The year of 2015 was a year of prosperity and growth for the housing market, and in turn, consumers displayed their confidence with positive feelings toward their income, job security, and overall economic outlook.

The year of 2015 was a year of prosperity and growth for the housing market, and in turn, consumers displayed their confidence with positive feelings toward their income, job security, and overall economic outlook.

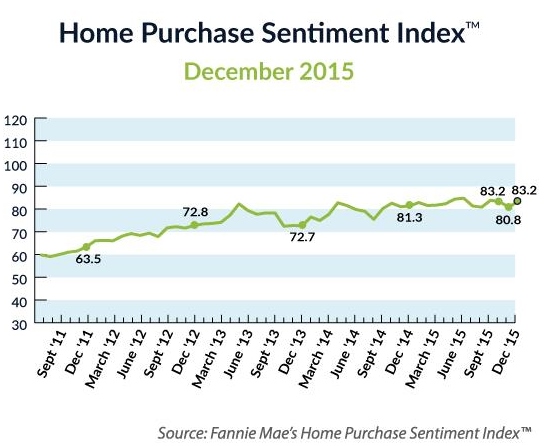

Fannie Mae’s reported that their Home Purchase Sentiment Index (HPSI) rose 2.4 points to 83.2 in December. This increase wraps up the strongest year the housing market has experienced thus far.

“Consumers ended the year on an improved note with regard to their income, job security, and overall economic outlook. This more positive consumer sentiment brought the HPSI up a few points, moving the index up for all of 2015,” said Doug Duncan, SVP and Chief Economist at Fannie Mae.

The Sentiment Index found that overall consumer sentiment about personal finances and the economy is up from last month.

According to the report, the share of respondents that reported that their income was significantly higher than it was a year ago rose 9 percentage points on net from November to December to 15 percent.

Meanwhile, those who were unconcerned about losing their job increased 3 percentage points on net to 72 percent in December. A total of 85 percent of those surveyed noted that they are not worried about losing their job, tying an all-time survey high.

In addition, to the positive financial outlook, more consumers feel its a good time to sell a home, but those who belie it's a good time to buy a home remained flat in December. Fannie Mae reported that 8 percent of those surveyed indicated that now is a good time to sell a home in December, up 4 percentage points, while those who say it's a good time buy a home was flat at 35 percent.

The net share of respondents who say that home prices will go up rose 2 percentage points to 40 percent, the survey data found. The net share of those who say mortgage interest rates will go down continued to decrease, dropping 4 percentage points to negative 52 percent.

“Brightening economic prospects, if sustained, should stimulate demand for homeownership. However, continuing upward pressure on rental prices and constrained housing supply, particularly for starter homes, may mean prospective first-time homebuyers could face affordability constraints," Duncan explained.

Click here to view the complete report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news