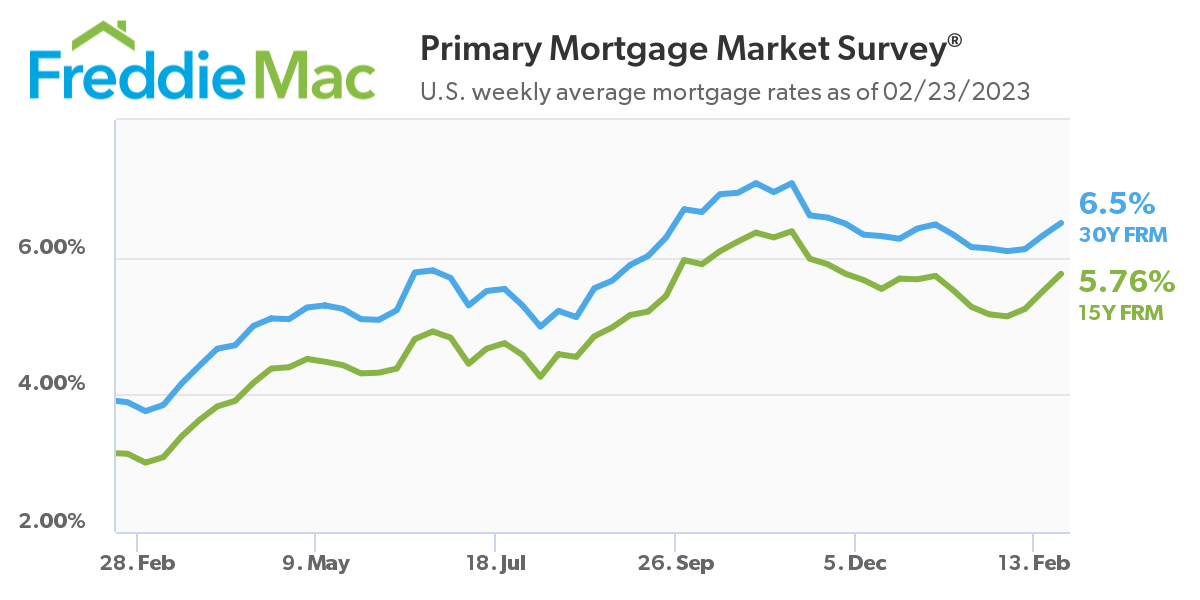

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS), a measure of the 30-year fixed-rate mortgage (FRM), jumped 18-basis points over last week, averaging 6.50% as of February 23, 2023, up from last week’s total of 6.32%. A year ago at this time, the 30-year FRM averaged 3.89%.

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS), a measure of the 30-year fixed-rate mortgage (FRM), jumped 18-basis points over last week, averaging 6.50% as of February 23, 2023, up from last week’s total of 6.32%. A year ago at this time, the 30-year FRM averaged 3.89%.

“The economy continues to show strength, and interest rates are repricing to account for the stronger than expected growth, tight labor market and the threat of sticky inflation,” said Sam Khater, Freddie Mac’s Chief Economist. "Our research shows that rate dispersion increases as mortgage rates trend up. This means homebuyers can potentially save $600 to $1,200 annually by taking the time to shop among lenders to find a better rate.”

Freddie Mac also reported the 15-year FRM averaged 5.76%, up from last week when it averaged 5.51%. A year ago at this time, the 15-year FRM averaged just 3.14%.

“On one hand, the hotter-than-expected inflation might force the Fed to reopen doors to faster interest rate growth, which is unwelcome news for both investors and businesses,” noted Realtor.com Economist Jiayi Xu. “On the other hand, some policymakers did not interpret January’s data as signs of accelerating growth, choosing to wait for more information before deciding. As a result, they are in favor of implementing smaller rate hikes in the coming months, which would be welcomed by markets.”

The hike in rates forced mortgage app volume downward, as the Mortgage Bankers Association (MBA) reported purchase mortgage apps dipping to lows last seen in 1995, with overall mortgage application volume fell 13.3% week-over-week. The rise in rates also forced away those seeking refis, as the MBA’s Refinance Index decreased 2% from the previous week—72% lower than the same week one year ago.

“Mortgage applications for refinances and home purchases declined significantly last week, with purchase activity decreasing to the lowest level since 1995,” said MBA President and CEO Robert D. Broeksmit, CMB. “High mortgage rates and elevated home prices continue to reduce affordability and are keeping many prospective buyers on the sidelines.”

Affordability remains an issue for prospective buyers, as existing-home sales fell for the 12th consecutive month in January 2023, sliding 0.7% from December 2022 to a seasonally adjusted annual rate of four million, according to the National Association of Realtors (NAR). Year-over-year, sales retreated 36.9% (down from 6.34 million in January 2022). Month-over-month sales were mixed among the four major U.S. regions, as the South and West registered increases, while the East and Midwest experienced declines. All regions recorded year-over-year declines.

NAR reported that the median existing-home price for all housing types in January was $359,000, an increase of 1.3% from January 2022 ($354,300), as prices climbed in three out of four U.S. regions while falling in the West—marking 131 consecutive months of year-over-year increases, the longest-running streak on record.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news