Mortgage rates have only headed one direction since the Fed's decision in December to raise rates by 0.25 percent. Freddie Mac says the falling rates reflect the tumultuous global economy and weak inflation.

Mortgage rates have only headed one direction since the Fed's decision in December to raise rates by 0.25 percent. Freddie Mac says the falling rates reflect the tumultuous global economy and weak inflation.

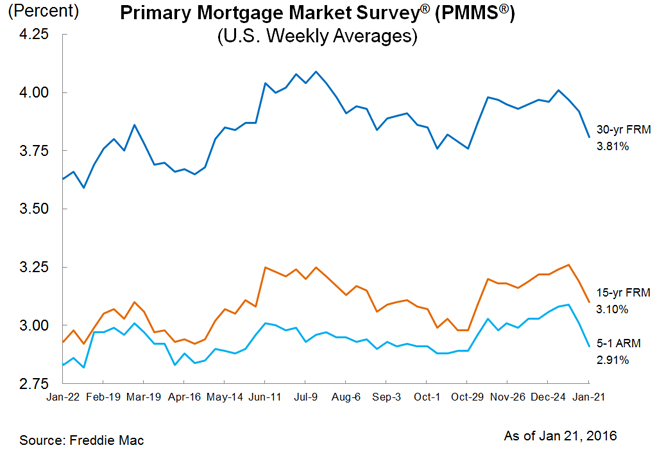

Freddie Mac's Primary Mortgage Market Survey showed that mortgage rates declined for the third week in a row in the midst of financial market turbulence.

According to Freddie Mac, for the week ending January 21, 2016, the 30-year fixed-rate mortgage (FRM) averaged 3.81 percent with an average 0.6 point. Last week, it averaged 3.92 percent and a year ago, the 30-year FRM averaged 3.63 percent.

Sean Becketti, Chief Economist at Freddie Mac advised that the Freddie Mac mortgage rate survey had difficulty keeping up with market events this week.

"The 30-year mortgage rate dropped 11 basis points to 3.81 percent, the lowest rate in three months," Becketti stated. "This drop reflected weak inflation—0.7 percent CPI inflation for all of 2015—and nonstop financial market turbulence that is driving investors to the safe haven of Treasuries. However, the survey was largely complete prior to Wednesday's Treasury rally that drove the yield on the 10-year Treasury below 2 percent, down 29 basis points since the end of 2015."

"The 30-year mortgage rate dropped 11 basis points to 3.81 percent, the lowest rate in three months," Becketti stated. "This drop reflected weak inflation—0.7 percent CPI inflation for all of 2015—and nonstop financial market turbulence that is driving investors to the safe haven of Treasuries. However, the survey was largely complete prior to Wednesday's Treasury rally that drove the yield on the 10-year Treasury below 2 percent, down 29 basis points since the end of 2015."

The 15-year FRM this week averaged 3.10 percent with an average 0.5 point, down from 3.19 percent last week. Last year at this time, the 15-year FRM averaged 2.93 percent, Freddie Mac reported.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.91 percent this week with an average 0.5 point. Last week it averaged 3.01 percent and a year ago, the 5-year ARM averaged 2.83 percent.

Concern over what will happen now that the Fed has raised the interest rate for the first time in a decade‒‒and with further increases on the way‒‒is surprisingly minimal. But any worries are based largely on that person's economic status, according to Bankrate's latest Financial Security Index survey.

The survey found that 41 percent of Americans believe rate increases could have dire effects on their personal finances and on the U.S. economy in general.

Those between 30 and 49 were most worried, the report found. A full 44 percent in this age range expressed concern over where the economy is headed. Twenty percent of Millennials, the largest generational group to voice concerns, said they worried about their personal economic futures. Millennials were, however, the least likely (12 percent) to be concerned about the effects of rate hikes on the economy overall.

On the other side, those 65 and older were far less concerned‒‒37 percent in this age group said they worried about their own finances or the economy in general.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news