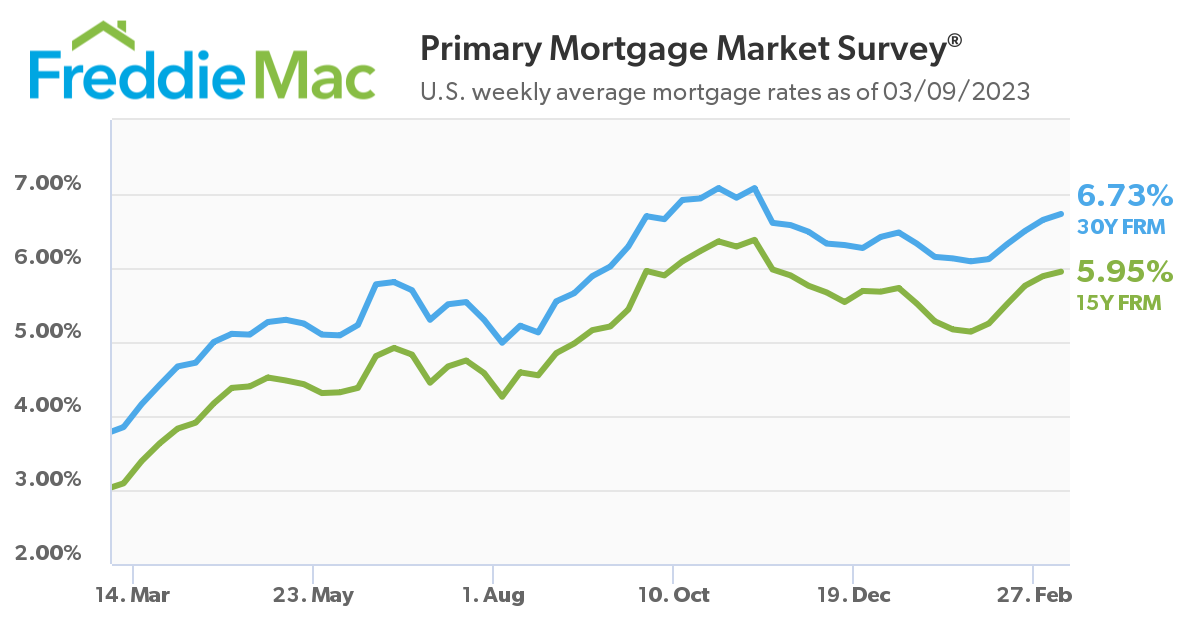

Mortgage rates continued to charge upward toward the 7% mark, as Freddie Mac reported the results of its Primary Mortgage Market Survey (PMMS) [1], which found that the 30-year fixed-rate mortgage (FRM) averaged 6.73% as of March 9, 2023, up from last week when it averaged 6.65% [2]. A year ago at this time, the 30-year FRM averaged 3.85%.

Mortgage rates continued to charge upward toward the 7% mark, as Freddie Mac reported the results of its Primary Mortgage Market Survey (PMMS) [1], which found that the 30-year fixed-rate mortgage (FRM) averaged 6.73% as of March 9, 2023, up from last week when it averaged 6.65% [2]. A year ago at this time, the 30-year FRM averaged 3.85%.

“Mortgage rates continue their upward trajectory as the Federal Reserve signals a more aggressive stance on monetary policy,” said Sam Khater, Freddie Mac’s Chief Economist [3]. “Overall, consumers are spending in sectors that are not interest rate sensitive, such as travel and dining out. However, rate-sensitive sectors, such as housing, continue to be adversely affected. As a result, would-be homebuyers continue to face the compounding challenges of affordability and low inventory.”

Also this week, the Freddie Mac reported the 15-year FRM averaged 5.95% [1], up slightly from last week when it averaged 5.89%. A year ago at this time, the 15-year FRM averaged nearly half that at 3.09%.

In an odd turn of events, as mortgage rates continued to climb, mortgage application volume followed suit and rose as well, as the Mortgage Bankers Association (MBA) reported overall mortgage application volume rising [4] 7.4% week-over-week (for the week ending March 3, 2023).

“Mortgage applications increased last week after three weeks of declines,” said MBA President and CEO Robert D. Broeksmit, CMB [5]. “Even with this jump in activity, both purchase and refinance applications remain well below year-ago levels when rates were much lower. The recent increase in mortgage rates, right at the start of the busy spring buying season, could cause prospective buyers to delay decisions until rates moderate.”

And the rise in rates may not be the sole deterrent holding back potential buyers as the spring buying season gets underway. A new report from Realtor.com [6] has found that builder confidence tailed off in the beginning of 2022, before dropping off more dramatically in May and continuing to fall, reaching levels last seen in June 2012.

“While the current housing market may not look promising for sellers due to factors such as an increasing number of unsold homes, longer time on market, and decelerating price growth driven by high mortgage rates, there are still opportunities to be found,” said Realtor.com Economist Jiayi Xu [7]. “For example, recent sales data show that the share of first-time homebuyers is up compared to one year ago. As a result, sellers with starter homes may see robust demand and retain some bargaining power. In addition, the widespread implementation of hybrid working models provide employees more flexibility to choose where to live, allowing them to avoid expensive and congested urban centers. Consequently, this trend could make homes with easy access to public transportation systems more attractive to home buyers, which in turn, enhances bargaining power for the sellers. Furthermore, for sellers who are also buyers, it is important to note that they can still leverage their record-high equity, even if they have to adjust their expectations to lower asking prices.”