The persistently wide homeownership rate gaps between Black, Hispanic, and white households mean that households of color are disproportionately excluded from the many potential financial and social benefits of homeownership, according to a new study from Harvard's Joint Center for Housing Studies. Senior Research Associate Daniel McCue and Managing Director Chris Hebert discuss the details of the racial disparities between households of color in their latest study.

The persistently wide homeownership rate gaps between Black, Hispanic, and white households mean that households of color are disproportionately excluded from the many potential financial and social benefits of homeownership, according to a new study from Harvard's Joint Center for Housing Studies. Senior Research Associate Daniel McCue and Managing Director Chris Hebert discuss the details of the racial disparities between households of color in their latest study.

These inequalities are the result of past and present racist policies and practices that specifically excluded non-white households from owning homes and addressing them calls for new policies and programs to support homeownership for these historically disadvantaged households. Downpayment assistance is one such program that has the potential to overcome a lack of savings and intergenerational wealth, which is one of the most significant barriers to buying a home and is a consequence of the historical barriers to homeownership among people of color.

There has been growing interest in expanding downpayment assistance efforts, with a notable example being the Downpayment Toward Equity Act proposed in 2021 (but as yet unpassed) which proposes up to $25,000 in assistance for first-generation homebuyers. In our new working paper, "How Much Can Downpayment Assistance Close Homeownership Gaps for Black and Hispanic Households?", we assess how many Black and Hispanic renters could purchase a home in their market area with this level of assistance to meet the need for cash at closing.

A lack of savings is just one of many barriers facing Black and Hispanic households looking to buy a home. Low incomes, low credit scores, and lack of familiarity with the homebuying process are other barriers, in addition to the limited availability of affordable homes for sale across the US.

However, the data available from the US Census Bureau’s American Community Survey used in our study does not include credit histories or wealth. Consequently, our paper focuses on a single barrier—monthly income levels—as a limiting factor in how much downpayment assistance could increase Black and Hispanic homeownership rates. The goal is to evaluate how much of the current shortfall in homeownership relative to white households might be closed through such a program and in which geographic areas it would be most effective. We limit gains in Black and Hispanic homeownership to match white homeownership rates by income in recognition that not all renters would want to buy a home and the white rate represents a reasonable expectation for a target rate for renters of color.

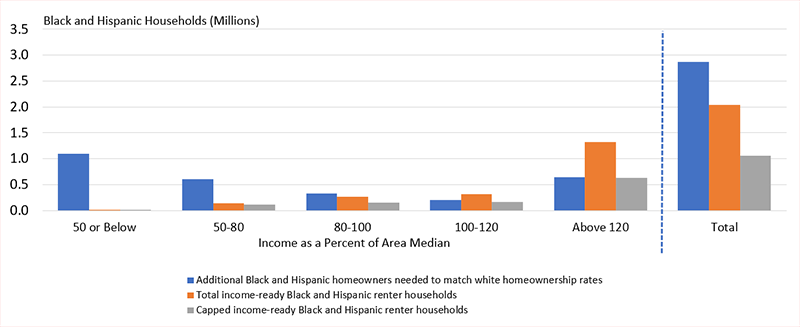

Employing standard underwriting assumptions for a mortgage backed by the Federal Housing Administration, we find that $25,000 in assistance would be enough to cover the required 3.5% downpayment on a home priced at 80% of the median home price in every state except Hawaii. We estimate this assistance could make homeownership possible for the 1.1 million income-ready Black and Hispanic renter households aged 25-55 who have the income needed to cover monthly mortgage payments on a moderately priced home in their state.

If each of these 700,000 Black and 400,000 Hispanic households were to purchase a home, Black and Hispanic homeownership rates among this age group would rise by 8.0 percentage points and 3.2 percentage points, respectively. These significant increases would not, however, eliminate the wide Black-white and Hispanic-white homeownership rate gaps of 31.8 and 20.6 percentage points, respectively.

Note: Total income-ready Black and Hispanic renters are those aged 25-55 who could afford monthly homeowner costs on the moderately priced home in their state without spending more than 31% of income on housing costs after having received $25,000 in downpayment assistance. The capped income-ready estimate limits the number of renters who would buy to the level that would eliminate homeownership rate gaps with white households at each income level within each state.

The potential impact on Black and Hispanic homeownership rates would vary by state. The shares who are income-ready for homeownership range from a high of 24.5% in Mississippi down to a low of just 1.3% in California. In general, states where the highest shares of Black and Hispanic renters are income-ready for homeownership have relatively low home prices and high shares of middle-income Black and Hispanic renter households. States with the lowest shares of income-ready Black and Hispanic renters have relatively high home prices and relatively high shares of Black and Hispanic renter households with very low incomes.

The potential to narrow homeownership rate gaps with white households would also be mostly among higher-income households. This is particularly true in high-cost coastal states like California and Massachusetts. Specifically, Black and Hispanic renters earning less than 80% of AMI could afford a moderately priced home only in a small number of states with the lowest home prices, whereas in high-cost states virtually all income-ready households would need to earn over 120% of AMI.

The intervention of $25,000 in downpayment assistance would go a long way toward removing a significant barrier to Black and Hispanic homeownership and could increase Black and Hispanic homeownership by 1.1 million households, which would narrow Black-white and Hispanic-white homeownership rates by 8.0 and 3.2 percentage points. Flexible financing would enable some additional households to own homes, but the impact of any downpayment assistance effort on homeownership rate gaps would be limited by the high share of Black and Hispanic renter households whose incomes still would not support ongoing monthly homeownership costs. The analysis does, however, suggest the potential benefit of downpayment assistance programs to higher-income Black and Hispanic households—those earning 80-120 or even 120% of area median and higher—for whom barriers other than income are the main deterrent to homeownership. Shared equity programs and special purpose credit programs able to direct benefits to Black and Hispanic households as disadvantaged groups are additional pathways for downpayment assistance programs to increase homeownership sustainably.

To read the full report, including more data, charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news