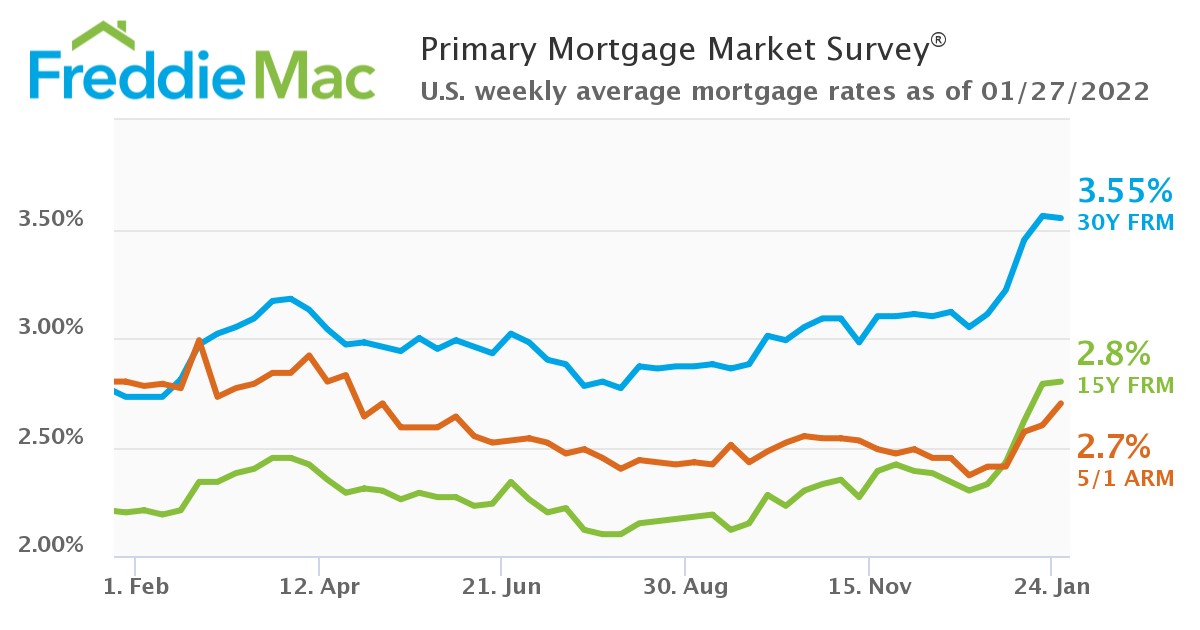

Freddie Mac reports that this week’s Primary Mortgage Market Survey (PMMS) found that the 30-year fixed-rate mortgage (FRM) averaged 3.55% for the week ending January 27, 2022, down slightly from last week when it averaged 3.56%. A year ago at this time, the 30-year FRM averaged 2.73%.

Freddie Mac reports that this week’s Primary Mortgage Market Survey (PMMS) found that the 30-year fixed-rate mortgage (FRM) averaged 3.55% for the week ending January 27, 2022, down slightly from last week when it averaged 3.56%. A year ago at this time, the 30-year FRM averaged 2.73%.

“Following a month-long rise, mortgage rates effectively stayed flat this week,” said Sam Khater, Freddie Mac’s Chief Economist. “Recent rate increases have yet to significantly impact purchase demand, as history demonstrates that potential homebuyers who are on the fence will often enter the market at the start of rate increase cycles.”

The 15-year FRM averaged 2.80% with an average 0.6 point, up slightly from last week when it averaged 2.79%. Meanwhile, a year ago at this time, the 15-year FRM averaged 2.20%.

Also this week, the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.70% with an average 0.2 point, up from last week when it averaged 2.60%. A year ago at this time, the five-year ARM averaged 2.80%.

Earlier this week, the Federal Reserve Board, led by Chairman Jerome Powell, decided to not hike rates, and keep rates steady, citing a strong economy and solid employment numbers.

On the jobs front, the U.S. Department of Labor reports strength in the employment market, as for the week ending January 22, the advance figure for seasonally adjusted initial unemployment claims was 260,000, a decrease of 30,000 from the previous week's revised level. The advance seasonally adjusted insured unemployment rate was 1.2% for the week ending January 15, unchanged from the previous week's unrevised rate. The four-week moving average was 1,651,750, a decrease of 10,750 from the previous week's revised average. This is the lowest level for this average since August 18, 1973 when it was 1,646,750. The previous week's average was revised down by 1,750 from 1,664,250 to 1,662,500.

The flatlining of mortgage rates is driving more away from the refinance market, as this week, the Mortgage Bankers Association (MBA) found overall mortgage application volume down 7.1% week-over-week. With less incentive to refinance, the refi share of mortgage activity decreased to 55.8% of total applications from 60.3% the previous week.

“We do expect rates to continue to increase but at a more gradual pace,” said Khater. “Therefore, a fair number of current homeowners could continue to benefit from refinancing to lower their mortgage payment.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news