As the qualified mortgage (QM) rule hits its two-year anniversary, many industry experts are concerned that the regulation is behind the decline in mortgage credit and has impacted low-income and minority borrowers the most, but this may not be the case at all.

As the qualified mortgage (QM) rule hits its two-year anniversary, many industry experts are concerned that the regulation is behind the decline in mortgage credit and has impacted low-income and minority borrowers the most, but this may not be the case at all.

The QM rule, introduced in January 2014, was created to stop borrowers from acquiring unaffordable loans and to protect lenders from enforcement actions.

Brian Koss, EVP of Mortgage Network told MReport, “We are not seeing the effect of QM other than the high-end. People with large assets but low income or people who desire creative mortgages like interest only are most affected but the average borrower is not affected.”

"The Qualified Mortgage rule has had little to no effect on United Wholesale Mortgage business or our Brokers. In general, the rules put certain criteria around the types of loans originated, to make sure lenders don’t offer the same types of risky loans as were offered during the subprime crisis," said Mat Ishbia, President and CEO of United Wholesale Mortgage.

Ishbia continued, "The QM rule has not affected the loans we’ve done, and hasn’t been too limiting to product innovation ideas. We have access to non-QM loans if we want, but there isn’t really any demand for non-QM loans as far as our business is concerned."

Urban Institute determined in analysis that the rule has had little impact on the availability of mortgage credit, mostly because the market had already underwent changes prior to the rule.

Urban Institute tracked four potential indicators, none of which showed a connection to reduced lending:

- The number of interest-only and prepayment penalty loans didn’t decrease: The QM rule disqualifies loans that are interest-only or have a prepayment penalty. A reduction in these loans might show QM impact, but both types of mortgages were virtually extinct before QM took effect.

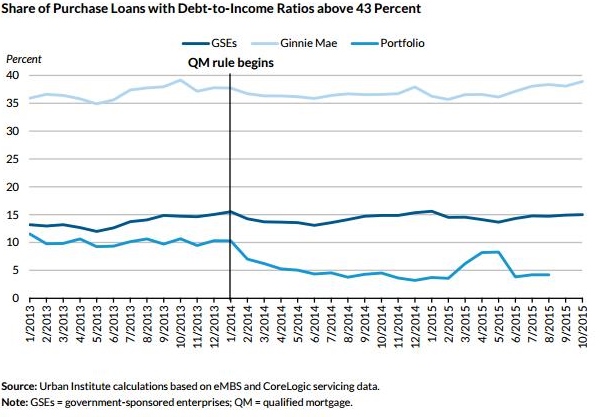

- The share of loans with debt-to-income ratios above 43 percent is unchanged: The QM rule disqualifies loans with a debt-to-income ratio above 43 percent except for loans with government backing.

- The adjustable-rate mortgage share still tracks interest rates: The share of adjustable-rate mortgages (ARMs) generally tracks interest rate changes, i.e. when rates go up, more people use ARMs and when rates go down, fewer people use ARMs. The QM rule requires that ARMs be underwritten to the maximum interest rate that could be charged during the loan’s first five years—a restriction that might deter ARMs and disrupt the interest-rate tracking. But after the QM rule took effect, the ARM share continues to track interest rate changes.

- The number of small loans has dropped but not much: The QM rule’s 3 percent limit on points and fees could discourage lenders from making smaller loans. But the slight drop since the rule took effect is largely attributable to home price appreciation.

"Though the effect of the QM rule appears small to nonexistent now, it reminds us that lenders must ensure that borrowers are able to repay their mortgages.," Urban Institute said. "Long after our collective memory of the crisis has faded, this rule will be one of the positive legacies of the crisis that should help prevent the re-emergence of risky lending practices that could cause another downturn."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news