Following an interest rate jump and an unexpectedly strong jobs report, mortgage rates increased, but only slightly, this week, according to Freddie Mac. It’s the first weekly rate increase since early January.

Following an interest rate jump and an unexpectedly strong jobs report, mortgage rates increased, but only slightly, this week, according to Freddie Mac. It’s the first weekly rate increase since early January.

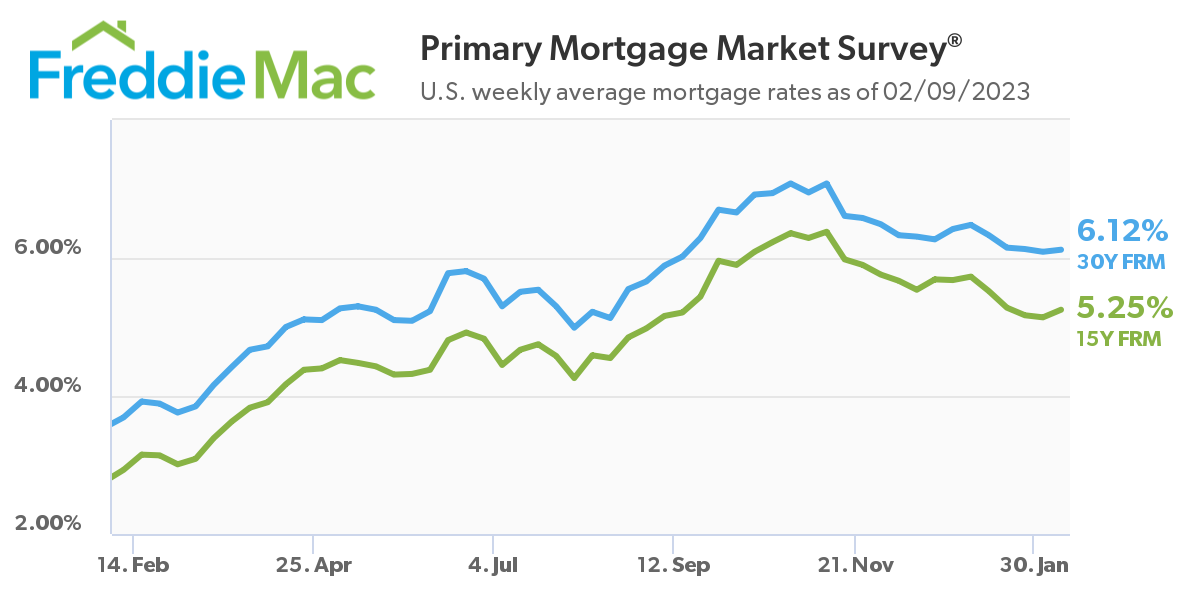

Freddie Mac’s Primary Mortgage Market Survey (PMMS) showed the 30-year fixed-rate mortgage (FRM) averaging 6.12% as of Thursday, 0.03 percentage point higher than the prior week, data analysts at Freddie Mac reported.

A year ago at this time, the 30-year FRM averaged 3.69%.

The 15-year FRM today averaged 5.25%, up from last week when it averaged 5.14%. And one year ago at this time, the 15-year FRM averaged 2.93%.

Freddie Mac’s Chief Economist Sam Khater points to “a surprisingly strong” recent employment report and the Federal Reserve’s interest rate hike as the reason for the increase.

"The 30-year fixed-rate continues to hover close to 6%, and interested homebuyers are easing their way back to the market just in time for the spring homebuying season,” Khater said in a press release.

In general, mortgage rate increases have slowed in 2023 following a year of significant gains.

"Mortgage rates are likely to continue moving up and down in a narrow range for the next few weeks," added Realtor.com Manager of Economic Research George Ratiu. "For housing markets, current rates remain a significant barrier to affordability, especially for first-time homebuyers. At the same time, there are several undercurrents which continue to reshape market dynamics. With employment still running at a strong pace, wages continue rising, putting more money in households’ budgets. Simultaneously, median list prices have declined 11% from their summer peak, resulting in lower down payments and monthly mortgage costs. In addition, with interest rates still running well-below the 7% range we saw in the fall, the psychological shock of the 2022 rate jump is wearing off for buyers, leading to a favorable adjustment in expectations. For the buyers of a median-priced home, today’s rate is translating into a $1,943 monthly payment (excluding taxes and insurance), $164 lower than in June 2022, when list prices hit their peak.”

The average mortgage rate this week was approximately 0.30 percentage point lower than the final weekly rate in 2022, and almost a full percentage point lower than the 2022 high of 7.08%.

Housing pundits have pointed out that, with housing costs in the spotlight, mortgage rate activity is of significant importance.

For example, the National Association of Realtors (NAR), at the end of 2022, reported that increasing mortgage rates played a role in Americans’ $700-per-month (on average) increase in typical housing payments on a single-family home.

On the other hand, some experts have said rising rates may “help tamper down demand somewhat to the point that it would help the housing market look more normal,” according to Money.com.

Freddie Mac’s PMMS report is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news