Real estate agents report that first-time homebuyers and investors prepared to pay cash are calling nonstop, but buyers and their agents are running into a lack of inventory.

Real estate agents report that first-time homebuyers and investors prepared to pay cash are calling nonstop, but buyers and their agents are running into a lack of inventory.

According to a new report from Redfin, homeowners’ reluctance to put homes on the market, as house prices and mortgage rates continue to decline, means the uptick in demand has not yet led to increased home sales.

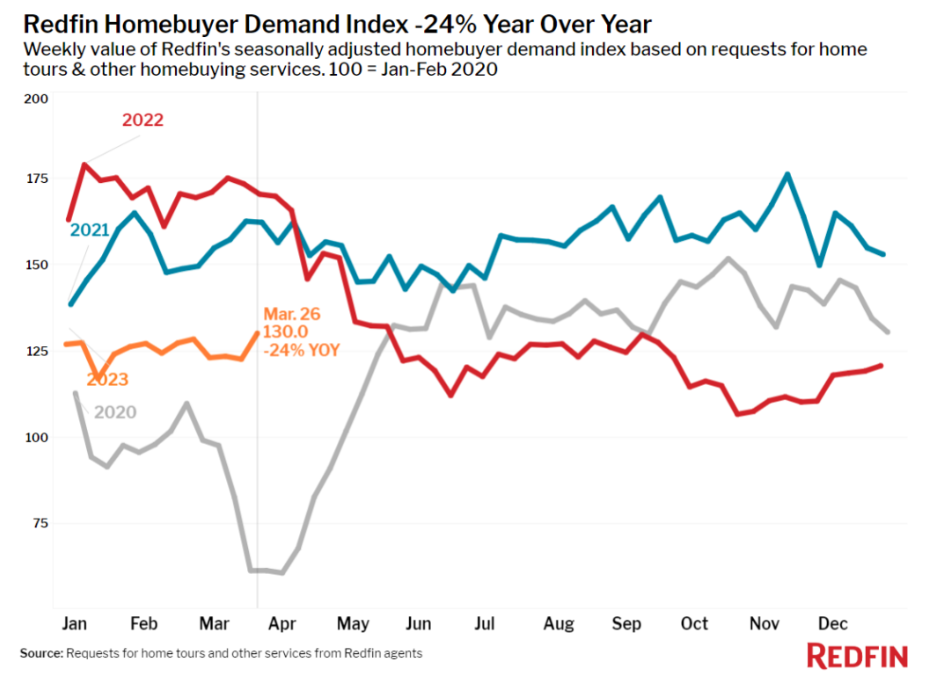

For the fourth week in a row, mortgage-purchase applications increased, Redfin reported. During the week ending March 26, Redfin’s Homebuyer Demand Index—a seasonally adjusted measure of requests to tour homes, make an offer or talk to an agent about a home search—jumped to its highest level since last May.

“My phone is ringing, and it’s usually first-time buyers or investors,” San Francisco Redfin Agent Ali Mafi said. “First-time buyers are interested in looking at homes because prices have come down, though they’re still concerned about high mortgage rates. Investors who can pay in cash are honing in on luxury San Francisco condos because prices on those have dropped even more significantly than the overall market.”

That early-stage demand has yet to translate into sales, according to Redfin, as pending sales dropped 19% year over year nationwide in the four weeks ending March 26, the biggest decline in about two months.

That is “mainly because would-be buyers are limited by lack of supply,” analysts explained.

New listings of homes for sale declined 22%, one of the biggest drops since the start of the pandemic. Analysts at Redfin say homeowners are reluctant to sell because they don’t want to give up a low mortgage rate.

Furthermore, “the lack of new listings is causing a growing share of homes to fly off the market quickly,” they reported. “Nearly half of homes are selling within two weeks, the largest share since June.”

On a national level, the median U.S. home-sale price fell 1.8% year over year to $360,500, marking the sixth straight week of declines after more than a decade of increases.

Redfin Deputy Chief Economist Taylor Marr explained that, while prices are still rising quickly in some places they are down by double digits in big tech hubs.

“It’s important for prospective buyers to work with an expert local agent,” she said. “One thing that’s true almost everywhere: It’s difficult to find a desirable, well-priced home for sale, so offer and negotiation strategies differ depending on where you’re looking.”

Home prices dropped in more than half (28) of the 50 most populous U.S. metros, with the biggest drop in Austin, Texas. Next come four northern California metros: San Jose, San Francisco, Sacramento, and Oakland. Those are the biggest annual declines since at least 2015 for Austin and Sacramento.

On the flip side, sale prices increased most in Milwaukee, where they rose 14.1% year over year. That’s followed by Fort Lauderdale, Florida; Virginia Beach, Virginia, West Palm Beach, Florida and Providence, Rhode Island.

Click here to view Redfin’s full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news