The economic and lending environments are changing. There are new segments of the population emerging that include millennials, minorities, immigrants, and rural dwellers, and the typical FICO score evaluation just won't cut it for lenders, and other data avenues must be considered to accommodate these new borrowers.

The economic and lending environments are changing. There are new segments of the population emerging that include millennials, minorities, immigrants, and rural dwellers, and the typical FICO score evaluation just won't cut it for lenders, and other data avenues must be considered to accommodate these new borrowers.

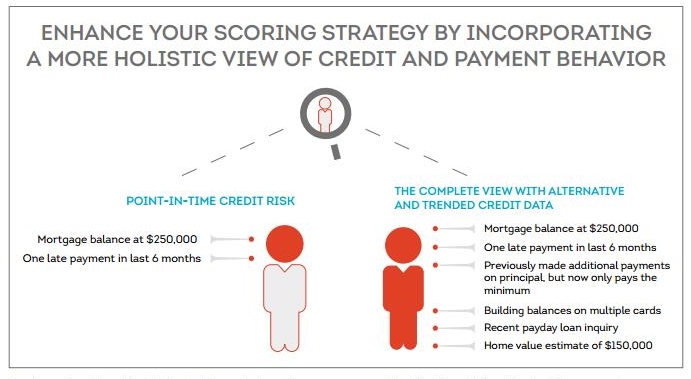

Theses populations require a more "holistic approach to risk assessment" when considering eligibility for a mortgage loan. According to a report from TransUnion, alternative and trended data is the only way lenders will be able to reach these untapped borrowers.

"A more holistic approach provides the accuracy and precision necessary to gain a complete picture of consumer risk, significantly improve business decisions and build healthier portfolios," TransUnion said. "With additional and different types of data, you can explore opportunities with more potential customers across all credit risk tiers, offer the right pricing, minimize institutional risk and capture greater wallet share."

These underserved consumers could greatly benefit from access to quality financial services from lenders, the report stated.

"When a lender is able to offer consumers with limited credit history a line of credit, there is an opportunity to build lifetime loyalty," the report noted. "Institution[s] can offer the first credit account in a consumer’s wallet and begin to build a long-term relationship, but doing this requires reinforcement data to show management of various past financial commitments."

"When a lender is able to offer consumers with limited credit history a line of credit, there is an opportunity to build lifetime loyalty," the report noted. "Institution[s] can offer the first credit account in a consumer’s wallet and begin to build a long-term relationship, but doing this requires reinforcement data to show management of various past financial commitments."

TransUnion's 2016 Strategic Initiatives for Lenders:

- Improve acquisitions without increasing risk

- Score more people with greater precision

- Identify leading risk indicators

A survey of 317 lenders from TransUnion showed that there is still a significant amount of unrealized opportunity for lenders to use alternative data.

The survey found that 75 percent of lenders said it is increasingly difficult to find and gain new customers, while nearly the same amount indicated that the challenges from the low interest rate environment is encouraging more competition for a pool of consumers who receive multiple credit offers.

Of those surveyed, 87 percent noted that they decline at least some credit applicants because they cannot be scored and do not meet risk guidelines when assessed with strictly traditional credit bureau information. However, 83 percent of lenders that use alternative data to score credit applicants report seeing tangible benefits and 64 percent have already seen positive results in the first year of using the method.

TransUnion's survey concluded that by using alternative data, lenders can:

- Open opportunities in new markets

- Extend reach to more creditworthy borrowers

- Improve the competitive position of a variety of lendersrises.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news