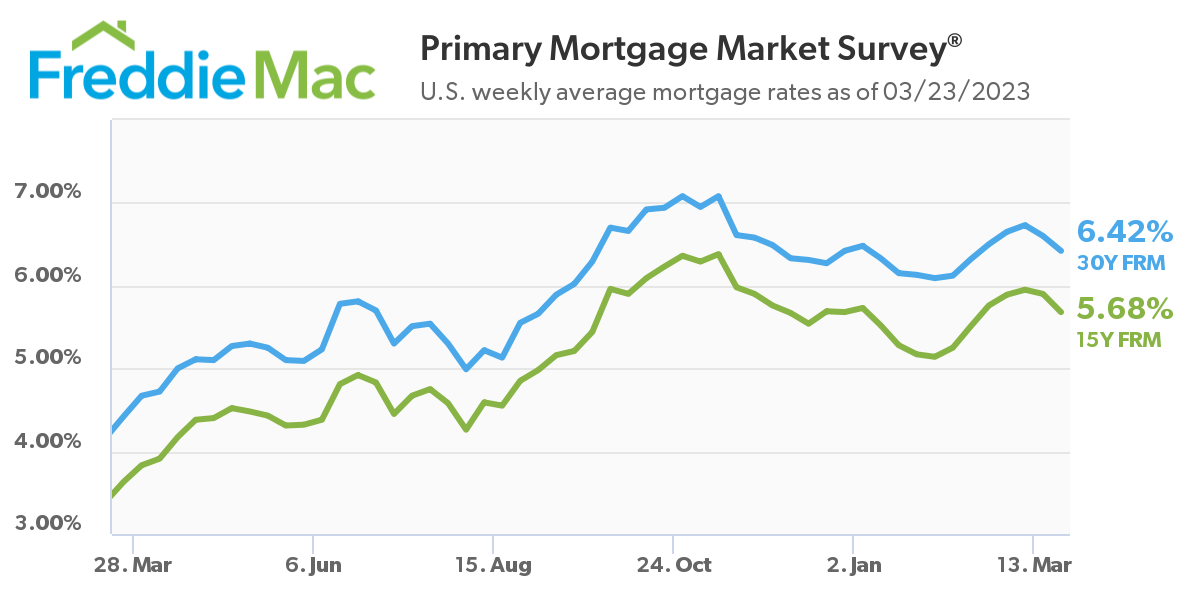

After a steady five-week march upward toward the 7% mark, the 30-year fixed-rate mortgage (FRM) fell for the second straight week, as Freddie Mac reported it falling from 6.60% to 6.42% this week in its Primary Mortgage Market Survey (PMMS) [1].

After a steady five-week march upward toward the 7% mark, the 30-year fixed-rate mortgage (FRM) fell for the second straight week, as Freddie Mac reported it falling from 6.60% to 6.42% this week in its Primary Mortgage Market Survey (PMMS) [1].

“Mortgage rates continued to slide down as financial market concerns came to the forefront over the last two weeks,” said Sam Khater, Freddie Mac’s Chief Economist. “However, on the homebuyer front, the news is more positive with improved purchase demand and stabilizing home prices. If mortgage rates continue to slide over the next few weeks, look for a continued rebound during the first weeks of the spring homebuying season.”

Also this week, Freddie Mac reported the 15-year FRM averaged 5.68%, down from last week when it averaged 5.90%. A year ago at this time, the 15-year FRM averaged 3.63%.

The slide in rates comes at an opportune time as the spring homebuyer season begins.

“Ongoing affordability challenges weigh on buyers and sellers preparing for the spring housing market,” said Realtor.com Economic Data Analyst Hannah Jones [2]. “Each downward tick in mortgage rates is met with increased buyer demand, as many eager home shoppers take advantage of the slightly lower cost of financing a home. Home prices were up 7.8% compared to last February, but price growth continues to slow and price reductions continue to climb. Home shoppers are looking to find the optimal combination of prices and mortgage rates before entering the market. However, elevated rates and high prices mean that point doesn’t yet exist in the market for many would-be buyers. At the current price and mortgage rate level, the typical housing payment on a median-priced home is still 36.4% higher than one year ago.”

The Mortgage Bankers Association (MBA) reported that overall application volume rose for the third consecutive week [3] in its Weekly Mortgage Application Survey as buyers begin to take advantage of these steadily sliding rates.

“The dip in mortgage rates has boosted borrower demand in recent weeks,” added Robert D. Broeksmit, CMB, President & CEO of the MBA [4]. “Mortgage applications increased for the third consecutive week, despite the ongoing volatility in the financial markets and the broader economy. While rates remain much higher than a year ago, MBA is forecasting a gradual decline, with the 30-year fixed rate falling to around 5.3% by the end of the year.”

Amid the backdrop of rates dropping and app volume rising, Signature Bank was closed by the New York State Department of Financial Services [5], which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. Signature Bank had reported total assets of $110.4 billion, and total deposits of $88.6 billion as of December 31, 2022. Earlier this week, New York Community Bancorp Inc. (NYCB) announced that its bank subsidiary, Flagstar Bank, acquired certain assets and assumed certain liabilities of Signature Bridge Bank from the FDIC [6].

On March 10, Silicon Valley Bank (SVB) was closed by the California Department of Financial Protection and Innovation [7] and the FDIC was appointed receiver. The FDIC then transferred all deposits—both insured and uninsured—and substantially all assets of the former Silicon Valley Bank of Santa Clara, California, to a newly created, full-service FDIC-operated ‘bridge bank’ in an action designed to protect all depositors of Silicon Valley Bank. The FDIC also named Tim Mayopoulos [8], former President and CEO of Fannie Mae, as CEO of Silicon Valley Bridge Bank.

And while things may have calmed down in the two-week span since the FDIC was made receiver of two banks, Federal Reserve Chairman Jerome Powell, at yesterday’s Federal Open Market Committee (FOMC) meeting opted to raise the nominal interest rate by 25 basis points to a range of 4.75% to 5.00% [9]. This marks the ninth consecutive hike and the biggest string of consecutive rate hikes on record. Since the rate hikes began, the FOMC raised rates in March 2022 (+25 points), May 2022 (+50 points), June 2022 (+75 points), August 2022 (+75 points), September (+75 points), November 2022 (+75 points), December 2022 (+50 points), February 2023 (+50 points), and now March 2023 (+25 points).

“The FOMC once again emphasized their commitment to cooling inflation to 2% during Wednesday’s meeting, but softened their stance on additional rate increases,” said Jones. “Chair Powell stated that the recent banking sector instability is likely to lead to tighter lending requirements, which could serve to cool inflation. Depending on the extent of the impact of a tighter banking sector, Powell expressed a ‘wait-and-see’ approach to further contractionary policy. However, the Federal Funds rate is expected to remain elevated through the end of the year, meaning that a higher interest rate environment is here to stay for the time being, including for home loans.”