[1]Concern over what will happen now that the Fed [2] has raised the interest rate for the first time in a decade‒‒and with further increases on the way‒‒is surprisingly minimal. But any worries are based largely on that person's economic status, according to Bankrate [3]'s latest Financial Security Index survey [4].

[1]Concern over what will happen now that the Fed [2] has raised the interest rate for the first time in a decade‒‒and with further increases on the way‒‒is surprisingly minimal. But any worries are based largely on that person's economic status, according to Bankrate [3]'s latest Financial Security Index survey [4].

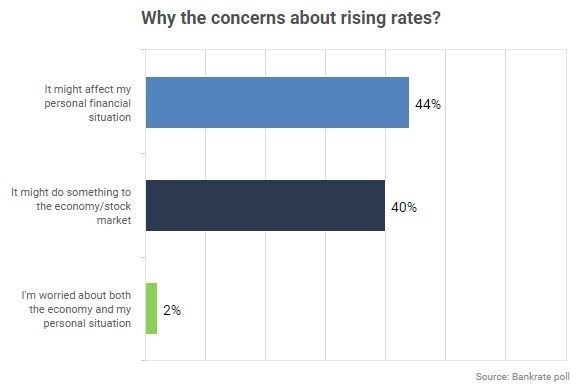

The results of the 1,003-person telephone survey, released Wednesday, found that 41 percent of Americans believe rate increases could have dire effects on their personal finances and on the U.S. economy in general. However, these concerns are not spread evenly across the population. According to Bankrate, age, economic status, and education level play major roles in how high someone’s anxiety might be.

Those between 30 and 49 were most worried, the report found. A full 44 percent in this age range expressed concern over where the economy is headed. Twenty percent of Millennials, the largest generational group to voice concerns, said they worried about their personal economic futures. Millennials were, however, the least likely (12 percent) to be concerned about the effects of rate hikes on the economy overall.

On the other side, those 65 and older were far less concerned‒‒37 percent in this age group said they worried about their own finances or the economy in general.

Most surveyed did not see much cause for alarm about rate increases. A full 56 percent were not concerned about rate hikes and 15 percent felt rates are getting back to normal after being artificially low for years.

"The impact of rising interest rates will take some time to show a cumulative effect," said Greg McBride, Bankrate’s chief financial analyst. He added that now is the time for consumers to insulate themselves from rising rates by refinancing from an adjustable-rate to fixed-rate mortgage or by snagging zero-percent balance transfer credit cards.

It should be noted, however, that Americans' financial security is actually better now than it was in December. The January Financial Security Index clocked in at 101.5, compared to December’s 101.1, and Bankrate found that greater feelings of job security and higher overall net worth among Americans of all age groups led the list of reasons.