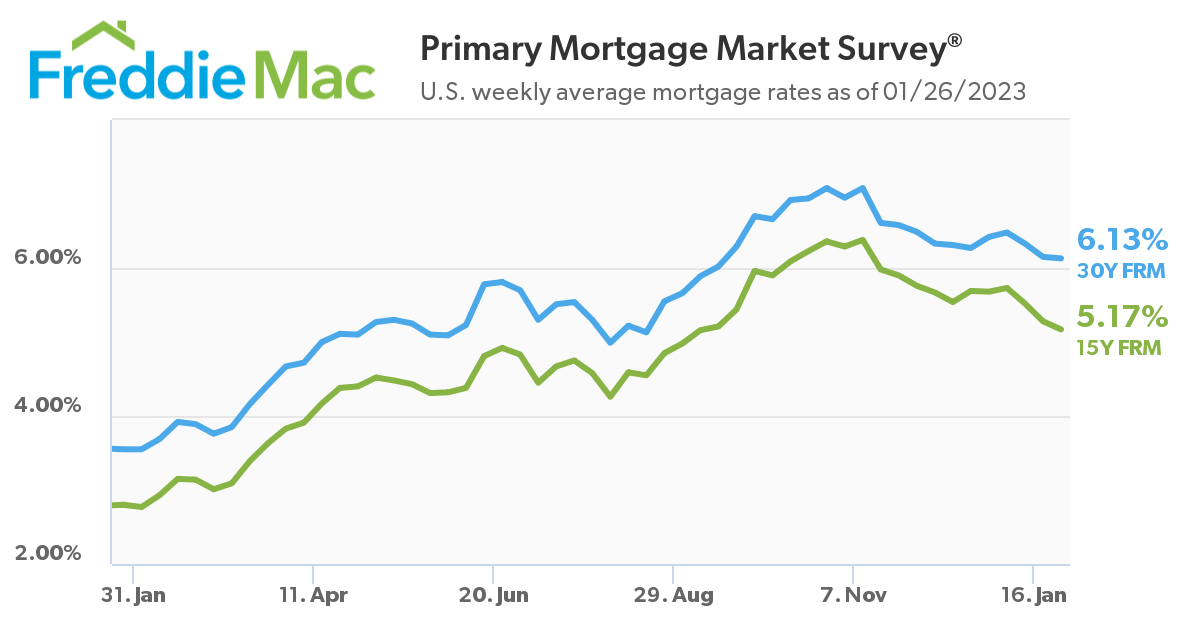

Freddie Mac reports that the 30-year fixed-rate mortgage (FRM) continued to trend downward as of January 26, 2023, dipping two basis points from 6.15% to 6.13%. A year ago at this time, the 30-year FRM averaged 3.55%.

Freddie Mac reports that the 30-year fixed-rate mortgage (FRM) continued to trend downward as of January 26, 2023, dipping two basis points from 6.15% to 6.13%. A year ago at this time, the 30-year FRM averaged 3.55%.

“Mortgage rates continue to tick down and, as a result, home purchase demand is thawing from the months-long freeze that gripped the housing market,” said Sam Khater, Freddie Mac’s Chief Economist. “Potential homebuyers remain sensitive to changes in mortgage rates, but ample demand remains, fueled by first-time homebuyers.”

Also this week, Freddie Mac reported the 15-year FRM averaged 5.17%, down from last week when it averaged 5.28%. A year ago at this time, the 15-year FRM averaged 2.80%.

“The Freddie Mac fixed rate for a 30-year loan continued to trend down, to 6.13%, the lowest level since mid-September,” added Realtor.com Economist Jiayi Xu. “While businesses and investors are watching the market closely, the recent large-scale layoffs in the tech sector, combined with Monday’s stock market rebound have created mixed signals. On one hand, many cash-burning tech companies are struggling with the Fed’s rate hikes. On the other hand, investors are happy about slowing inflation and anticipate that interest rate hikes may begin to moderate or stabilize in the months ahead. The nearly half-century low unemployment rate (3.5%) and the cooling inflation rate (6.5%) do not point toward a recession. However, it’s important to keep in mind that monetary policy takes time to have an impact, and these economic indicators might not yet show the full effects of the restrictive policy.”

Earlier this week, Spotify reduced its staff by 600 workers, or 6% of its workforce, bringing the total number of tech layoffs in 2023 to 57,000, following an overall reduction of 159,000 in all of 2022. Microsoft also said it would cut 10,000 jobs last week after adding 40,00 over the last fiscal year.

And as the tech sector is suffering, the Federal Reserve, at next week’s Federal Open Market Committee (FOMC) Meeting, is expected to raise rates once again, but not the degree it has over the past year to continue to curb inflation.

“Next week, the Federal Reserve is expected to announce a smaller increase in the Fed Funds rate, with a 25-basis point hike, compared with the 50 and 75 basis point increases in the previous meetings,” said Xu. “The slower rate increase is encouraged by the recent moderation in wage growth, which may still need to decrease further to reach the desired inflation rate of 2%. While the Fed may continue to raise rates this year, reaching just above 5% from the current range of 4.25% to 4.5%, the slower pace will help to create a soft landing for the economy by balancing the risks of bringing down inflation without pushing up the unemployment rate.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news