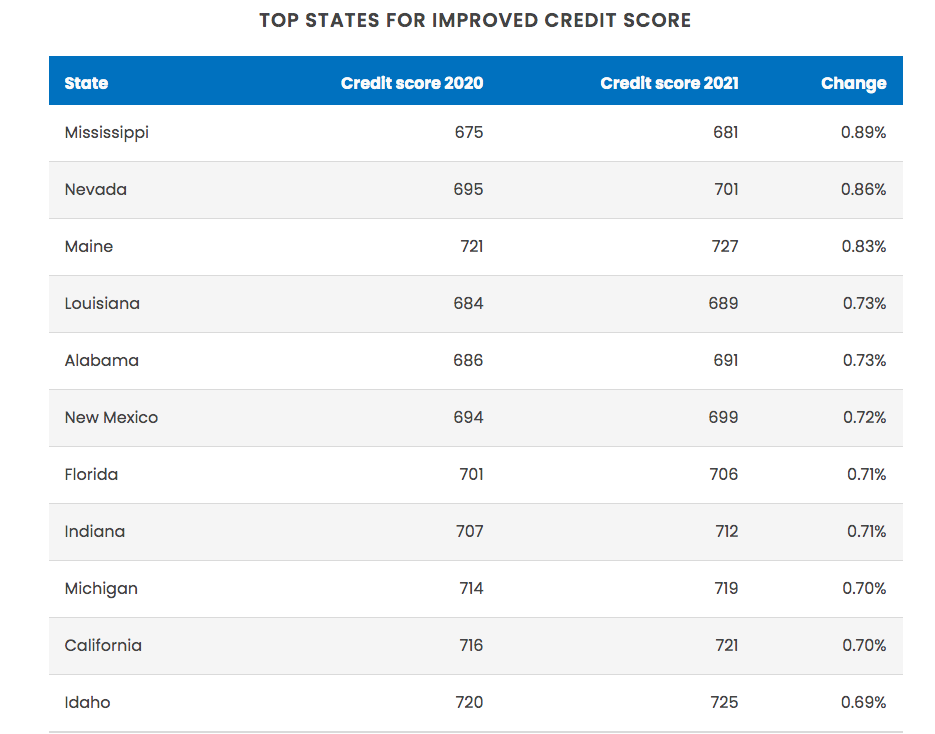

Mississippi, Nevada and Maine saw the biggest improvements in their average scores nationwide, as credit scores in these three states went up by six points in one year. Mississippi, however, still has the lowest average credit score nationwide.

Meanwhile, South Dakota, Oklahoma and Minnesota had the smallest changes in their average credit scores. The average score increased by just two points in South Dakota and Oklahoma. Minnesota’s average score increased by three points, but the state already had the highest average credit score nationwide.

Credit scores increased significantly during the first year of the pandemic because many people were able to pay off debt. Our analysts found that credit card and student loan delinquency dropped by around 30% between 2020 and 2021.

Do all states use credit scores for home insurance?

Not all states permit the use of credit reports to calculate home insurance rates. In California, Maryland and Hawaii, it is illegal for insurers to use your credit score to increase your home insurance rate. Other states may allow the practice; however, these states won't allow insurers to use your CBI score as a reason to cancel or deny your home insurance coverage.

What determines your credit rating?

While CBI scores are similar to your standard credit score, there are some slight differences. Credit-based insurance scores only use some of the factors that comprise standard credit scores.

Credit-based insurance scores are different from the FICO scores your mortgage lender or auto lender might pull. Credit-based insurance scores are designed to consider factors that can be found on your credit reports. They also consider factors from your previously filed insurance claims.

Home insurers look at different factors when calculating your CBI scores. The two main influences on your insurance credit score are:

- Hard inquiries: Hard inquiries occur when a possible lender, such as a credit card company or an auto loan financer, checks your credit score to measure your risk value. These can lower your credit rating. However, if you make all your searches for mortgage, student loan rates or anything else requiring a hard inquiry within a 45-day window, all the inquiries will count as only one.

- Payment history: Your ability to pay your bills consistently and on time is of great interest to home insurers. Being in good standing with all your accounts will reduce your risk level.

Other factors that can affect your CBI score are:

- Debt-to-available-credit ratio

- The length of your credit history

- Your credit limits

Your insurance score "differs from a traditional credit score because the company does not factor in your employment history, your earnings history, your gender or a good bit of other personal information." said David Bakke, contributor at Money Crashers. "It's a lot more limited compared to the criteria for establishing a credit score."

The three main credit bureaus, Equifax, Experian and Transunion, can weigh the influence of each factor differently as well. Experian may weigh your payment history at 20% of your score while Transunion may weigh it at 30%.

To read the full report, including more data, charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news