$43 trillion: that is the new value of the housing market as a whole, now double what it was since the lows of the post-recession market and the corresponding building slump of the early 2010s.

$43 trillion: that is the new value of the housing market as a whole, now double what it was since the lows of the post-recession market and the corresponding building slump of the early 2010s.

According to Zillow, the housing market gained $6.9 trillion in value in 2021 increasing to $43.4 trillion throughout the year. It was found that the market hit the $40 trillion mark in June and continued increasing at a rate of at least a half-trillion per month.

For reference, the market hit the $10 trillion mark in 1994, the $20 trillion mark in 2004, and $30 trillion in July 2017.

How did the market hit the $40 trillion mark then sail past it so quickly? Strong demand faced record lows of inventory, increasing real estate values by an average of 16.9% last year, a record seen by Zillow.

"Even in the context of a year in which several housing records were topped, the scale of the housing market's growth in 2021 is eye-popping," said Zillow senior economist Jeff Tucker. "Not only did prices rise faster than ever, but more homes were built than in any year since 2007 as builders raced to meet demand. Skyrocketing home values may be celebrated by longtime homeowners, but are daunting for those trying to buy their first home. This year is likely to be less competitive for buyers, but it will continue to be a seller's market."

As a whole, when dividing the total number of houses by price into thirds, the top third of the most expensive homes now makes up 60.8% of the market, the middle third makes up 26.4%, while the bottom third of homes accounts for only 12.8% of the market. Putting that another way, a top-tier home is on average worth five times more than the lowest tier.

The real estate market in California also put up strong numbers throughout the year.

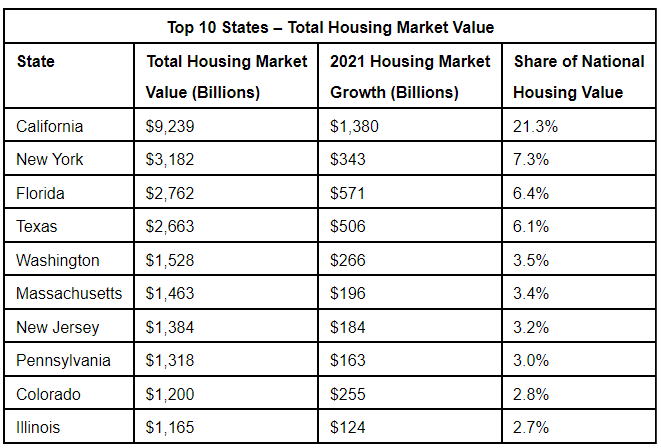

In total, the value of the California real estate market is now worth over one-fifth, or 21.3%, of the total U.S. real estate market. It’s market increased by $1.4 trillion last year and is now worth $9.4 trillion, more than the bottom 30 states, combined.

Other states performed better than California when comparing the amount they added to the market in 2021 compared to their market share. Those states are: Idaho (+64.1%), Utah (+49.2%), Montana (+46.3%), Arizona (+40.0%), Colorado (+34.5%), and Florida (+30.9%).

Among metropolitan areas, New York City remains the nation's most valuable, clocking in at $3.51 trillion, but the second-place market, Los Angeles, is quickly closing the gap, coming in at $3.27 trillion.

Los Angeles also contributed more to the total growth this year than any other city. The city is responsible for adding $431 billion in value, or 6.3% of total gains. This is followed by New York City (5.0%), San Francisco (3.3%), San Diego (2.9%), and Phoenix (2.5%).

“This list is heavily influenced by the overall size of the market—a larger market means more homes means more value, all else equal, but there were some notable exceptions,” Tucker wrote in his report. “Phoenix, for example, is the nation’s 14th-largest metro area by population, but was in the top 5 of this list. Growth in Austin, the nation’s 35th-largest metro area, matched the value added in Houston—the nation’s sixth-largest metro.

Click here to read the research in its entirety, including a ranking of the top 50 metro areas.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news