Since the highly anticipated rate hike last year, mortgage interest rates have not moved up as many in the mortgage industry expected, leaving many to wonder what happened to the Federal Reserve's so-called increase in rates.

Since the highly anticipated rate hike last year, mortgage interest rates have not moved up as many in the mortgage industry expected, leaving many to wonder what happened to the Federal Reserve's so-called increase in rates.

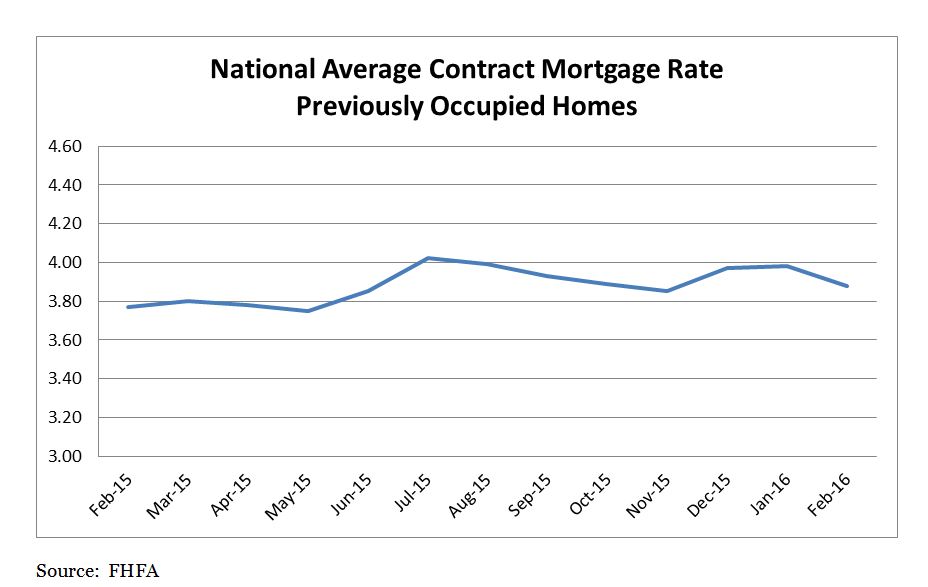

Interest rates on conventional purchase-money mortgages decreased from January to February, according to an index [1] from the Federal Housing Finance Agency [2] (FHFA).

The index, released Tuesday, showed that the national average contract mortgage rate for the purchase of previously occupied homes by combined lenders was 3.88 percent for loans closed at the end of February, down 10 basis points from 3.98 percent in January.

Additionally, the average interest rates on all mortgage loans declined 8 basis points from 3.97 in January to 3.89 percent in February.

The effective interest rate on all mortgage loans, which accounts for the addition of initial fees and charges over the life of the mortgage was 4.03 percent, down 7 basis points from 4.10 percent.

According to the report, the average loan amount for all loans was $316,700 in February, up $6,300 from $310,400 in January.

The Federal Open Market Committee (FOMC) opted out of raising rates [3] at their last meeting until "further improvement" in the economy. With the economic picture on the path of improvement, many in the industry are wondering why the Fed held off this month and when the Committee will actually follow through with one of the four anticipated increases.

"The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run," the release said. "However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data."

In December, the Federal Reserve made the long-awaited, much-anticipated announcement that the federal funds target rate will increase by a quarter of a percentage point [4] from its near-zero level where it has been since 2006. The federal funds rate is now one-fourth to one-half percent [5], according to the Federal Open Market Committee.

"This action marks the end of an extraordinary seven-year period during which the federal funds rate was held near zero to support the recovery of the economy from the worst financial crisis and recession since the Great Depression. It also recognizes the considerable progress that has been made toward restoring jobs, raising incomes, and easing the economic hardship of millions of Americans," said Fed Chair Janet Yellen. "And it reflects the Committee’s confidence that the economy will continue to strengthen. The economic recovery has clearly come a long way, although it is not yet complete."