As overall first-lien mortgage performance improves with more borrowers maintaining their monthly payments, the need for other loss mitigation actions is dissipating.

As overall first-lien mortgage performance improves with more borrowers maintaining their monthly payments, the need for other loss mitigation actions is dissipating.

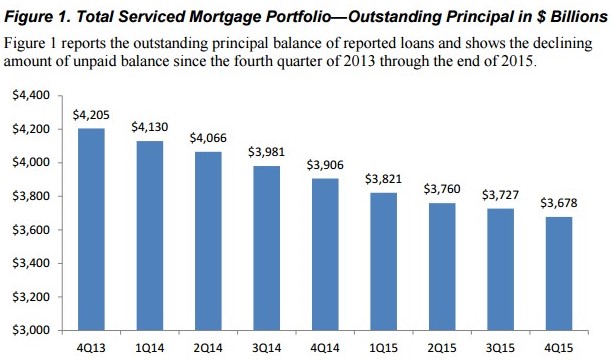

The Office of the Comptroller of the Currency’s (OCC) Mortgage Metrics Report for the fourth quarter of 2015 found that eight reporting banks ( (Bank of America, JPMorgan Chase, CIT Bank (formerly OneWest), Citibank, HSBC, PNC, U.S. Bank, and Wells Fargo) serviced approximately 21.5 million first-lien mortgage loans with $3.7 trillion in unpaid principal balances (UPB) as of December 31, 2015. The UPB was 41 percent of all first-lien residential mortgage debt outstanding in the U.S.

According to the data, overall performance of mortgages that were current and performing at the end of the fourth quarter of 2015 was 94.1 percent, up from 93.2 percent a year earlier and 93.9 percent the previous quarter.

With mortgage payment performance continuing its upward path, foreclosure activity has steadily declined since the end of 2013. Foreclosure activity fell 15.9 percent since the end of 2014. A total of 63,387 new foreclosures were initiated by reporting servicers during the fourth quarter of 2015, down from 75,395 a year earlier.

With mortgage payment performance continuing its upward path, foreclosure activity has steadily declined since the end of 2013. Foreclosure activity fell 15.9 percent since the end of 2014. A total of 63,387 new foreclosures were initiated by reporting servicers during the fourth quarter of 2015, down from 75,395 a year earlier.

The OCC's report also found that as mortgage performance improves, the need for other loss mitigation actions has also declined. Servicers implemented 35,118 mortgage modifications in the fourth quarter of 2015, compared with 47,561 mortgage modifications the previous year. According to the data, 87 percent of the modifications lowered monthly payments for borrowers.

For some time there have been questions surrounding how servicers can protect the lien rights of their investors with regard to the lien position of Homeowner Association properties, but there are ways to avoid this conflict.

The problem stems from the various lienholders of a property residing in one of these communities, according to a whitepaper released by LRES on Wednesday.

When an HOA forecloses on a property for unpaid association fees, the servicer faces significant risk of increased loss and even of losing its investor’s stake in the property, the report said. "Since no investor would consider this acceptable, servicers are left in need of a better method of managing the HOA lien process," LRES stated.

“Homeowner associations are very important to the housing industry as a whole, which is why it is extremely important for servicers to have a good understanding of the risks to be mitigated and the requirements for doing so," said Roger Beane, LRES founder and CEO.

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news