[1]JPMorgan Chase [2], one of the nation's largest lenders, announced Thursday that their fourth quarter earnings wrapped 2015 on a positive note, but could trouble be brewing in the mortgage banking division of the company?

[1]JPMorgan Chase [2], one of the nation's largest lenders, announced Thursday that their fourth quarter earnings wrapped 2015 on a positive note, but could trouble be brewing in the mortgage banking division of the company?

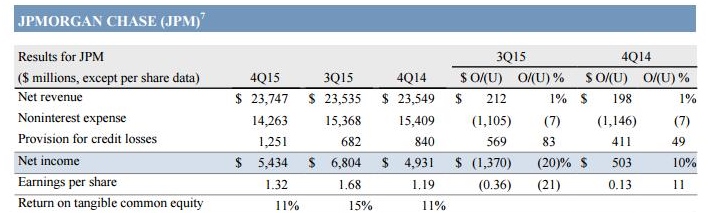

According to the 2015 fourth quarter earnings statement [3], JPMorgan's net income reached 5.4 billion, or $1.32 per share for the fourth quarter, down from the 6.8 billion, or $1.68 per share that was reported in the third quarter. Last year, during this same period, earnings were $4.9 billion.

But despite the quarter-to-quarter decline, JPMorgan can say that they had an outstanding year in 2015 overall. Year-over-year in the fourth quarter of 2015, JPMorgan's earnings totaled a record-breaking $23.7 billion, up from $23.5 billion in the fourth quarter of 2014.

"We had a good quarter as 2015 came to a close. The businesses generated strong loan growth and credit quality, except for some stress in energy," said Jamie Dimon, Chairman and CEO of JPMorgan. "The consumer business continues to gather deposits, outpacing the industry. Markets were somewhat quieter, and we saw the impact reflected in the results of our trading and Asset Management businesses.”

The earnings statement also showed that JPMorgan's net revenue rose 1 percent to $23.7 billion, thanks to higher revenue in Corporate and Consumer & Community Banking, but largely offset by lower revenue in Corporate & Investment Banking and Asset Management. Meanwhile, noninterest expense was $14.3 billion in the fourth quarter of 2015, down 7 percent.

“Looking at performance for the full year, 2015 was another record year for the Firm for net income and EPS, and importantly we exceeded on all of our commitments–balance sheet optimization, capital, GSIB and expense," Dimon explained. "On operating leverage, we delivered core efficiencies while continuing to invest in innovation and technology, infrastructure and talent–crucial for protecting the company and customers, and for our growth.”

The mortgage banking division of the bank experienced a disappointing fourth quarter, with net income totaling $266 million, down 21 percent year-over-year. Net revenue also fell 10 percent to $1.7 billion. On the bright side, higher loan balances pushed net interest income up 11 percent to $1.1 billion.

Noninterest revenue at JPMorgan was $533 million, down 37 percent, due to lower repurchase benefit and lower net servicing revenue, the lender reported. Net revenue increased 8 percent quarter-over-quarter, driven by higher MSR risk management and loan growth, partially offset by lower repurchase benefit.

"The Firm is getting safer and stronger each year. We are continuing to adjust our strategy to the new world and to meeting all requirements. We see exciting opportunities to invest for the future, to continue to deliver better and faster for our clients and customers," Dimon concluded.

Click here [3]to view JPMorgan's 2015 fourth quarter earnings statement.