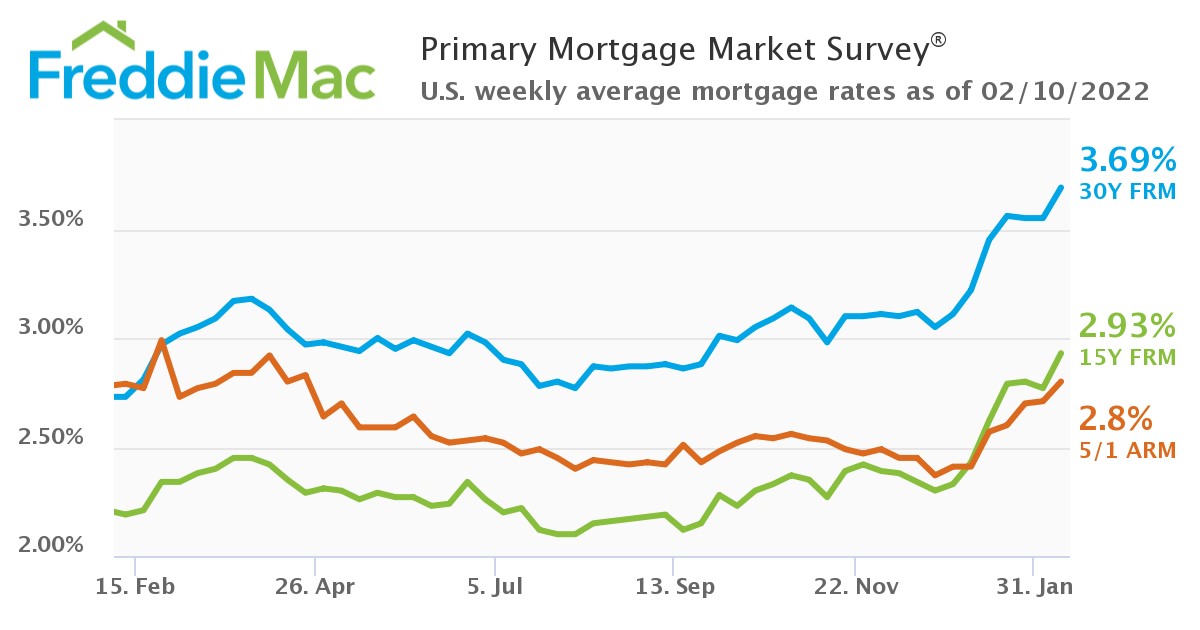

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) [1], for the week ending February 10, 2022, shows that the 30-year fixed-rate mortgage (FRM) averaged 3.69%, up from last week when the FRM averaged 3.55%. A year ago at this time, the 30-year FRM averaged 2.73%.

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) [1], for the week ending February 10, 2022, shows that the 30-year fixed-rate mortgage (FRM) averaged 3.69%, up from last week when the FRM averaged 3.55%. A year ago at this time, the 30-year FRM averaged 2.73%.

“The normalization of the economy continues as mortgage rates jumped to the highest level since the emergence of the pandemic,” said Sam Khater [2], Freddie Mac’s Chief Economist. “Rate increases are expected to continue due to a strong labor market and high inflation, which likely will have an adverse impact on homebuyer demand.”

The anticipated rise in rates also continues to impact mortgage application volume for the short-term, as the Mortgage Bankers Association (MBA) has noted that application volume was down 8.1% week-over-week [3] for the week ending February 4, 2022, with the refinance share of mortgage activity decreasing to 56.2% of total applications, from 57.3% the previous week.

Positive news in the labor market continued this week, as the U.S. Department of Labor (DOL) reported [4] that, for the week ending February 5, the advance figure for seasonally-adjusted initial unemployment claims was 223,000, a decrease of 16,000 from the previous week's revised level. The advance seasonally adjusted insured unemployment rate was 1.2% for the week ending January 29, unchanged from the previous week's unrevised rate.

“Rates increased along with the surge in the 10-year Treasury which passed 1.9% this week, the highest point since November 2019, prior to the pandemic,” said Realtor.com Manager of Economic Research George Ratiu [5]. “The stronger-than-expected employment report for January and rising inflation are keeping investors bullish on the economy and the expected rate hikes from the Federal Reserve in the first half of the year. With rising rates, mortgage applications to purchase a home declined last week, as many first-time buyers were priced out of the market.”

Also this week, Freddie Mac found the 15-year FRM averaged 2.93%, with an average 0.8 point, up from last week when it averaged 2.77%. A year ago at this time, the 15-year FRM averaged 2.19%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.80% with an average 0.3 point, up from last week when it averaged 2.71%. A year ago at this time, the five-year ARM averaged 2.79%.

“Real estate markets are caught in a lopsided dynamic, with many buyers eager to find the right home before rates rise even higher, but very few available homes for sale as a result of almost a decade and a half of underbuilding,” said Ratiu. “Based on Realtor.com’s latest research [6], the shortage of new homes accelerated in 2021, passing 5.8 million at the end of the year. With millennials and Gen Z forming households at faster rates, new home construction would have to triple the rate of home completions to close the gap in five to six years. For now, many buyers are facing prices still rising at more than 10% over last year. At the current rate, they are paying $250 more on their monthly mortgage payment. The benefits that ultra-low interest rates provided over the last two years are wearing off and affordability is becoming a huge hurdle for many buyers.”

Redfin has found that the estimated monthly mortgage payment [7] for a typical home for sale rose 25% year-over-year—or $388—to a record high of $1,931, based on the all-time high median asking price of $376,000 recorded during the four-week span ending February 6, and an average 30-year mortgage rate of 3.69%.