A good credit score is necessary for many of life's necessities, especially for obtaining a mortgage loan. So where can lenders find borrowers with the best and worst credit scores in the U.S.?

A good credit score is necessary for many of life's necessities, especially for obtaining a mortgage loan. So where can lenders find borrowers with the best and worst credit scores in the U.S.?

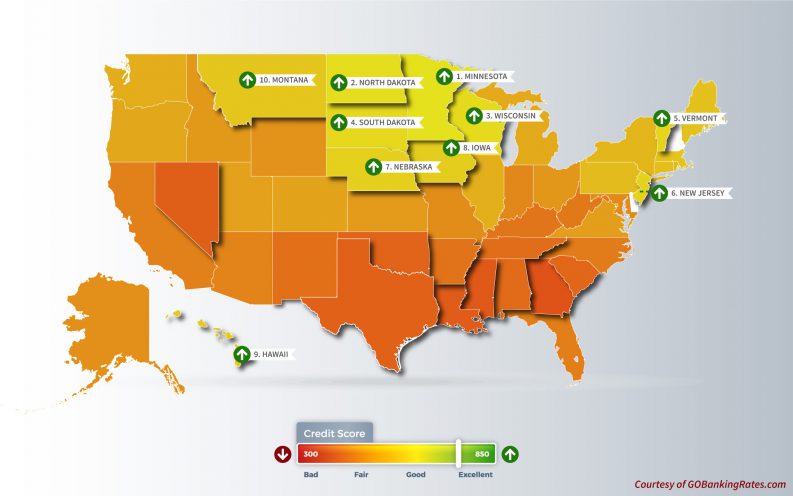

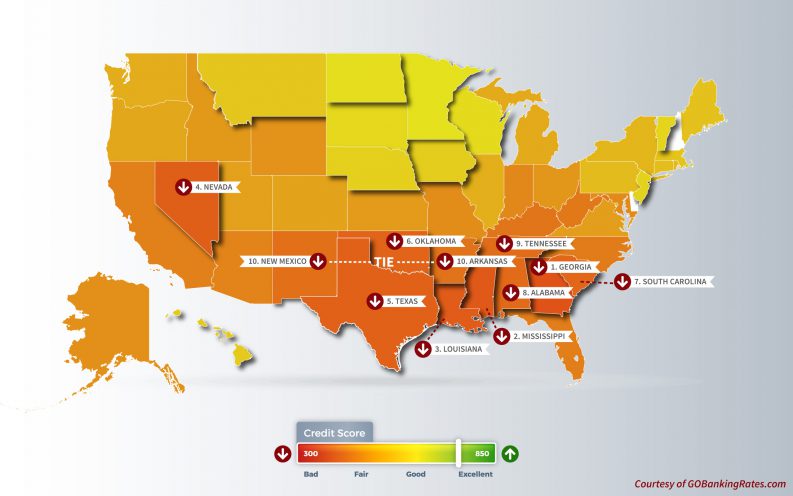

A new study from GOBankingRates.com using Experian data found that credit scores are heavily influenced by location. With this data in mind, GOBankingRates.com determined the 10 states where people have the best credit scores and the 10 with the worst credit scores.

The study showed that credit score usually fall between 300 and 850, and "the 10 states with the best credit scores all have credit scores of 690 or above, comfortably in the range of "good credit."With good credit scores in this range, residents of these state will find it easier to qualify for loans as well as get lower interest rates and other favorable terms."

"If you live in the Midwest, you're more likely to have a higher credit score. Of the 10 states with the highest average credit scores, six are located in the Midwest," the report said. "The states with higher credit scores also tend to have lower rates of debt delinquency (debts that are past due or possibly in collections)."

According to the report, Minnesota hosts borrowers with the highest credit scores with an average score of 704, while Georgia borrowers have the worst credit scores at 636.

GOBankingRates.com's States With the BEST Credit Scores:

GOBankingRates.com's States With the BEST Credit Scores:

- Minnesota: 704

- North Dakota: 696.5

- Wisconsin: 695.8

- South Dakota: 694.3

- Vermont: 693.4

- New Jersey: 693

- Nebraska: 690.7

- Iowa: 690.2

- Hawaii: 689.7

- Montana: 688.4

GOBankingRates.com's States With the WORST Credit Scores:

GOBankingRates.com's States With the WORST Credit Scores:

- Georgia: 636

- Mississippi: 637.1

- Louisiana: 643.6

- Nevada: 644.3

- Texas: 646.9

- Oklahoma: 649.5

- South Carolina: 650.3

- Alabama: 652.4

- Tennessee: 653.6

- New Mexico and Arkansas: 653.7

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news