According to a new report from Redfin, home sales fell 35.1% year-over-year in November on a seasonally-adjusted basis—the largest decline in Redfin’s records that date back to 2012.

Home-price growth also lost momentum, as the median U.S. home-sale price rose just 2.6% from a year earlier, the smallest gain since May 2020—when the onset of the coronavirus pandemic brought the housing market to a near halt.

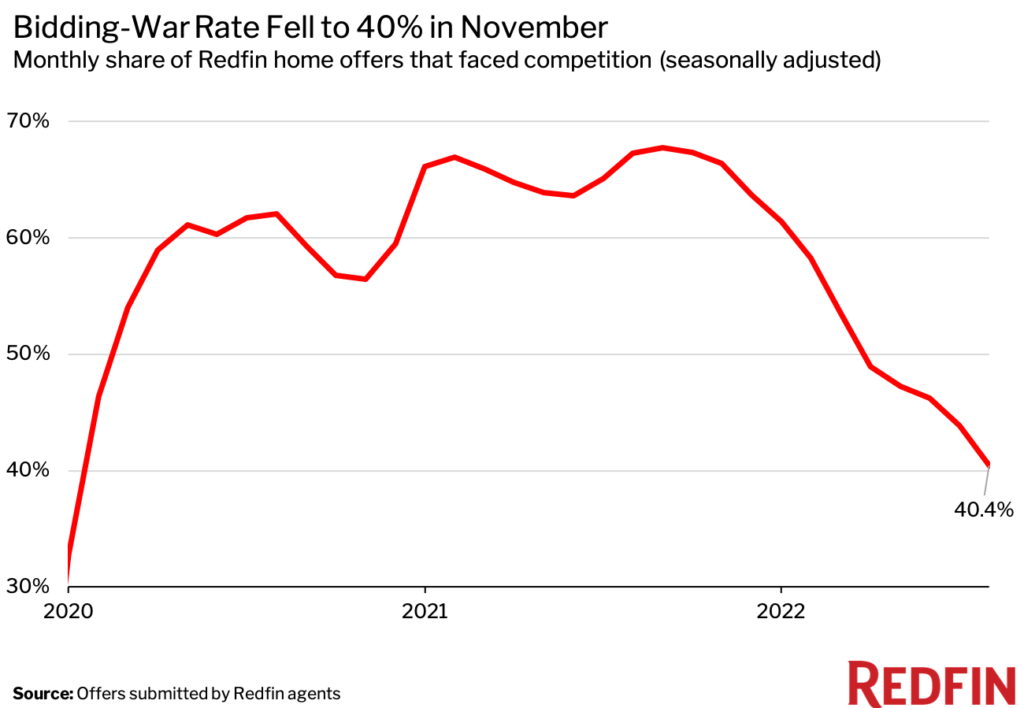

New data showed the housing market continued to cool in November as elevated housing costs kept buyers and sellers on the sidelines. New listings also slumped 28.4% year-over-year, the biggest drop on record aside from April 2020. Despite the decrease in listings, overall supply rose 4.6% from a year earlier—a sign that homes lingered on the market as demand ebbed. On average, the typical for-sale home took 37 days to go under contract, up from 23 days a year earlier.

Metro-Level Highlights: Pandemic Boomtowns, Pricey Coastal Cities Drove Market Slowdown

- Home sales: Pandemic boomtown Las Vegas saw the biggest drop in home sales, down 51.8% year-over-year in November. Next came San Jose, California (-50.1%), Salt Lake City (-49.9%), Stockton, California (-49.8%) and Oxnard, California (-48.7%).

- Prices: Eleven metros saw year-over-year declines in median sale prices, with San Francisco leading the drop (-11.1%). It was followed by San Jose, Detroit, Pittsburgh and Boise, ID, all down between 2% and 3%.

- Supply: Pandemic boomtowns North Port, Florida and Tampa led the increase in the number of homes for sale, with active listings rising 61.3% and 46.1%, respectively. Next came Nashville, Tennessee (45.1%), New Orleans, Louisiana (40.2%) and Seattle (39.2%). Florida metros likely topped the list because Hurricane Ian drove people to sell their homes; North Port and Cape Coral, another area hit by the storm, were the only two metros where new listings rose on a monthly basis in November.

But experts say there are early signs that demand may be starting to creep back as mortgage rates fall. There was a slight downtick in the portion of home-purchase agreements that were canceled in November, and mortgage applications and Redfin’s Homebuyer Demand Index have both been on the rise.

“The worst of inflation is likely in the rearview mirror,” said Redfin Economics Research Lead Chen Zhao. “We do anticipate that mortgage rates will decline slightly further in 2023 as the Fed’s actions continue to bring inflation down, which should ultimately bring more homebuyers back to the market. Still, we have a ways to go until we reach recovery mode, and we may see sales continue to ebb in the short term.”

Mortgage rates reversed course in late November, dropping below 6.5% after soaring to the highest level in roughly two decades at 7.08% earlier in the month, but they’re still twice as high as they were a year ago. The recent decline was driven by signs of easing inflation, which this week prompted the Federal Reserve to slow the pace of interest-rate hikes. But the Fed signaled that it has more work to do to quell inflation and isn’t yet finished raising rates.

“Prospective buyers in places like San Francisco and Austin, where prices have already fallen from a year ago, should pay close attention to a potential turnaround," said Zhao. "It could be the time to take action as demand and competitive offers could pick up in the coming months.”

To read the full report, including more data, charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news